Bad debts going worse

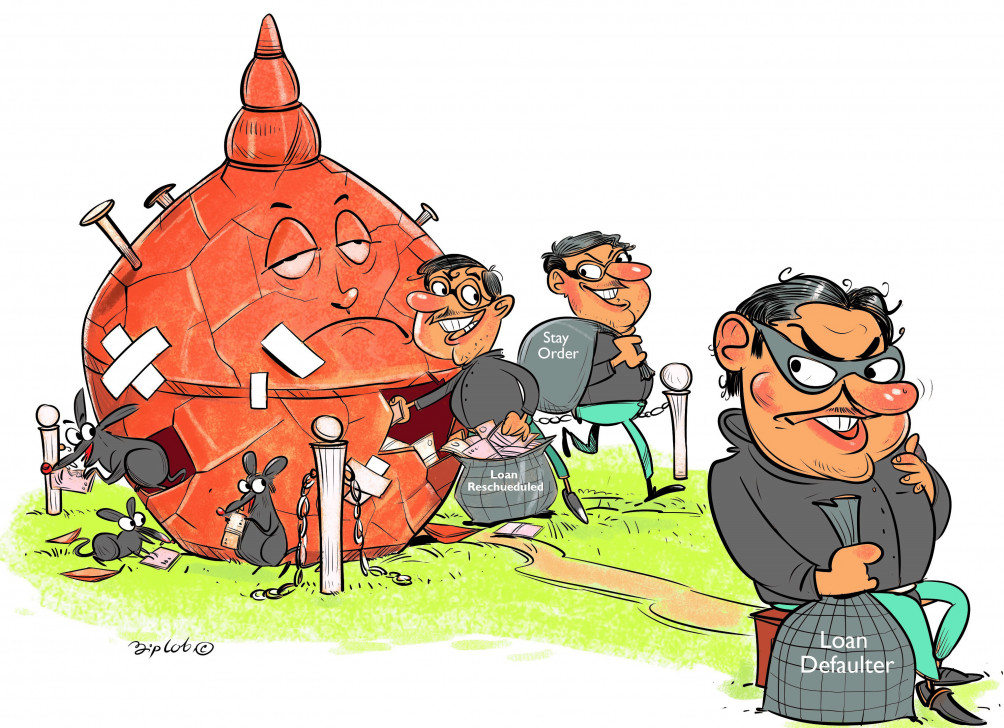

Misgovernance, corruption, nepotism and subsequent bad debts keep plaguing the banking landscape of Bangladesh. Central bank data reveals that non-performing loans (NPL) have swelled to a whopping Tk 134,396 crore as of September this year, accounting for 9.36 percent of the total loans disbursed. Nearly 29 percent of the loans disbursed by the six state-owned banks have been defaulted on as of September. This is despite the relaxed loan classification rules to allow banks to window-dress their accounts and make their financial health look sound.

According to Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem), the real amount of bad debt should be over Tk 2 lakh crore. The same thought was shared by the International Monetary Fund (IMF).

The IMF, during a recent visit to Bangladesh to negotiate the USD 4.5 billion loan proposal, raised concerns once again about the sustained spiralling of bad debts here. When it suggested that the overall NPL rate should be brought down to 10 percent, the central bank assured the international lender that it was already the case and there should be significant improvement by June 2024.

Interestingly, while these discussions between the IMF and Bangladesh Bank were going on, a dramatic episode was being staged at one of the largest commercial banks in the country. In the first 17 days of November alone, a supposed gang withdrew Tk 2,490 crore from the Islami Bank Bangladesh Ltd (IBBL) as loans.

The total sum this gang took from the bank amounted to around Tk 7,000 crore, using the names of eight companies whose addresses exist only on paper. That these loans were disbursed without proper documentation of the companies that applied has raised suspicion. How could the IBBL sanction these loans without due diligence?

Several other banks, including Social Islami Bank Ltd (SIBL) and First Security Islami Bank Ltd (FSIBL), have also sanctioned loans to these companies, amounting to around Tk 2,320 crore. Since the grace period for such loans is one year, they must expire before we fully understand their fate. But given the circumstances, it would not be wrong to predict that these debts may go sour as well.

Investigation into the matter revealed that some of the major beneficiaries are linked to the Rajshahi-based Nabil Group. When Prothom Alo reached out to its MD Md Aminul Islam, he said, "I have been in business for 18 years and there is nothing to hide. The bank knows everything and they will speak about my loan."

Now the question is: if these companies do actually belong to Nabil Group, why were the addresses and company names not given correctly? Unsurprisingly, Nabil Group is also one of the major beneficiaries of the SIBL and FSIBL loan.

While the central bank is now investigating the issue and have halted loans in the name of these shady companies, this incident has once again exposed the irregularities that ail our financial sector.

One of the other beneficiaries of the IBBL loans is Chattogram-based S Alam Group, which controls the bank. While the group's maximum borrowing entitlement is Tk 215 crore, using its influence within the board, it has secured loans amounting to Tk 30,000 crore. It is interesting that, recently, a concern of S Alam Group purchased Ibis Novena Hotel in Singapore for 170 million Singaporean dollars, which roughly amounts to Tk 1,290 crore.

We should note that the NPL rate in foreign banks operating in the country stand at about 4.77 percent because of stringent compliance processes. But while banks and regulators should focus on strict enforcement of policies, especially with regard to due diligence before sanctioning loans, they should also ask where this money is going. Are they being utilised in legal or illegal activities? Are vested quarters laundering money abroad? To what purpose?

This is being suggested in the context of increased suspicious transaction reports (STR) and suspicious activity reports (SAR) – 8,571 to be specific – to the Bangladesh Financial Intelligence Unit (BFIU) in FY 2021-22, compared to 5,280 such reports in FY 2020-21. These cases should be thoroughly investigated and the criminals identified to understand their portfolio, motivations and transaction patterns. Investigating these reports would also give the BIFU a clearer picture of suspicious banking transactions and their correlation with money laundering.

However, none of this will matter if nepotism and corruption in the banking sector does not end, and the central bank keeps creating scopes for the banks to window-dress their accounts. Moreover, NPLs should be defined as per international standards, as suggested by the IMF – making the NPL ratio a maximum of three percent – which would put adequate pressure on the banks. Also, the central bank should revisit its policy to allow individual bank boards to decide on default loan rescheduling and grant facilities. Such authority should be vested with the central bank alone if we want a better grip on bad debts.

It's high time the central bank and relevant authorities ramped up their activities and updated their policies to bring down bad debts and curb the defaulted loan ratio. In a situation where Bangladesh is struggling with depleting forex reserves and a potential liquidity crisis, there is no other way. The entire nation cannot be allowed to suffer to fill up the coffers of certain vested groups.

Tasneem Tayeb is a columnist for The Daily Star. Her Twitter handle is @tasneem_tayeb

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments