Private sector driving Bangladesh towards $1-tr economy

Private companies are spearheading Bangladesh's growth with their energy and optimism, putting the economy on a path to cross the $1-trillion mark by 2040, according to a top global consulting firm.

The milestone will be achieved because of private firms' drive to become world-class global businesses and their ability to recruit the best talent, build globally recognised brands, and compete with leading multinational companies, said the Boston Consulting Group (BCG) in a report.

The "Trillion-Dollar Prize Local Champions Leading the Way" report calls private sectors firms as emerging champions.

"Bangladesh's emerging champions are willing to push themselves to embrace more winning traits to go truly beyond great and lead the nation towards becoming a trillion-dollar economy by 2040," it said.

"Bangladesh's emerging champions are innovative companies that have grown rapidly, created a structural advantage in the domestic market and are ready to pursue global ambitions."

The success of these champions echoes the path of exemplary enterprises in other countries, doubling down on domain expertise, domestic success, and quality talent.

"These champions aim to raise international capital, form global alliances and penetrate a diverse and shifting global supply chain to ensure supply security," said the report.

The report is expected to be launched in Dhaka today.

According to the report, the private sector is also boosting innovation and productivity and leveraging the growing digital landscape with well-structured strategic programmes.

"We believe these champions can be powerful contributors to realising Bangladesh's trillion-dollar ambition."

The report was based on BCG analysis and in-depth interviews of leading companies in Bangladesh having an annual revenue range of $300 million to $3 billion.

The emerging companies boast an impressive ten-year average shareholder return of 16 per cent, delivering above the S&P Global 1200 companies' 15 per cent, the Asia 50 Index's 14 per cent, and the MSCI Emerging Markets' 10 per cent.

The BCG report found solid optimism among companies with 57 per cent believing the next generation will have better lives.

In Bangladesh, there is a growing young workforce with a median age of 28 and the working age population is 68.4 per cent.

The report found that 83 per cent of Bangladeshi companies surveyed have a bold ambitious vision and 38 per cent focused on driving better customer outcomes through personalisation.

About 78 per cent strongly believe that they must build a culture of continuous transformation and 61 per cent are pursuing strategic international expansion to create global brands.

According to the report, a key driver is the domestic consumer market.

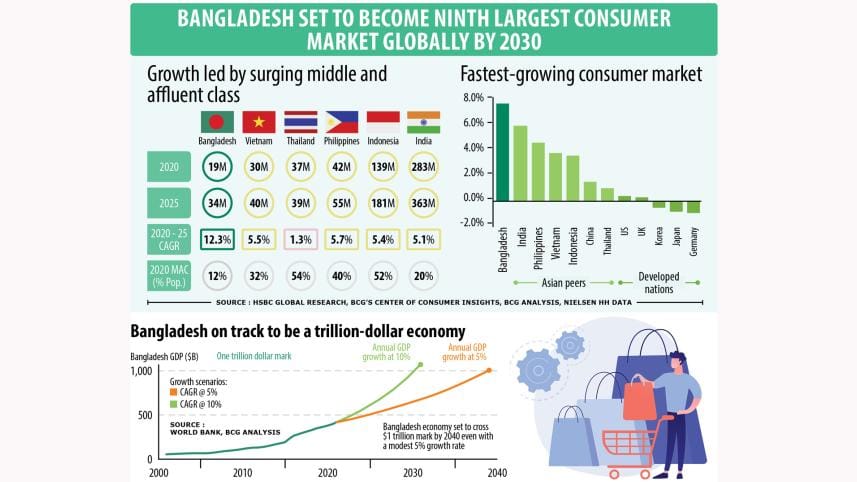

The local consumer market is set to become the ninth-largest in the world driven by a rapidly expanding middle and affluent class, which is projected to grow from about 19 million in 2020 to about 34 million by 2025.

With an average annual GDP growth of 6.4 per cent between 2016 and 2021, Bangladesh has outpaced major Asian peers such as India, Indonesia, Vietnam, the Philippines, and Thailand. The country's growth rate was around double its fellow lower-middle-income countries and significantly higher than the global average of 2.9 per cent.

The country has high economic resilience with a savings rate of 34 per cent against the global average of 27 per cent. The government debt at 19 per cent is the lowest among peers, said the report.

"Besides China, the two most dynamic countries in the world are in South Asia. I would say India and Bangladesh have strong momentum," said Hans-Paul Bürkner, global chair emeritus for BCG, in an interview with The Daily Star last week.

"One of the key elements now for Bangladesh is to really make good use of these opportunities. I think this is crucial."

"Don't see yourself as a poor country, lagging far behind and without having many opportunities. Actually, there is a real opportunity to really move forward to become a middle-income country in the coming years and decades."

But, of course, it takes special efforts, according to Bürkner.

Companies around the world are diversifying their supply chain and Bangladesh can seize the opportunity.

"A massive shift in the supply chains will occur in five to seven years where Bangladesh can play a role. I think the key is really to be open to grab these opportunities," he added.

He urged Bangladesh to build infrastructures in order to lower logistics and transportation costs significantly.

"There are opportunities. That's why we are positive about Bangladesh. We feel progress is being made, but a lot more needs to be done."

Bangladesh is widely recognised for its important role in the global supply chain for textile and apparel, and the BCG continues to see growth in this sector with major domestic players expanding their businesses globally.

The momentum in the digital industry, three times increase in public spending in the last decade, the government's 2041 vision and the Smart Nation Plan are also powering growth.

The telecom industry is led by three private players, Grameenphone, Robi and Banglalink, which have helped position Bangladesh as the ninth-largest mobile market in the world.

The NGO sector has also been a major driver of growth for the economy, with the world's largest NGO Brac and the pioneer of microfinance Grameen Bank providing a safety net for the bottom of the pyramid, the report said.

The startup industry has raised funding of over $700 million and now the government is taking an active role in promoting start-ups.

Other sectors are also emerging on the global stage with players like multinational goods company Pran-RFL establishing franchises in Africa and the Middle East, and pharmaceutical companies like Renata Ltd is driving expansion in Europe, the UK, and the US.

The BCG is aware about the challenges Bangladesh faces amid the current global uncertainty.

"No story is without ups and downs. The current economic climate has created some uncertainties, with liquidity challenges, foreign exchange risks and inflationary pressures in the short term. But the measures the country is taking should allow Bangladesh to remain on its course towards a trillion-dollar economy," the report said.

There are areas where Bangladesh needs to do more, said Saibal Chakraborty, managing director and a partner of the BCG office in New Delhi. He co-authored the report.

"For example, digital analytics is an area where more needs to be done."

Although the country is enjoying a great demographic dividend, some companies are feeling the crunch when it comes to cutting-edge managerial talent or tech talent, said Chakraborty.

The BCG found that 56 per cent of organisations have social impact at the top of their mind and are geared to drive meaningful change.

Zarif Munir, managing director and senior partner in the Kuala Lumpur office of BCG, said: "In 2015, we observed one big trend in Bangladesh and that was the middle and affluent class, and they were the driving force of the economy."

"Now, we believe the next big driving force after the middle class are local companies. They're young, They're hungry. They want to grow despite the challenges."

The report assessed companies based on three pillars: growing beyond, operating beyond, and organising beyond.

The companies that are "growing beyond" to realise global ambitions with societal impact at heart are Brac, bKash, Brac Bank, PHP, ShopUp, Pathao, Walton, Pran, and Summit.

The companies that are "operating beyond" through partnerships and multi-local delivery networks are Square, FCI, Walton, PHP, ShopUp, Renata, Walton, Pathao and Meghna Group.

The firms that are "organising beyond" include Confidence Group, Renata, Pran, Beximco and FCI.

"Bangladesh is on the move. But to reach its full potential, the emerging champions will need to lean in," said Tausif Ishtiaque, a partner in the Kuala Lumpur office of the BCG and a co-author of the report.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments