bank

Who should be a bank CEO?

Future CEOs should combine financial prudence with tech and data

30 August 2025, 18:10 PM

How to choose a good bank

A good bank ensures quality of loans (assets) by selecting the right borrowers, sanctioning loans to various sectors in different sizes, and keeping collateral.

9 November 2024, 02:00 AM

Key reforms needed to salvage the banking sector

The banking industry as a business is inherently risky.

14 October 2024, 06:00 AM

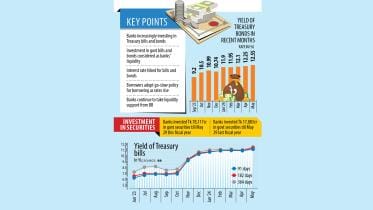

Banks’ surging investments in bills, bonds shrink loanable funds

Banks in Bangladesh are increasing their investments in Treasury bills and bonds to net higher profits from the rising interest rate, a development that has squeezed the availability of loans for borrowers.

16 June 2024, 01:20 AM

DBBL, Bank Asia advance despite market fall in early trade

Shares of most companies fell in the morning trade on the Dhaka Stock Exchange (DSE), extending a losing streak for the fourth day.

18 April 2024, 05:35 AM

MJL to double stakes in Prime Bank

MJL Bangladesh, one of the nation’s leading lubricants companies, is going to buy 2.20 crore shares of Prime Bank in order to increase its stake in the lender.

17 April 2024, 15:48 PM

Bancassurance: a win-win solution for Bangladesh

With a gross domestic product growth rate of nearly 5.8 percent in 2023, Bangladesh is one of the fastest-growing economies in the world. Driving Bangladesh’s prospects is our extremely active domestic consumer market, which accounts for nearly 70 percent of GDP and is rapidly expanding on the back of a growing middle and affluent class. Fuelling this growth is a digital economy that is also expanding rapidly.

19 March 2024, 00:36 AM

Bancassurance can change how we do insurance

The system of selling insurance services to bank customers will ultimately expand financial inclusion.

2 January 2024, 03:00 AM

The Bangladeshi model of dealing with bank crises

The growth of bad loans is mainly due to the business-politics nexus, lack of corporate governance, and weak judicial system

3 October 2023, 14:00 PM

Banks’ CSR spending falls 9%

During the first half of this year, profits of 35 listed banks in Bangladesh dropped 9 percent year-on-year to Tk 4,160 crore.

1 October 2023, 04:47 AM

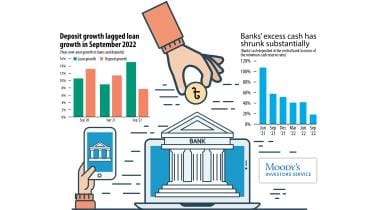

Spike in funding costs to hurt banks’ profitability

Weak banks in Bangladesh with small holdings of government securities, which are used to mobilise funds either from the central bank or peers, may become more vulnerable in the days to come, Moody’s Investors Service warned yesterday.

23 February 2023, 02:00 AM

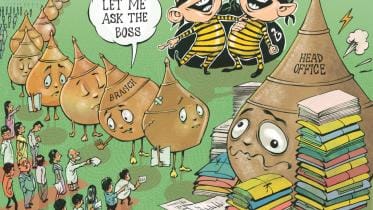

Centralised Decision-Making: Bank services slow down

Faruk Hussain was waiting for about an hour at the branch office of a private bank in the capital's Karwan Bazar to encash his boss' savings scheme.

17 January 2019, 18:00 PM

Nat'l handball gets underway

Exim Bank 26th National Men's Handball Championship got underway yesterday at the Shaheed Mansur Ali National Stadium in Paltan with 33 teams participating.

1 January 2017, 18:00 PM

Cricket: India threaten to cancel England Test in funds row

India's cricket board threatened Tuesday to cancel the first Test against England, less than 24 hours before it was due to begin, unless judges end a freeze on its bank accounts.

8 November 2016, 07:19 AM

Nasir propels Prime DSC

In the rain-curtailed match at Bangladesh Krira Shikkha Protisthan No. 3 ground at Savar, Prime Doleshwar Sporting Club posts 191 for 7 in 28 overs against Abahani Limited today.

28 May 2016, 09:59 AM

Mohammedan win again

Mohammedan SC record their second victory in the Green Delta Insurance Premier Division Hockey League with a 3-1 win over Sonali Bank.

19 May 2016, 18:00 PM

Siddikur needs a good show in Mauritius

Bangladesh's ace golfer Siddikur Rahman will be hoping for a good outing in the AfrAsia Bank Mauritius Open beginning in Mauritius today as a place in the Olympics looks slipping away.

11 May 2016, 18:00 PM

BB heist: Slim chance to get back more money, says Muhith

Finance Minister AMA Muhith says there is hardly any chance to get back more money from the US$100 million hacked from the Bangladesh Bank's account with the Federal Reserve Bank of New York.

6 May 2016, 05:11 AM

Billionaire by mistake

An auto-rickshaw driver became a billionaire but only for a few hours. Before he could be aware of it, the bank that issued a deposit order fixed the mistake.

4 April 2016, 18:00 PM

Bank robbery foiled in Bhola, guard injured

A security guard is stabbed by robbers as he attempts to resist a robbery bid at a branch of Krishi Bank in Charfashion upazila of Bhola.

2 April 2016, 05:05 AM