Bangladesh economy 2022

Time to hit the reset button

This year was always supposed to be a celebration of Bangladesh’s economic progress with the opening of Padma bridge and Dhaka metro rail and 100 percent electrification.

31 December 2022, 01:00 AM

Govt revises down growth forecast

The government has trimmed its growth forecast for this fiscal year by a whole percentage point to 6.5 percent as the energy shortage and inflation dampened economic activities.

21 December 2022, 01:30 AM

FY23’s first budget support materialises

The Asian Infrastructure Investment Bank has become the first multilateral lender to respond to Bangladesh’s call for budget support this fiscal year to weather the impacts of the Ukraine war after its board approved $250 million last week.

30 November 2022, 01:00 AM

Consumption-led growth could slow economic expansion

Bangladesh may witness slower economic growth in the coming future if it retains the consumption-led growth, which will also exacerbate the widening inequality, said a development economist yesterday.

28 November 2022, 02:10 AM

Bangladesh has learnt a lot from Sri Lanka’s woes

Sri Lanka is generally known for its quality education, healthcare, natural beauty and even migration policies and practices. But in recent times, the island nation has made the headlines for all the wrong reasons.

26 November 2022, 01:40 AM

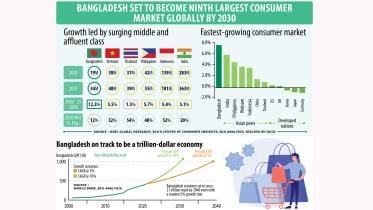

Private sector driving Bangladesh towards $1-tr economy

Private companies are spearheading Bangladesh’s growth with their energy and optimism, putting the economy on a path to cross the $1-trillion mark by 2040, according to a top global consulting firm.

25 November 2022, 02:00 AM

Jersey sales surge as football fever grips fans

Jersey sales have surged in Bangladesh despite the cost-of-living crisis as fans are gearing up to watch the FIFA World Cup 2022 in style.

21 November 2022, 02:30 AM

Will the government touch the ‘untouchables’?

The default-loan narrative has smeared our otherwise powerful story of graduation from the Least Developed Country (LDC) status.

17 November 2022, 17:36 PM

What is Bangladesh's current forex reserve?

Ever since Sri Lanka and Pakistan’s economic turmoil, Bangladesh’s foreign exchange reserves has become a part of public discourse. So much so that despite having an official figure from the central bank every week, people are speculating.

16 November 2022, 18:00 PM

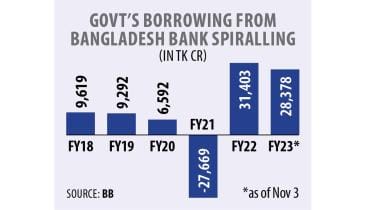

Govt borrowing from Bangladesh Bank stokes inflation fears

In a time of elevated inflation, the government has started to borrow heavily from the Bangladesh Bank to meet the budget deficit, in a move that is set to push up the consumer price level further.

11 November 2022, 02:00 AM

IMF’s $4.5b loan coming

The government yesterday reached a preliminary agreement with the International Monetary Fund over a $4.5 billion loan programme, putting to bed all suspense on whether a deal would be struck with the multilateral lender at all.

10 November 2022, 02:00 AM

"Bangladesh won't accept IMF loan with hard conditions"

The government will not accept IMF loan with “hard conditions”, Road Transport and Bridges Minister Obaidul Quader said today.

9 November 2022, 06:46 AM

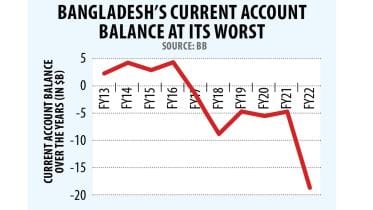

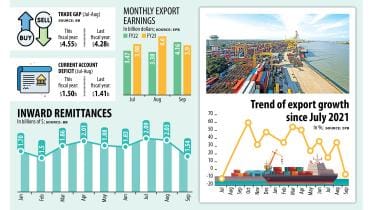

Current account balance: Sinks further in red

Bangladesh’s current account balance sank further in the red in September, heaving the pressure on the exchange rate that is trading at record lows against the US dollar.

3 November 2022, 02:00 AM

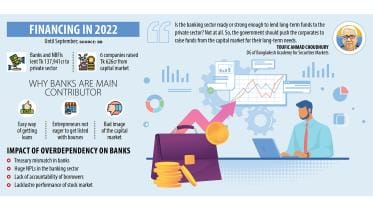

Banks meet 99.6pc as firms shy from stock market

Though Bangladesh has made stellar progress in many economic indicators in the past one decade, entrepreneurs, industrialists and the entire business sector still rely on the banking sector for financing.

1 November 2022, 03:00 AM

Current account balance: Deficit to remain high till 2027

Bangladesh will continue to see high deficit in its current account balance till 2027, predicts the International Monetary Fund.

26 October 2022, 02:00 AM

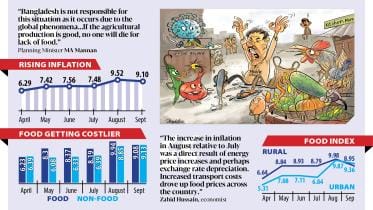

Inflation rings alarm bells

People in rural areas were hit harder by food and non-food inflation than those in urban areas over the last two months, with the overall inflation surging to a 10-year high of 9.52 percent in August.

12 October 2022, 02:00 AM

Two major economic woes Bangladesh needs to address right now

High inflation and low export and remittance earnings are a major cause for concern at the moment.

10 October 2022, 14:00 PM

Three factors holding back economy

The interest rate cap on loans, the frequent changes to the exchange rate regime and a relaxed attitude to enforcing austerity measures are the major challenges facing Bangladesh in restoring stability in the economy.

4 October 2022, 02:20 AM

Exports slip after 13 months

Export earnings dropped 6.25 per cent year-on-year to $3.9 billion in September, the first fall in 14 months, as the cost-of-living crisis in the western countries took its toll on Bangladesh’s main foreign currency earning sector.

3 October 2022, 02:30 AM

Remittance lowest in seven months

Despite a surge in the outflow of migrant workers, remittances to Bangladesh declined 11 percent year-on-year to $1.54 billion in September, the lowest in seven months.

3 October 2022, 02:10 AM