Global firms see sales rise in Bangladesh, but profits stay weak

Things are improving for international companies running businesses in Bangladesh as consumer demand begins to recover. People are buying more products ranging from paints to tobacco and malted milk drinks. Even though sales have risen, profits have not grown much.

Investment experts view the development as a sign of economic recovery. Multinational companies also expressed optimism about business prospects in the coming months.

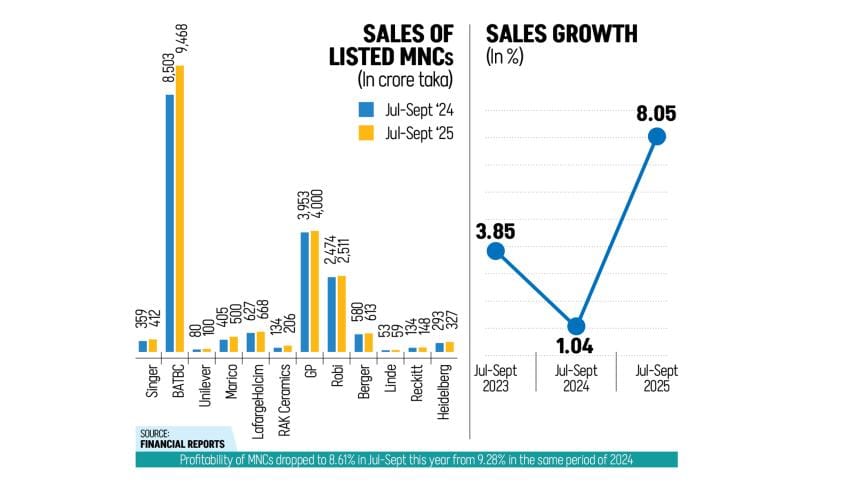

According to financial reports by 12 multinational companies, their combined sales grew by 8 percent in the July-September period of this year. By comparison, their sales increased by 1 percent in 2024 and 3 percent in 2023.

However, profitability by the multinationals, which is measured as profit relative to sales, fell in the current fiscal year, due mainly to higher raw material costs and finance charges.

Combined profitability fell from 9.28 percent in the first quarter of 2024 to 8.61 percent in Q1 of FY26, according to the financial reports.

The multinational companies are Grameenphone, British American Tobacco, Robi, LafargeHolcim, Berger Paints, Marico, Singer, Heidelberg Cement, RAK Ceramics, Reckitt Benckiser, Unilever Consumer Care Limited, and Linde Bangladesh.

The companies say their sales were hit last year amid nationwide student-led protests, violent crackdowns, curfews, and the eventual fall of the government.

On the other hand, they say low growth in 2023 was caused by a severe dollar shortage and stubbornly high inflation.

Despite the decline in profitability, the combined profits of the multinationals rose slightly to Tk 1,637 crore in the first quarter of fiscal year 2025-26, up from Tk 1,633 crore in Q1 of FY25.

In these accounts, profits of Linde Bangladesh were excluded due to an exceptionally high one-off gain in the previous year.

Iqbal Chowdhury, CEO of LafargeHolcim Bangladesh, told The Daily Star that high sales growth this year partly reflects the low base from the previous period.

"In some cases, inflation and volume growth also contributed to sales growth, which differs from sector to sector," he said.

For example, in the cement industry, sales volumes increased while prices fell, as high production capacity coincided with weaker demand from government projects, said Chowdhury.

He said companies also offered promotions and incentives to boost sales, which reduced profitability. Rising variable costs, including raw materials, energy, and finance charges, further weighed on earnings.

He added that firms could not fully pass these costs on to customers.

Shahidul Islam, managing director and CEO of VIPB Asset Management Company, said multinational companies usually report double-digit sales growth, which fell after 2022 during "an extremely bad time" for the economy.

High inflation suppressed consumer demand, the dollar crisis affected raw material imports, and political unrest also hurt sales, he commented.

Inflation in Bangladesh was 8.36 percent in September and has remained elevated since March 2022, according to the Bangladesh Bureau of Statistics (BBS).

Islam said sales are expected to rebound this year as the economy shows signs of recovery.

"The sales growth is a very clear indication of economic rebound," he said.

Having invested hundreds of crores in shares of several multinational companies, he predicted the recovery would continue.

"Foreign exchange levels are improving and, although inflation has not dropped as much as expected, it is easing." Once political stability returns, Islam said, consumer demand and corporate sales are likely to rise further.

In the July-September quarter, RAK Ceramics reported the highest sales growth at 54 percent, followed by Unilever Consumer Care at 25 percent and Marico Bangladesh at 23 percent.

Singer Bangladesh recorded 15 percent growth, British American Tobacco 11 percent, and Reckitt Benckiser 10 percent. Linde, Berger, LafargeHolcim, Grameenphone, and Robi saw growth between 1 and 7 percent.

Ali Imam, CEO of EDGE Asset Management, said the 2025 sales growth shows that consumer demand is still below levels seen in previous years.

"As their sales in 2024 were low, there is a low base effect in 2025," he said.

If the underlying demand were stronger, sales growth could have been higher. Of the 8 percent growth, around five percentage points came from price adjustments, while the remainder reflected volume increases, commented Imam.

Rising interest rates, higher overheads, and increased raw material costs have limited companies' ability to adjust prices fully, affecting profitability in the last quarter, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments