Bangladesh Bank (BB)

Bangladesh Bank stops all direct customer services across its offices

Directs commercial banks to ensure smooth and uninterrupted delivery of these services

23 November 2025, 07:03 AM

All BB branches stop selling savings certificates, prize bonds

The central bank said its branches in Dhaka, Chattogram, Khulna, Bogura, Rajshahi, Sylhet, Barishal, and Rangpur will not provide the services anymore from November 20

20 November 2025, 15:48 PM

How to rescue banks without creating more risk

Burdened with massive NPLs, many banks have been facing a serious crisis, failing to carry out their daily operations.

19 September 2025, 03:00 AM

BB to intervene in forex market

Bangladesh Bank (BB) will intervene in the foreign exchange market to curb volatility in the exchange rate and rebuild the country's foreign exchange reserves.

31 July 2025, 22:55 PM

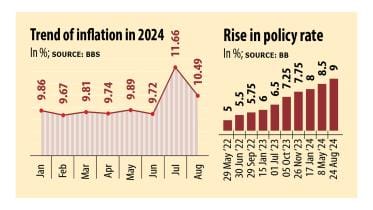

BB keeps policy rate unchanged

BB said the 10 percent policy rate would remain in place for the July-December period

31 July 2025, 09:11 AM

BB reduces cash reserve requirement for banks

Bangladesh Bank (BB) has reduced the daily cash reserve requirement (CRR) for banks to enable them to manage liquidity more easily.

4 March 2025, 18:00 PM

3 banks get Tk 12,500cr in emergency funds

Bangladesh Bank (BB) has extended a total of Tk 12,500 crore in emergency funds to three beleaguered banks to dress up their balance sheet ahead of the year’s end.

31 December 2024, 18:00 PM

BB to keep policy rates unchanged as panel suggests shift from crawling peg

A high-powered panel of the Bangladesh Bank (BB) decided to maintain the policy rate at 10 percent until the inflation comes down to a desired level and also spoke about moving away from the crawling peg and letting market forces determine the US dollar exchange rate.

9 December 2024, 18:00 PM

Custodian to manage Beximco assets

The Bangladesh Bank (BB) took three major decisions yesterday, including the appointment of a custodian, officially termed as a receiver, at troubled Beximco Group in order to prevent its fall and protect the interests of investors, employees and lenders.

10 November 2024, 18:00 PM

Islamic banking to be off limits to regular banks

A bank will not be able to do Islamic banking business along with conventional banking at the same time, according to the draft ‘Islami Bank Company Act-2024’, as the central bank looks to level the playing field for Shariah-based banks.

9 November 2024, 18:18 PM

Banks get higher target for lending to green, sustainable ventures

Bangladesh Bank has revised the lending target for green and sustainable ventures as banks in the country recently achieved the previous benchmark in this regard..As such, banks will have to disburse more loans for green and sustainable initiatives from next year as Bangladesh aims to redu

6 November 2024, 18:00 PM

BB to hike policy rate in two phases to fight inflation

The Bangladesh Bank will increase the policy rate twice and interest rate once by October to tame double-digit inflation, central bank Governor Ahsan H Mansur said at a press briefing yesterday.

23 September 2024, 18:00 PM

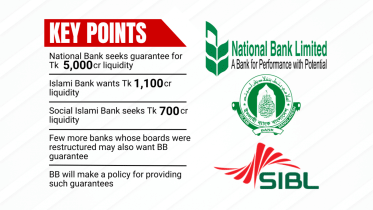

Five crisis-hit banks secure BB guarantee for liquidity

Five crisis-hit banks have obtained a Bangladesh Bank (BB) guarantee to avail liquidity support from the inter-bank money market, according to central bank officials.

22 September 2024, 18:00 PM

Three banks seek BB guarantee for Tk 6,800cr liquidity support

National Bank, Islami Bank Bangladesh and Social Islami Bank have applied to the Bangladesh Bank (BB) for its guarantee to avail a total of Tk 6,800 crore in liquidity support through the inter-bank money market for a period of three months.

11 September 2024, 18:00 PM

Arif Quadri resigns as UCB managing director

Arif Quadri, managing director and CEO of United Commercial Bank (UCB), formally resigned from his post today. He had been absent from office ever since the Sheikh Hasina-led Awami League government was ousted by a mass uprising on August 5

11 September 2024, 12:21 PM

Can we change the story of our ailing banks?

Restoring trust in the banking sector is crucially important

9 September 2024, 15:05 PM

Central bank not blocking any business accounts: Governor

BB is not blocking or interfering with the accounts of any businesses, regardless of their political affiliations, said BB Governor Ahsan H Mansur

9 September 2024, 05:46 AM

Interest rate spread rises to highest level since 2003

The spread between interest rates on deposits and loans rose to 6.03 percent, the highest in two decades, indicating that banks are making money at the expense of depositors and borrowers.

7 September 2024, 18:00 PM

The renaissance of Bangladesh Bank and some expectations

We hope that the BB governor will continue the momentum and spirit to bring order and promote the economy.

4 September 2024, 03:00 AM

A laundry list for BB governor

A new governor has joined the central bank of Bangladesh. As a leading macroeconomist, he has rightly identified inflation and the lack of discipline in the banking sector as the main culprits to be addressed. Both issues are very important, there’s no doubt about it.

24 August 2024, 18:00 PM