banks

Banks asked to ensure women-friendly washrooms across all branches

Lack of washrooms for females are causing inconvenience and posing a significant barrier to creating a women-friendly work environment, says central bank

6 January 2026, 15:13 PM

Why we need microcredit banks

"Financial inclusion" has been a buzzword in Bangladesh for many years.

6 January 2026, 07:00 AM

Banks to stay open on Saturday for election payments

Candidates will be able to make payments through bank drafts, pay orders or treasury challans at any branch of scheduled banks across the country

24 December 2025, 14:34 PM

Non-banks deserve equal protection

The Bangladesh Bank’s recent decision to merge five distressed Islamic banks into a single entity has been widely praised as a bold move to protect depositors and preserve financial stability.

10 November 2025, 18:00 PM

Banks must retain female talent

Decline in women’s participation in the banking sector is concerning

20 September 2025, 06:00 AM

Data-driven lending solution for Bangladeshi banks

The process of securing a loan from most banks and non-bank financial institutions (NBFIs) feels like a maze.

18 May 2025, 09:30 AM

Banks shun old-time Motijheel for glitzy Gulshan

Motijheel is losing its historic lustre as Dhaka’s commercial hub, with Gulshan, among the wealthiest neighbourhoods in the capital, stealing its thunder.

6 December 2024, 18:00 PM

Tk 92,261 crore embezzled in 24 banking scams in last 15 years: CPD

Clinically dead banks should be allowed to close down, the think-tank says

12 August 2024, 06:03 AM

Ransomware attack hits small banks across India

Nearly 300 small banks have been isolated from the country’s broader payment network to prevent any wider impact, the sources

1 August 2024, 04:01 AM

Banks reopen after Eid with new office timing

Banks in Bangladesh reopened with a new office timing today after the Eid-ul-Azha holidays

19 June 2024, 05:45 AM

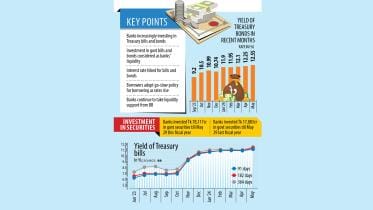

Banks’ surging investments in bills, bonds shrink loanable funds

Banks in Bangladesh are increasing their investments in Treasury bills and bonds to net higher profits from the rising interest rate, a development that has squeezed the availability of loans for borrowers.

16 June 2024, 01:20 AM

Eid-ul-Azha: Banks in industrial area to remain open June 14-16

The branches of banks in industry-related areas will remain open on a limited scale on June 14, 15, and 16, to facilitate payment of salaries and bonuses to the staff working in the garment industry before Eid-ul-Azha

10 June 2024, 03:43 AM

Banks are vehicles for financial oligarchy: CPD

The financial oligarchy under crony capitalism in the country is using banks as vehicles to fulfil their goals, said Fahmida Khatun, executive director of Centre for Policy Dialogue (CPD)

23 May 2024, 06:22 AM

Bar non-compliant banks from giving new loans

Citing BB data, he said there were 16 banks where the NPL ratio exceeded 10 percent and 9 banks where the NPL ratio exceeded 20 percent as of June 2023.

15 May 2024, 01:52 AM

Banks’ CSR spending slumps

Banks’ spending on socially impactful schemes as part of their corporate social responsibility (CSR) fell in the second half of 2023, said a central bank report yesterday..During the July-December period of last year, banks spent Tk 353 crore on CSR-related activities, which was 31 percent

28 March 2024, 00:00 AM

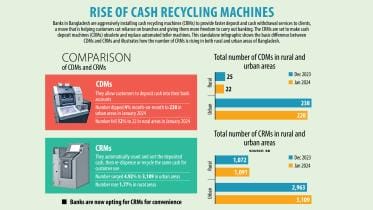

Rise of cash recycling machines

This standalone infographic shows the basic difference between CDMs and CRMs and illustrates how the number of CRMs is rising in both rural and urban areas of Bangladesh.

18 March 2024, 10:36 AM

How far a tough central bank can help?

All stakeholders, including the citizenry, have for years been warning about the deteriorating health of Bangladesh's banking sector. Hard data such as those on the prevalence of default loans have also been indicating the same. .A recent Bangladesh Bank report is the latest to reaffirm

16 March 2024, 18:00 PM

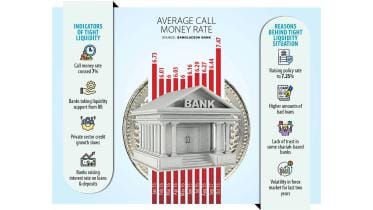

Banks suffering for growing liquidity stress

A majority of banks in Bangladesh, including some Shariah-based ones, are facing difficulties to run their activities due to a liquidity crisis, according to industry people.

17 October 2023, 01:30 AM

Defences against bank risks

Banks are an essential part of a nation’s economy. They facilitate the flow of funds from surplus units (depositors) to deficit units (borrowers) to fuel the growth of the economy.

8 August 2023, 18:00 PM

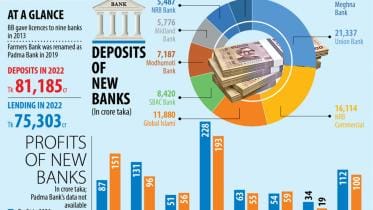

How new banks are faring after a decade

The government awarded licences to set up new nine banks in 2013 despite criticism from analysts and economists and initial reservations from the central bank since the number of lenders was already high in Bangladesh and approvals were largely given on political consideration.

20 July 2023, 01:00 AM