Bad loans

Bad loans at non-banks hit 37%

Defaulted loans at the country’s non-bank financial institutions (NBFIs) have surged to a record 37 percent, highlighting the sector’s fragile condition.

19 January 2026, 00:00 AM

NBFIs’ bad loan ratio climbs to 37.11% in signs of growing stress

The rise reflects growing stress in the overall financial sector

18 January 2026, 18:43 PM

From 10%, Premier Bank’s default loans jump to 42% in a year

The jump in bad loans forced the commercial lender to make heavy provisions

13 January 2026, 00:36 AM

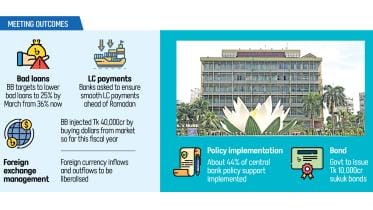

BB aims to cut bad loans to 25% by March

The Bangladesh Bank (BB) has set a target to reduce non-performing loans (NPLs) to 25 percent from the current 36 percent by March, according to senior bankers.

12 January 2026, 00:00 AM

National Bank’s bad loans climb to 75%

Nearly three out of every four taka lent by National Bank has now gone unpaid, according to the central bank, after stay orders that had long protected several large borrowers were lifted in recent months.

23 December 2025, 18:00 PM

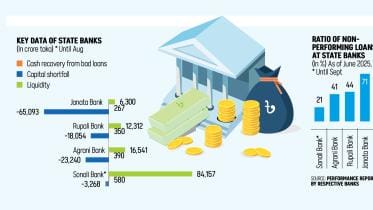

Janata Bank struggles while Sonali recovers

Biannual report to BB shows Sonali Bank’s strong liquidity and asset quality

13 December 2025, 18:00 PM

Islami Bank’s bad loans surpass Tk 1 lakh crore

Scams and irregularities by S Alam Group pushed the shariah-based bank into crisis, as toxic assets continue to surface

10 December 2025, 18:00 PM

300 companies ask BB for Tk 2 lakh crore loan rescheduling

The businesses are seeking repayment periods ranging from five to 15 years

7 December 2025, 18:14 PM

Tk 4 lakh crore default loans stuck in lawsuits

BB data show that as of June, 222,341 cases involving Tk 407,435 crore were pending across the courts

7 December 2025, 15:32 PM

A decade needed to get rid of bad loan crisis

BB governor says as businesses demand action

29 November 2025, 20:12 PM

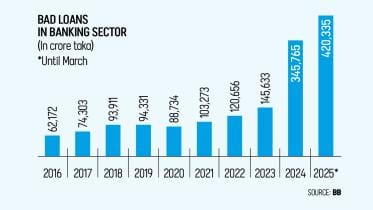

Bad loans continue to break records

Defaulted loans in the banking sector rose further to Tk 6.44 lakh crore, or nearly 36 percent of total disbursed loans, at the end of September, indicating the continued fragile state of the country’s financial sector.

26 November 2025, 18:10 PM

BB yet to release Q2 bad loan data

Bangladesh Bank has not published the banking sector’s classified loan data for the April-June quarter even five months after it ended, leaving analysts without a clear picture of the sector’s condition.

24 November 2025, 19:40 PM

AB Bank’s ‘hidden’ bad loans push NPLs to 84%

AB Bank’s bad loans have ballooned to an unprecedented level, with nearly 84 percent of its total loans in default, a sign of severe financial distress caused by years of irregularities at the country’s first private commercial lender.

22 November 2025, 19:03 PM

With bad loans at 30%, boardroom feud erupts at Standard Bank

Standard Bank is mired in internal conflict as its bad loans rise to nearly a third of total lending, exposing governance problems at the shariah based lender already under scrutiny by the central bank, show documents.

15 November 2025, 18:49 PM

Banks’ CSR spending drops as bad loans surge

Corporate social responsibility (CSR) spending by Bangladesh’s banks nearly halved in the first half of 2025 amid rising bad loans, according to Bangladesh Bank’s (BB) half-yearly report on CSR activities of scheduled banks and non-bank financial institutions.

17 September 2025, 18:00 PM

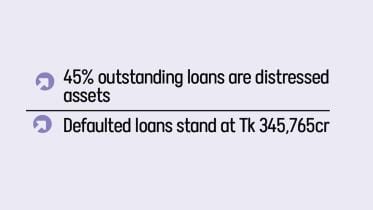

Distressed loans surge to Tk 7.56 lakh cr

Banking sector's asset quality declines as distressed loans balloon to Tk 7.56 lakh crore

19 August 2025, 18:11 PM

Audits expose hidden bad loans at 6 Islamic banks

The reviews, initiated in January with backing from the ADB, expose deep-seated financial mismanagement at those banks

20 July 2025, 18:16 PM

21 banks bucked rising bad loan trend in 2024

Twenty-one banks managed to keep their bad loan ratios under 5 percent of their total lending, even amid turbulence last year that rattled the sector and eventually pushed up the industry average of bad loans to 16.8 percent.

3 July 2025, 19:51 PM

Ten banks hold 71% of total bad loans

Just ten banks, both state-owned and private, account for 71 percent of all non-performing loans (NPLs) in the country’s banking sector.

17 June 2025, 18:00 PM

A staggering increase in default loans

Central bank must strive to improve banking sector’s health

17 June 2025, 10:00 AM