bank loan

BB issues new rules on home loan repayment

The Bangladesh Bank has issued new directives on the repayments of industrial term and home construction loans in line with the new market-based method of calculating the interest of bank loans.

25 June 2024, 18:00 PM

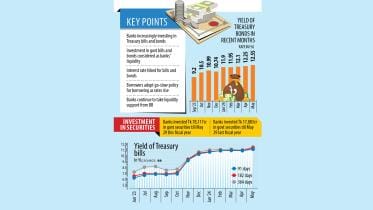

Banks’ surging investments in bills, bonds shrink loanable funds

Banks in Bangladesh are increasing their investments in Treasury bills and bonds to net higher profits from the rising interest rate, a development that has squeezed the availability of loans for borrowers.

16 June 2024, 01:20 AM

Increase loans for agriculture, small firms

Experts yesterday urged banks to increase loan disbursements for cottage, micro, small and medium enterprises and the agriculture sector as a majority of the lenders were currently showcasing a reluctance to do so.

28 August 2022, 18:00 PM

Finacing the future, sustainably

Global temperatures have been rising at an alarming pace in recent years thanks to increased human activity and as such, even climate change deniers can now perceive the growing heat wave.

30 July 2022, 18:00 PM

Defaulters cannot get any fresh loan from banks: HC

The High Court extends its earlier order which ruled that the defaulters, who have taken the opportunity for rescheduling their bank loans by two per cent down payment, cannot get any fresh loan facilities from the banks.

20 October 2019, 14:25 PM

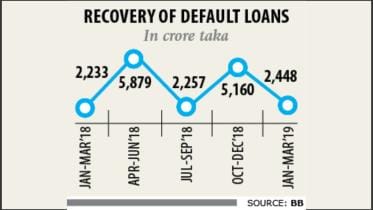

Loan recovery falters in first quarter

Banks’ loan recovery in the first quarter of 2019 was 9.68 percent higher than a year earlier, but given the extraordinary rate at which default loans are increasing it seems below par.

30 July 2019, 18:00 PM

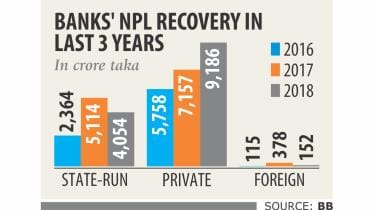

Recovery fails to keep pace with default loan spike

The pace of recovery of banks' nonperforming loans (NPL) was much lower than the rate at which their NPL increased last year -- an ominous development for the sector.

30 March 2019, 18:00 PM

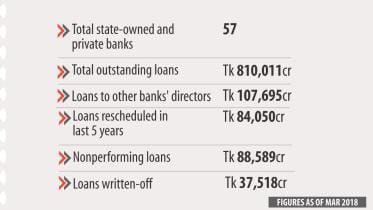

Outstanding Loans in Banking Sector: Big chunk held by bank owners

In Bangladesh, industrialists and businesspeople become shareholders and directors of banks, and borrow money from each other's banks.

And not only that, up to four members of a family can now be in the board of directors of a bank, up from two previously, after the relevant rules were amended last year following Finance Minister AMA Muhith's recommendation.

28 August 2018, 18:00 PM

Interest rates rattle people

Kaniz Fatima Binte Alam, a doctor, took Tk 48.50 lakh home loan at 8.5 percent interest in October last year from a lender with expertise in financing homes.

19 May 2018, 18:00 PM

Loan write-offs soar

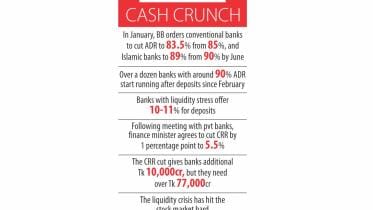

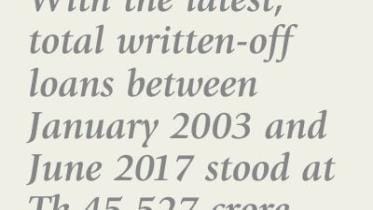

Banks wrote off Tk 452 crore in the three months to June last year, up by over 18 times from Tk 24.76 crore in the previous three months.

2 January 2018, 18:00 PM

Financing tertiary education

Every year, after the university admission tests, we find students who score well, but cannot afford their educational expenses, and eventually drop out. Private banks, on the other hand, offer many lucrative loan products for their customers, including education loans.

26 October 2017, 18:00 PM

Bank loans to finance deficit

The government will balance the Tk 20,000 crore budget deficit -- as a result of not imposing excise duty and the flat 15 percent VAT

13 July 2017, 18:00 PM

SC directs Sylhet pvt medical college to submit financial documents

The Supreme Court seeks for the documents on the bank transactions of Jalalabad Ragib-Rabeya Medical College Hospital in Sylhet.

24 August 2016, 14:07 PM

The Moral Compass

The fact that the country's actual default loan amount - including that of written-off loans - in the country's banking sector has exceeded Taka 1 trillion mark for the first time, qualifies us to be one of the leaders of the corporate shame club.

24 May 2016, 18:00 PM

BASIC Bank scam: ACC files 18 cases

Anti-Corruption Commission files a total of 18 cases with three police stations in Dhaka in connection with alleged irregularities and corruption at BASIC Bank.

21 September 2015, 13:36 PM

Loan to women entrepreneurs made mandatory

Commercial banks and non-banking financial institutions must provide minimum Tk 50,000 as loan to at least a woman entrepreneur each year

28 March 2015, 05:21 AM