Cashless Bangladesh

No Cash, No Corruption

Cash does not leave a trail. It is not about convenience; it is about invisibility

21 August 2025, 14:07 PM

Cashless society still a distant dream

Bangladesh’s goal of a cashless future is colliding with failed projects, user mistrust, and an economy that thrives on cash

25 July 2025, 18:00 PM

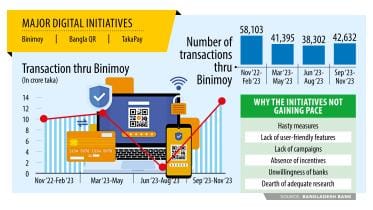

Bangladesh Bank’s digital efforts off to a slow start

The services have received lukewarm responses from the targeted customers because they were launched hastily and lack user-friendly features and campaigns were not run to make them popular. Besides, there is no incentive and banks are unwilling, industry insiders said.

12 June 2024, 03:18 AM

Cashless in Dhaka: Navigating pre-Eid expenses with a tap

Cashless in Dhaka: Navigating pre-Eid expenses with a tap

1 April 2024, 18:00 PM

Digital currency: Is it the future of money?

CBDCs are a form of digital currency regulated by a country's central bank. They are similar to cryptocurrencies, but their value is fixed by the central bank.

1 April 2024, 00:58 AM

Govt aims for a cashless economy by 2031

Mohammad Arif Hossain, CEO of payment service provider Dmoney, said if the government gives merchants a 1 percent incentive and customers a 2 percent cashback, it could yield big results.

24 March 2024, 00:45 AM

Digital Bliss: Cashless spree for Eid

Sales continue to surge for lifestyle products, home appliances, electronics, and groceries in anticipation of Eid-ul-Fitr, the biggest religious festival and the pinnacle of business activity in Bangladesh.

23 March 2024, 18:00 PM

Women delighting in cashless celebrations this Eid

An occasion like Eid holds particular significance for women, who often experience happiness from shopping, reveling in intricate accessories, luxurious cosmetics, elegant attire, and the perfect pair of shoes to complete their Eid ensemble.

23 March 2024, 18:00 PM

Making the most of plastic money

Plastic money is not a new concept in Bangladesh but debit and credit card penetration in the country has been creeping along over the years due to a lack of awareness of their benefits coupled with a deep-seated fear of falling into a perceived debt trap.

23 March 2024, 18:00 PM

Towards Cashless Bangladesh

Bangladesh has embarked on an unprecedented journey towards building a cashless society, marked by a significant increase in card and cardless transactions, mobile banking, and digital payment systems such as QR Payment.

23 March 2024, 18:00 PM

A Cashless Day with Mobile Money

In the hustle and bustle of my life as a university student juggling academics with a part-time job, one ordinary day took an unexpected turn.

27 January 2024, 18:00 PM