Bangladesh Banking sector

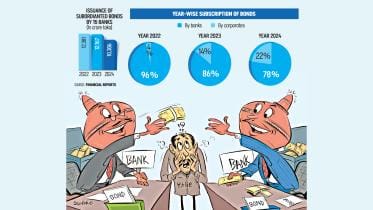

The dangerous illusion of bank bonds

At its core, banking is about pricing and managing risk. Trouble begins when risk is quietly recycled within the system rather than reduced or spread adequately across the board. In trading bonds, that is increasingly what is happening in the country’s banking sector.

18 January 2026, 00:00 AM

Tk 35,000cr more needed to revive the fragile banks

An estimated Tk 70,000 crore, along with time and careful management, would be needed to solve the crisis in the banking sector, said Bangladesh Bank Governor Ahsan H Mansur.

4 December 2025, 22:45 PM

The prerequisites to creating sustainable banking system in Bangladesh

To attain viability, banks must manage the various risks they encounter in this process of intermediation.

4 December 2025, 07:00 AM

A decade needed to get rid of bad loan crisis

BB governor says as businesses demand action

29 November 2025, 20:12 PM

Three more banks face asset quality review

Asset quality review aims to improve banking sector stability

20 August 2025, 22:16 PM

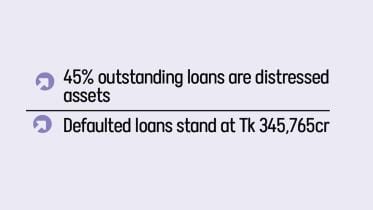

Distressed loans surge to Tk 7.56 lakh cr

Banking sector's asset quality declines as distressed loans balloon to Tk 7.56 lakh crore

19 August 2025, 18:11 PM

Capital base of Bangladeshi banks lowest in South Asia

Large volumes of long-buried toxic loans surfaced after last August's political changeover

19 August 2025, 18:00 PM

Govt unveils uniform promotion policy for specialised banks

New rules tie promotion to exams, training, and clean service records across four state-run banks

5 August 2025, 12:17 PM

End political influence on the banking sector

The ongoing crisis has been caused by the last one and a half decades of grand-scale deviation of governance in the banking industry.

30 December 2024, 07:08 AM

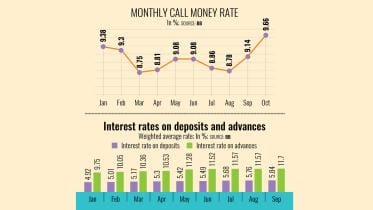

Banks reel from liquidity crisis despite rising deposit rates

Despite rising interest rates on deposits and various efforts by the central bank, Bangladesh’s banking sector continues to face a liquidity crisis that has hamstrung some lenders.

25 November 2024, 18:00 PM

Why is the banking sector crisis so deep-rooted?

The regime-sponsored immorality to protect or pamper the financial gangsters not only eroded the future of the banking sector, but also made the wound too difficult to recover from.

25 November 2024, 02:00 AM

Balancing inflation control and banking stability

Traditional contractionary policies may not be suitable for Bangladesh’s unique economic structure.

19 November 2024, 05:00 AM

BB to design new law for bank mergers, acquisitions

The Bangladesh Bank is working to formulate a “Bank Resolution Act” for mergers, acquisitions, liquidation or recapitalisation of banks.

11 November 2024, 18:00 PM

Can we change the story of our ailing banks?

Restoring trust in the banking sector is crucially important

9 September 2024, 15:05 PM

The renaissance of Bangladesh Bank and some expectations

We hope that the BB governor will continue the momentum and spirit to bring order and promote the economy.

4 September 2024, 03:00 AM

Banking sector issues that the new governor should address

Good governance and adequate legal infrastructure—relevant laws, courts and impartial judges—need to be established.

26 August 2024, 06:00 AM

We need a bank commission that can drive radical reforms

But its objectives must be clearly defined and regularly scrutinised

20 August 2024, 15:00 PM

Several banks are clinically dead: CPD

Several banks in Bangladesh are clinically dead but are being kept alive through bailouts, said Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD).

12 August 2024, 18:00 PM

Urgent bank reforms are crucial

Recover bad loans, punish those who exploited the sector

12 August 2024, 09:30 AM

Factors that may cause bank run in Bangladesh

A recent study was carried out to discover the factors that may cause bank run in Bangladesh.

28 July 2024, 06:00 AM