Bangladesh Bank

BB defers primary nod for digital bank licences

Bangladesh Bank (BB) today reviewed the progress of its digital bank licensing initiative but did not grant primary approval to any applicants, following protests from a group of BB officials.

16 February 2026, 21:57 PM

Why is full central bank autonomy still elusive?

Interim government’s decision to stall BB's autonomy is disheartening.

10 February 2026, 19:30 PM

Bangladesh Bank plans collateral audits in fraud crackdown

The central bank will no longer rely solely on commercial banks' internal valuations

9 February 2026, 17:55 PM

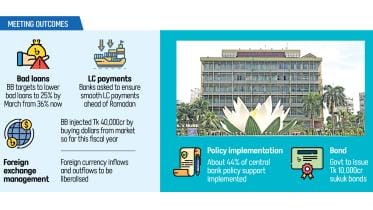

BB purchased $4.15 billion in FY26 so far

For the first time in February, the central bank bought $218.50 million from 16 commercial banks today

2 February 2026, 19:57 PM

BB autonomy deadlocked as interim govt nears end

Authorities tell IMF new govt will take key decisions as an economist says issue is about control, not policy substance

1 February 2026, 00:00 AM

Bangladesh Bank bought nearly $4 billion in FY26 so far

The central bank purchased $55 million from five commercial banks today

29 January 2026, 20:11 PM

Financial inclusion in rural areas improves: BB

A recently published Bangladesh Bank (BB) report shows a significant rise in financial inclusion of the rural population, especially women, in several sectors, including agent banking, deposit, CMSME, and cooperatives.

18 January 2026, 00:00 AM

Referendum campaign creates unease among some bankers

The referendum concerns the constitutional reform agenda outlined in the “July Charter”

14 January 2026, 00:00 AM

BB aims to cut bad loans to 25% by March

The Bangladesh Bank (BB) has set a target to reduce non-performing loans (NPLs) to 25 percent from the current 36 percent by March, according to senior bankers.

12 January 2026, 00:00 AM

Banks asked to settle inward remittances in a day

Banks must promptly notify customers once an inward remittance message is received

8 January 2026, 11:03 AM

Banks asked to ensure women-friendly washrooms across all branches

Lack of washrooms for females are causing inconvenience and posing a significant barrier to creating a women-friendly work environment, says central bank

6 January 2026, 15:13 PM

Mohammad Rokonuzzaman now a director of BB

He joined Bangladesh Bank as an assistant director in 2003

5 January 2026, 14:23 PM

Banks to stay open on Saturday for election payments

Candidates will be able to make payments through bank drafts, pay orders or treasury challans at any branch of scheduled banks across the country

24 December 2025, 14:34 PM

Provisioning requirement reduced for agri, CMSME loans

BB took the move to encourage banks to expand credit to priority sectors

21 December 2025, 12:50 PM

Bangladesh Bank tightens rules on incentive bonuses for bankers

The central bank issued a circular in this regard

9 December 2025, 15:13 PM

300 companies ask BB for Tk 2 lakh crore loan rescheduling

The businesses are seeking repayment periods ranging from five to 15 years

7 December 2025, 18:14 PM

Bangladesh Bank targets fully digital transactions by July 2027

BB governor says at the signing of a deal with the Gates Foundation’s Mojaloop

24 November 2025, 09:05 AM

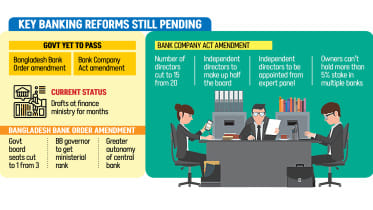

Banking clean-up is long overdue

Authorities must press ahead with the proposed changes to banking law.

19 November 2025, 04:00 AM

Bangladesh Bank to stop selling savings certificates, prize bonds

The Bangladesh Bank (BB) will discontinue five services, including the sale of national savings certificates and prize bonds, as part of a move to limit public access and refocus on its core regulatory duties..Other services the central bank will discontinue include the exchange of damaged

17 November 2025, 15:30 PM

BB rejects Dutch-Bangla Bank’s Tk 1,000cr HQ purchase plan

The Bangladesh Bank has rejected Dutch-Bangla Bank’s proposal to purchase a Motijheel building for more than Tk 1,000 crore to use as its corporate headquarters, saying the price was significantly inflated and the deal posed a conflict of interest involving the bank chairman’s family.

16 November 2025, 18:00 PM