US leads in Bangladeshi credit card spending abroad

Bangladeshi nationals spent the most on credit cards in the United States, debit cards in the United Kingdom, and prepaid cards in Saudi Arabia in June this year, according to a recent report by Bangladesh Bank.

21 August 2025, 18:00 PM

Wage gap narrows as inflation eases: BB report

The gap between wages and inflation, which has been narrowing gradually since February 2025, shrank further in the fourth quarter of fiscal year (FY) 2024-25, offering a slight boost to household purchasing power, the central bank said in a report released this week.

29 July 2025, 18:00 PM

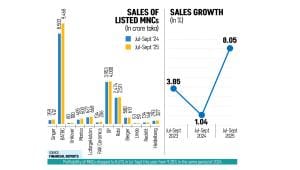

Local, global crises prolong DSE slump in first half

The Dhaka Stock Exchange (DSE), the country’s premier bourse, failed to regain its footing in the first half of 2025 amid several geopolitical crises across South Asia, looming tariffs announced by the United States, and domestic political uncertainty, according to the latest performance review by BRAC EPL Stock Brokerage.

1 July 2025, 18:00 PM

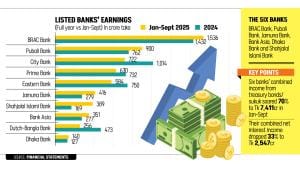

Sonali Bank reports Tk 988cr profit in 2024

Sonali Bank saw its earnings rise in 2024, driven by higher interest income.

4 June 2025, 18:59 PM

Widespread graft was the norm, not exception

The Awami League regime's economic strategy was not always based on equity.

11 November 2024, 18:29 PM

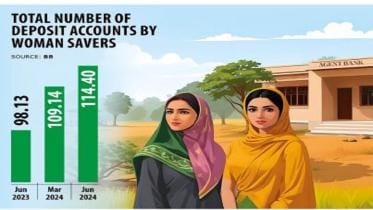

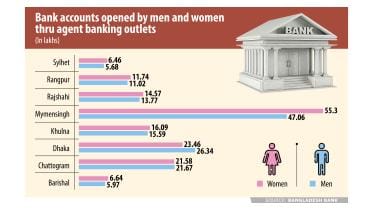

Agent banking sees rise in female participation

Women now account for 49.67 percent of the total deposits made through agent banks

3 November 2024, 04:41 AM

High inflation a concern for stability

Bangladesh has been grappling with elevated inflation for the past two and a half years, significantly straining the daily lives of its population.

21 October 2024, 18:00 PM

Islamic banking sees steady growth

Islamic banking in Bangladesh continued its steady growth trajectory as of May this year, driven by consistent increases in deposits, investments and remittances..According to the Islamic Banking and Finance Statistics (IBFS) report by the Bangladesh Bank for that month, several key indica

26 August 2024, 18:00 PM

Islami Bank's profit rises 7% in second quarter

Islami Bank Bangladesh has reported a 7.2 percent increase in profit for the April-June quarter of 2024..The profit amounted to Tk 307 crore whereas it was Tk 286.22 crore in the same period last year..For the first half of the year, the bank's profit rose to Tk 356.92 crore from Tk

31 July 2024, 16:16 PM

Local credit card use shows upward trend

Purchases using credit cards in Bangladesh displayed periodic fluctuations but overall indicated an upward trend in the months since May 2023, highlighting a growing appetite among consumers for credit.

15 July 2024, 18:00 PM

How taka’s drop ate away economic output per person

The fluctuation indicates that the growth of the economy, when measured in dollars, has been lower than initially projected, due to the weakening of the taka.

23 May 2024, 00:49 AM

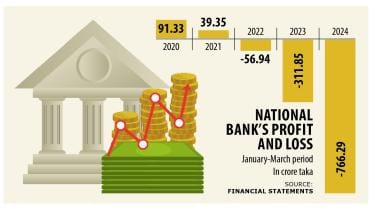

National Bank’s losses jump 145% in Q1

Crisis-ridden National Bank’s financial woes have deepened further, as the bank’s losses increased by a massive 145 percent year-on-year in the first quarter of 2024.

17 May 2024, 03:03 AM

How National Bank lost its way

National Bank went from a financially stable bank to a bank marred in irregularities

7 May 2024, 07:46 AM

Islami Bank Bangladesh’s full-year profit rises to Tk 635 crore, highest since 2019

Islami Bank Bangladesh recorded a profit of Tk 635.33 crore in 2023, the highest since 2019

25 April 2024, 06:27 AM

The life insurance products that are most popular in Bangladesh

Endowment is the most popular life insurance plan in Bangladesh as it offers a life cover and fixed returns

14 March 2024, 00:12 AM

Women hold majority of accounts opened thru’ agent banking

The number of women in Bangladesh with bank accounts opened via agent banking far exceeds that of men as the facility offers better accessibility and guidance for various banking services, making it particularly suitable for those living in rural areas.

1 March 2024, 00:58 AM

Dhanmondi Lake: A welcoming oasis for city residents

Dhaka can be full of chaos. With all the noise pollution, traffic congestion, and overcrowding, there still exist a few places where you can find respite from all that and just get lost in the serenity and Dhanmondi Lake is one of them.

3 February 2024, 18:00 PM

Maddhapara Granite posts drop in profit for declining sales

Even with record high production, profit of MGMCL dropped as half of the rock remained unsold

20 January 2024, 18:00 PM

14 individuals, 12 firms on top taxpayers' list for 8th straight year

It comes as the NBR unveiled the names of 141 individuals and companies as the highest taxpayers for the assessment year of 2022-23.

6 December 2023, 00:00 AM

Top 5 places to visit in Panchagarh

Most people associate Panchagarh district with the scenic view it offers of the Kanchenjunga, the third highest peak in the world situated in the eastern Himalayas on the border between Sikkim State and eastern Nepal. However, it has plenty of other attractive sights to offer to tourists. So, read on to find out the top 5 places to visit in Panchagarh district.

4 December 2023, 12:14 PM