Bangladesh Private sector

Post-LDC strategies for empowering our private sector

The development of private sector capabilities is a prerequisite for securing sustainable economic growth.

6 May 2025, 06:12 AM

Private sector driving Bangladesh towards $1-tr economy

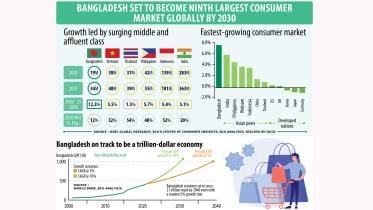

Private companies are spearheading Bangladesh’s growth with their energy and optimism, putting the economy on a path to cross the $1-trillion mark by 2040, according to a top global consulting firm.

25 November 2022, 02:00 AM

Private sector in a sorry state

Bangladesh’s private sector has long been in stagnation because of the coronavirus pandemic, and this was again on display during the auction for sukuk last week.

12 June 2021, 18:00 PM

Govt’s Aggressive Bank Borrowing: Private sector may face credit crunch

The government is going to exceed its annual limit for bank borrowing within the first half of this fiscal year due to poor revenue collection, and this could give a credit crunch for the private sector to deal with.

2 December 2019, 18:00 PM

Private credit growth hits 18-month low

Private sector credit growth dropped to an 18-month low of 15.87 percent in July, as banks have adopted a “go slow” policy for loan disbursement to comply with the central bank's newly set loan-deposit ratio.

5 September 2018, 18:00 PM