BB reluctant to allow profit payouts for five Shariah banks

The Bangladesh Bank (BB) will not change its decision about paying no profits on deposits for 2024 and 2025 at five shariah-based banks now undergoing a merger, even as depositors staged protests at a number of branches.

19 January 2026, 00:00 AM

Depositors bear the brunt of loan scams

The regulator supervises 61 banks and 35 NBFIs

16 January 2026, 00:00 AM

From 10%, Premier Bank’s default loans jump to 42% in a year

The jump in bad loans forced the commercial lender to make heavy provisions

13 January 2026, 00:36 AM

Legal loopholes allow defaulters to stay in race

If loan defaulters continue to receive such advantages in all areas, it will have negative consequences, especially in a national election, said experts and analysts.

6 January 2026, 18:00 PM

2025 brings calm to external balance sheet, not to businesses

In 2025, some macroeconomic indicators improved, but the mood on the ground did not.

29 December 2025, 18:00 PM

Banking crisis laid bare in 2025, lasting fixes hinge on next govt

When bankers entered the new year and opened their books for 2025, many quickly realised that the scale of long-buried damage was too large to hide any longer.

25 December 2025, 18:00 PM

National Bank’s bad loans climb to 75%

Nearly three out of every four taka lent by National Bank has now gone unpaid, according to the central bank, after stay orders that had long protected several large borrowers were lifted in recent months.

23 December 2025, 18:00 PM

One-third of local private banks keep NPLs below 10%

Seventeen lenders keep healthier balance sheets amid rising industry bad loans

14 December 2025, 18:36 PM

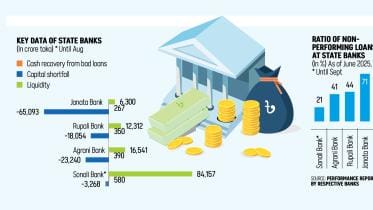

Janata Bank struggles while Sonali recovers

Biannual report to BB shows Sonali Bank’s strong liquidity and asset quality

13 December 2025, 18:00 PM

Islami Bank’s bad loans surpass Tk 1 lakh crore

Scams and irregularities by S Alam Group pushed the shariah-based bank into crisis, as toxic assets continue to surface

10 December 2025, 18:00 PM

300 companies ask BB for Tk 2 lakh crore loan rescheduling

The businesses are seeking repayment periods ranging from five to 15 years

7 December 2025, 18:14 PM

Tk 4 lakh crore default loans stuck in lawsuits

BB data show that as of June, 222,341 cases involving Tk 407,435 crore were pending across the courts

7 December 2025, 15:32 PM

A scammer dies, but the rot in Bangladesh’s banks lives on

The Hallmark scam was the largest loan scam involving Sonali Bank at that time

1 December 2025, 13:53 PM

BB board clears winding up of nine non-banks

Governor says govt verbally approved Tk 5,000cr to pay depositors; Sammilito Islami Bank gets licence

30 November 2025, 18:00 PM

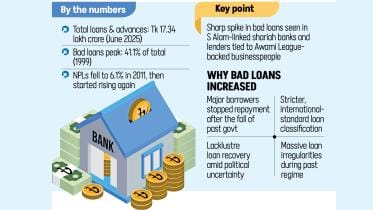

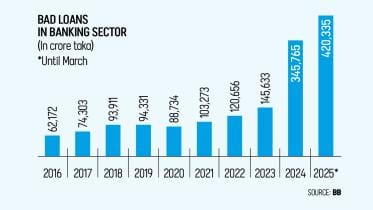

Bad loans continue to break records

Defaulted loans in the banking sector rose further to Tk 6.44 lakh crore, or nearly 36 percent of total disbursed loans, at the end of September, indicating the continued fragile state of the country’s financial sector.

26 November 2025, 18:10 PM

Bank Asia ramps up retail-SME drive, bets on digital banking

Bank Asia plans to accelerate the expansion of retail and SME lending, strengthen its presence at home and abroad, widen its agent network, and continue leading digital innovation in the coming years. The private bank wants to expand SME and retail loans to at least 50 percent of the total portfolio within the next three years.

26 November 2025, 18:00 PM

Bank merger: employees to face salary, benefit cuts

Today, fresh Tk 350 crore liquidity support approved for the to-be-merged banks, taking the total to Tk 35,300 crore

26 November 2025, 15:42 PM

Defaulted loans double to a record Tk 6.44 lakh crore in a year

This is the highest bad loan ratio since 2000

26 November 2025, 09:31 AM

Default loans hit 34%, highest in 25 years

NPLs reach their highest level since 2000, reflecting irresponsible lending, political influence under previous regime

25 November 2025, 19:29 PM

BB yet to release Q2 bad loan data

Bangladesh Bank has not published the banking sector’s classified loan data for the April-June quarter even five months after it ended, leaving analysts without a clear picture of the sector’s condition.

24 November 2025, 19:40 PM