Banks’ surging investments in bills, bonds shrink loanable funds

Banks in Bangladesh are increasing their investments in Treasury bills and bonds to net higher profits from the rising interest rate, a development that has squeezed the availability of loans for borrowers.

This has forced a section of banks to continuously secure liquidity support from the Bangladesh Bank to meet their day-to-day fund requirements.

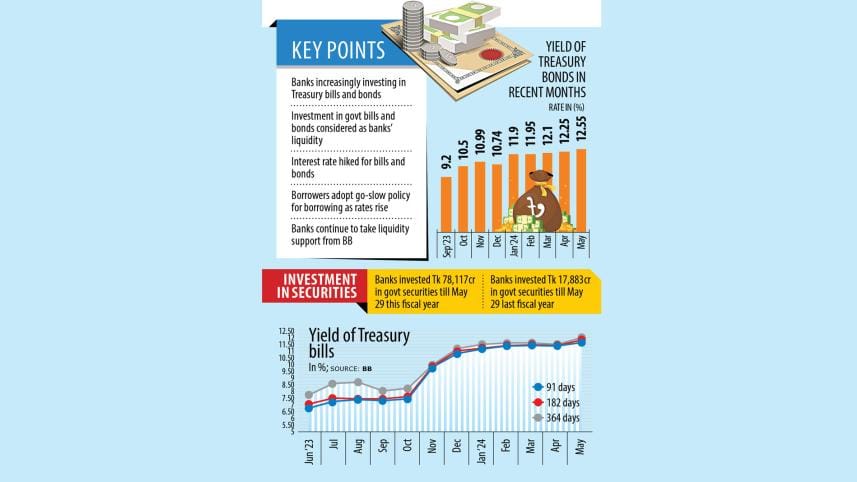

The government has used the bills and bonds to borrow Tk 78,117 crore from banks between July 1 and May 29 this fiscal year, up 337 percent from Tk 17,883 crore during the same period a year ago, central bank data BB showed.

The escalated borrowing through bills and bonds came after the central bank stopped lending to the government since such injection of funds into the economy fuels inflation, which has stayed above 9 percent for nearly two years and shows no signs of cooling.

The government plans to borrow Tk 137,500 crore from banks to finance the deficit in the proposed budget for 2024-25.

Banks are also more interested in investing in bills and bonds than lending to the private sector because of the rising interest rate. Government instruments are also secure whereas loans can turn sour.

"Therefore, banks are keener about Treasury bills and bonds and a major portion of their surplus liquidity has been invested in the tools," a central banker said.

The interest rate of Treasury bills now ranges from 11.60 percent to 12 percent whereas it was 6.75 percent to 7.75 percent in June last year. The interest rate of bonds recently jumped to a 15-year high of 12.75 percent.

Bills have short-term maturities while bonds have long maturities.

Owing to the higher investments by banks in government securities, excess liquidity, which includes cash and cash-equivalent assets, including Treasury bills and bonds, has risen in the banking system.

Excess liquidity stood at Tk 1,76,205 crore at the end of April, up 5 percent from Tk 1,66,825 crore a month earlier, central bank data showed.

A senior banker said although bills and bonds are considered liquid assets, they can't be turned into cash instantly because the secondary market is yet to become vibrant. Thus, the volume of surplus liquidity reported by the BB is not the actual liquid asset situation.

"This is evidenced by the liquidity stress confronting several banks."

Banks have collectively obtained around Tk 20,000 crore from the central bank through repo (repurchase agreement) and assured liquidity support tools in the past six months.

Mirza Elias Uddin Ahmed, managing director of Jamuna Bank, said although the surplus liquidity has increased, many banks are still taking liquidity support from the central bank.

"There is a liquidity mismatch in the banking sector. Some Islamic banks have been experiencing a liquidity crisis for more than one year. This has impacted the overall banking sector."

Another factor that has made banks cautious when it comes to lending is unbridled bad loans: default loans hit an all-time high of Tk 182,295 crore in March.

The demand for fresh loans has also declined as there has been a slowdown in the economy for the past two years owing to the lingering impacts of the coronavirus pandemic and the Russia-Ukraine war.

Recently, borrowers have adopted a go-slow approach in expanding their footprint amid the climbing interest rate.

Customers enjoyed a maximum 9 percent lending rate between April 2020 and June last year after the central bank introduced the ceiling to keep the cost of funds lower with a view to spurring industrialisation. However, amid lingering inflation, it was forced to scrap the cap in July last year, and on May 8, it even left the interest rate in the hands of the market.

Sector-wise surplus liquidity

The surplus liquidity in the banking sector has been rising gradually since November. The amount stood at Tk 1,40,979 crore in the month.

In April this year, private commercial lenders, excluding shariah-compliant banks, had the highest excess liquidity of Tk 84,758 crore.

State-run banks were sitting on Tk 52,733 crore surplus liquidity while foreign banks had Tk 37,396 crore.

Islamic banks had the highest volume of additional cash as of 2021. However, in the subsequent years, they started to face a huge liquidity crisis because of alleged loan irregularities at half a dozen shariah-based banks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments