High inflation to increase inequalities

High inflation is eroding purchasing power and reducing real incomes and this can lead to a rise in income and consumption inequalities, Bangladesh Bank (BB) said today.

The caution comes as inflationary pressures remained persistently high above 9 percent since March 2023 and inequality—as measured by the Gini coefficient on a scale from 0 to 1—stood at 0.499 at the end of 2022, up from 0.482 in 2016.

The latest rate is the highest at least since 1984, according to official data.

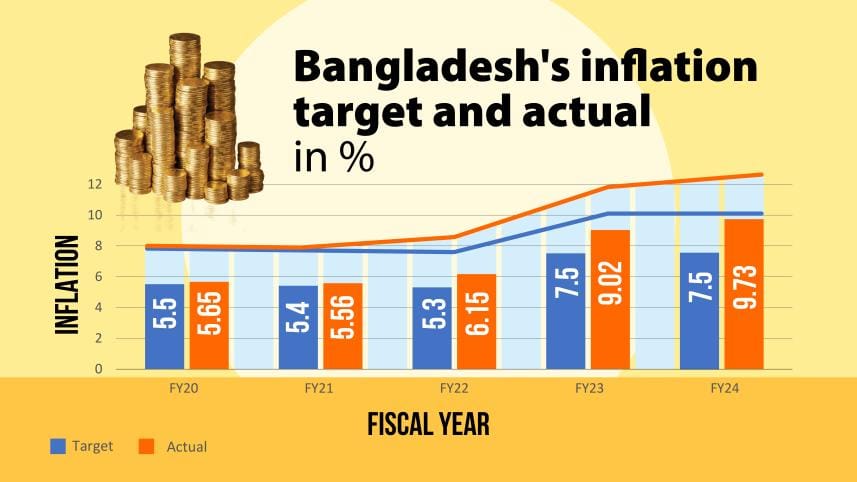

Annual inflation rose to 9.73 percent in 2023-24, the highest since 2011-12, overshooting the government's target of containing it to 7.5 percent, according to the Bangladesh Bureau of Statistics (BBS).

The BB targeted to bring down the consumer price to 7.5 percent in FY23. The authorities have failed to contain prices within their targets in 2022-23 fiscal year.

Yearly average inflation shot up to 9.02 percent, much higher than the 7.5 percent goal for the year, though the BB began to tighten the monetary policy by hiking its policy interest rate, at which it lends to the commercial banks.

In its monetary policy statement for July-December period of 2024, the central bank said Bangladesh faces several near-term macroeconomic issues and challenges that could impact its economic stability and growth prospects.

"These challenges stem from both domestic and international factors, creating a complex environment for policymakers."

"Inflation and exchange rate pressures have been major challenges over the past two years. The ongoing unrest in the Middle East and the Russia-Ukraine conflict could impact energy and commodity prices, affecting the domestic economy through import and exchange rate channels," it said.

The BB said global supply chain disruptions, exacerbated by geopolitical tensions such as the Russia-Ukraine conflict and Middle Eastern unrest, have led to higher prices for essential commodities, including food and energy.

Citing that contractionary monetary policy it has been pursuing to manage inflation, the BB said balancing inflation control with economic growth remains a delicate task.

"The Taka has been under pressure from external sector difficulties and high import bills, leading to a significant depreciation. This volatility not only increases import costs but also risks imported inflation."

The BB said implemented a crawling peg system to stabilize the exchange rate.

"While this approach has shown initial success, ongoing monitoring and adjustments are crucial to sustain stability. Moreover, potential policy rate cuts by major central banks such as the ECB and the US Fed could offer some relief from these exchange rate pressures."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments