Distressed loans surge to Tk 7.56 lakh cr

Distressed loans at banks soared 59 percent to a record Tk 756,526 crore in 2024, laying bare the fragile state of the country's financial sector.

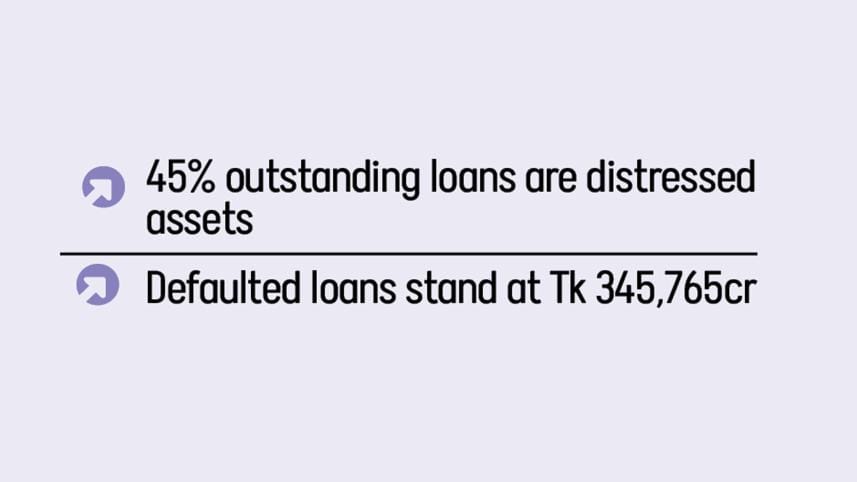

The distressed loans amounted to 45 percent of the total outstanding loans of about Tk 16,82,878 crore as of December last year and close to the national budget for fiscal year 2025-26.

Distressed loans are generally high-risk assets where the borrower is unable to make scheduled payments of interest or principal, making them problematic for banks.

It is calculated by adding written-off loans and rescheduled loans to the defaulted loans.

Among the distressed assets, defaulted loans stood at Tk 345,765 crore, rescheduled loans at Tk 348,461 crore, and written-off loans Tk 62,300 crore.

The breakdown of distressed assets was unearthed in the Financial Stability Report-2024 by the Bangladesh Bank.

The central bank has revealed the distressed assets as part of the conditions agreed with the International Monetary Fund for the $4.7 billion loan programme.

"This is a reflection of the massive irregularities and a lack of strict action against loan defaulters," said Moinul Islam, economist and a former professor at the Chittagong University.

Distressed loans will increase in future.

"The figure that is now being said has already crossed Tk 7 lakh crore, but it will increase further as around Tk 2.5 lakh crore is stuck in various cases in money loan courts, the High Court and the Supreme Court," he said.

Unless the top defaulters of the banking sector are tried in tribunals and the judicial process is expedited, there will be no way out.

"That is the reality," he added.

The sharp increase in bad loans in the banking sector indicates a decline in asset quality, likely caused by imprudent lending and weak oversight of loans and advances, said the Financial Stability Report-2024.

The sluggish pace of defaulted loan recovery has contributed to the piling up of distressed loans, it said.

The top 10 banks accounted for 74.87 percent of the defaulted loans.

Distressed assets have increased sharply after the fall of the Awami League-led government in August last year as the party's affiliated businesspeople enjoyed different kinds of policy support, all of which are now suspended, said Bangladesh Bank officials.

Some Shariah-based banks controlled by the controversial business conglomerate S Alam Group and some other banks where AL-affiliated businesses had influence were hit the hardest.

Some large borrowers, including S Alam Group, Beximco Group and Bashundhara Group, defaulted heavily after the AL's fall, pushing the total distressed assets to an unprecedented level, they added.

Reputed companies are now facing trouble and are unable to repay bank loans due to the country's economic situation, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

"Those companies are now rescheduling their loans due to domestic and external economic pressures, which have pushed up distressed loans," said Mahbubur, also the former chairman of the Association of Bankers, Bangladesh.

The situation has arisen due to the overall slowdown of the economy.

The total distressed loans in the banking sector are hitting the capital adequacy ratio, he said.

The Financial Stability Report-2024 showed that the banking industry's Capital to Risk-weighted Asset Ratio (CRAR) declined by 8.56 percentage points and stood at 3.08 percent at the end of 2024.

The CRAR is significantly below the minimum regulatory requirement of 10.00 percent of Risk-Weighted Assets under the Basel III capital framework issued by the central bank.

Profitability of banks will come down and provision requirements will increase, Mahbubur said.

"This is the reality -- the financial sector is adversely affected because of the previous regime," said Mohammad Ali, managing director of Pubali Bank.

It will take some time for the banking sector to recover, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments