Bangladesh economy

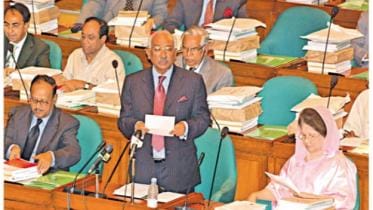

Bangladesh has become an over-regulated country: Finance Minister Khosru

He also said priority would be given to developing institutions, which, he said, are in a "very bad shape."

8 hour(s) ago

Extortion capitalism and the economics of control

In its idealised form, an economic system such as capitalism—often known for rewarding productivity, risk-taking, and innovation— is one in which profits follow value creation, competition disciplines excess, and institutions protect exchange.

18 February 2026, 00:13 AM

Interim govt stopped macro bleeding but couldn’t reignite growth

When the interim government assumed office around 18 months ago, it inherited an economy under severe strain.

18 February 2026, 00:00 AM

Bangladesh’s economic roadmap: Priorities for the next government

The report emerges from a critical moment in Bangladesh’s history.

24 January 2026, 19:33 PM

Business community wants well-defined economic roadmap

Political parties need to prioritise law and order, macroeconomic stability, and ease of doing business in their election manifestos, say business leaders and trade bodies.

24 January 2026, 02:33 AM

What Bangladesh and the Global South face

The Global Risks Report 2026, published by the World Economic Forum (WEF), presents some of the stark realities of the world today.

21 January 2026, 11:30 AM

Rebutting again: The wrong lens for our interim economy

Economics is not a museum of immortal models. It is a diagnostic discipline whose tools must match the condition of the economy under examination.

19 January 2026, 00:40 AM

Three economic priorities for the upcoming political government

The upcoming parliamentary election, scheduled for February 12, is of exceptional political and economic significance for Bangladesh.

13 January 2026, 09:00 AM

Low investment, high inflation major hurdles for next govt: CPD

Raising investment and taming inflation will be the main economic challenges for the next elected government, private think tank Centre for Policy Dialogue (CPD) said yesterday.

11 January 2026, 00:00 AM

Banking sector among most fragile as Bangladesh economy faces multiple risks: CPD

CPD said Bangladesh is at a ‘critical juncture of its journey'

10 January 2026, 11:48 AM

Uneasy recovery: strong reserves, weak exports

Record remittances and recovering foreign-exchange reserves offer a rare cushion, but weakening exports expose vulnerabilities

9 January 2026, 06:00 AM

Economy is now at a turning point

Political clarity has therefore emerged as a decisive factor shaping the outlook

6 January 2026, 18:00 PM

Khaleda Zia’s economic legacy, lessons, and the road ahead

Over the 55 years since Bangladesh's independence, the processes of state-building, political transformation, and economic reconstruction have unfolded in deeply interconnected ways.

6 January 2026, 02:00 AM

The quiet strain behind economic headlines

Bangladesh’s economy seems to be stabilising at first blush. Reserve levels have climbed, imports have slowed, and officials are finding some signs of resilience in the aftermath of a tumultuous period. For a country accustomed to absorbing shocks, this narrative of cautious recovery sounds reas

5 January 2026, 03:00 AM

Can economy turn around in 2026?

A full economic turnaround may take time, as any new government will need time to implement policies

31 December 2025, 18:00 PM

Bangladesh economy in 2025 and expectations for 2026

The outlook for FY2026 indicates a modest recovery, although some risks remain.

31 December 2025, 02:00 AM

The economy Khaleda Zia trusted others to build

Economists say many of the changes that transformed the country's economy began during her years in power

30 December 2025, 18:00 PM

Ending discretionary oversight: Why Bangladesh needs rule-based trade monitoring

The ghost of the past regulatory regime should not overshadow present progress.

30 December 2025, 03:00 AM

Unchecked violence casts a shadow on our economy

The recent wave of violence has revealed a deeply worrying trend in public life.

23 December 2025, 02:00 AM

Govt unveils new 5-year plan to bolster fiscal governance

The Finance Division under the finance ministry has launched its third Public Financial Management (PFM) Reform Strategy, a five-year plan designed to shift fiscal governance from system-based reforms to outcome-driven accountability and service delivery..For the first time, the plan mains

17 December 2025, 15:32 PM