Bangladesh Bank’s digital efforts off to a slow start

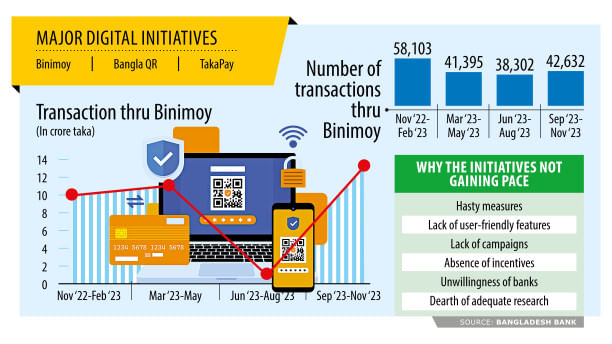

Bangladesh Bank has rolled out three major digital initiatives -- Binimoy, Bangla QR and TakaPay – as part of the government's vision to build a cashless society but they have failed to gain an expected traction.

The services have received lukewarm responses from the targeted customers because they were launched hastily and lack user-friendly features and campaigns were not run to make them popular. Besides, there is no incentive and banks are unwilling, industry insiders said.

They pointed out that the digital initiatives have been rolled out by following the examples of India. However, adequate research was not carried out to find out whether there is demand for the services.

"Binimoy has almost stagnated for some reasons and this is yet to become a user-friendly digital platform," said Syed Mahbubur Rahman, a former chairman of the Association of Bankers Bangladesh.

He, however, thinks there is a huge opportunity for Bangla QR and TakaPay cards to become vibrant platforms. "It will take time for them."

Binimoy

Binimoy, an interoperable digital transaction platform, was launched in November 2022, to enable transactions across mobile financial service (MFS) providers and banks. The Innovation Design and Entrepreneurship Academy (IDEA) of the ICT Division developed the platform, which is operated by the BB.

IDEA has followed India's United Payment Interface (UPI) as a model to develop it at a cost of Tk 65 crore. By registering with Binimoy, users can perform transactions via MFS providers or banks.

The platform is yet to gain popularity due to a lack of user-friendly features, a lack of efforts aimed at popularising it, and unwillingness on the part of banks, said a senior central banker.

Currently, eight banks, three MFS providers, and two payments service providers offer services through the platform.

The banks are Sonali, BRAC, UCB, Eastern, Mutual Trust, Pubali, Al-Arafah, and Midland while the three MFS providers are bKash, Rocket, and mCash.

Some 99,498 transactions were carried out through the platform between November 2022 and May 2023. It stood at 80,934 between June and November last year, central bank data showed.

The transaction amount was Tk 21.25 crore from November 2022 to May 2023. It was Tk 14.41 crore between June to November last year.

Mezbaul Haque, spokesperson of the BB, acknowledged the slower-than-expected transactions and registrations with Binimoy.

Haque is the executive director of the Payment Systems Department of the central bank. He said the department is now upgrading the technology behind the platform.

"Several features are being added and the work is underway on how to perform inter-account transactions. When more features are put in place, more banks will be interested in joining Binimoy."

Bangla QR

In January last year, the BB rolled out Bangla QR, a uniform digital payments system, to significantly cut cash-based retail transactions in an economy that is mostly cash-based. More than a year has passed but most banks have not adopted it.

Bangla QR (quick-response code) enables paying bills for goods and services through mobile banking apps, MFS, and payment service providers.

A senior official of the central bank said the volume of transactions through Bangla QR was not satisfactory. Therefore, the BB recently asked several banks to increase cashless transactions on the platform.

Most banks don't have apps to offer services digitally. "This is a major obstacle," he said.

Dhaka Bank is one of the banks that has adopted Bangla QR.

Emranul Huq, managing director of the private commercial lender, said campaigns to promote Bangla QR should be accelerated. Simultaneously, the central bank should ensure effective services of the platform.

Last month, the central bank allowed banks to show their expenses related to the marketing of Bangla QR in the CSR (corporate social responsibility) accounts.

TakaPay debit card

In November 2023, the BB inaugurated TakaPay, the local currency debit card, to cut users' reliance on international cards and save much-needed US dollars needed to pay for goods and services while travelling abroad.

The central bank introduced the card, the first of its kind in the country. Eight banks have been allowed to issue the cards. However, more than six months have passed, but the card is yet to be unveiled commercially.

Bankers said the card is based on magnetic stripe, an outdated technology that is being phased out globally and replaced with more secure microchip technology. Thus, banks have not issued any cards.

However, BB Spokesperson Mezbaul Haque said it would take some time to issue the card because banks are now upgrading their technology to commercially launch it.

He said a chip, which provides consumers with additional security, will be added to make TakaPay cards more popular.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments