Keep spending on tight leash

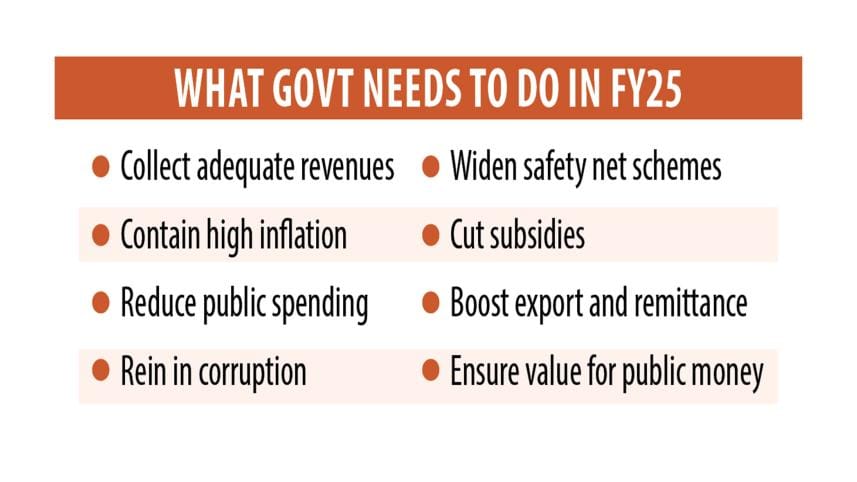

The national budget for the fiscal year of 2024-25 is going to be presented in parliament on Thursday with monumental tasks ahead for the government to collect more revenues and contain stubbornly high inflation.

Amid the tight fiscal situation, economists are calling for cutting public spending, especially in mega projects, and reining in corruption in budget implementation. They, however, recommend widening the social safety net to help the lower-income groups and the poor keep their head above water amid the worst cost-of-living crisis in recent times.

The government has no other alternative but to accelerate tax collections with a view to reducing its reliance on commercial borrowing since the interest rate on bank loans has gone past 14 percent while the yield of treasury bills and bonds has surged to 12 percent.

The elevated borrowing, which is needed to run the country and carry out development work, may appear as a major cause of concern for Bangladesh as interest expenses are ballooning.

The main challenge for the new budget will be to deliver some respite to the people since prices show no signs of cooling while incomes have either stagnated or declined.

Industrialists and entrepreneurs will look for relief from the rising cost of production emanating from a spike in interest and exchange rates and the lingering gas crisis.

The government will have to rein in its willingness to maintain generosity when it comes to providing subsidies and tax exemptions as it is already in a tight spot fiscally and is implementing a programme of the International Monetary Fund (IMF), which has called for cutting tax expenditures.

The government should not spend money on projects in a way that will not give an expected return compared to a spike in debts, said MA Taslim, a former chairman of the economics department at the University of Dhaka.

As of September, the government's outstanding debt stock was Tk 16,55,156 crore.

The government's spending is rising whereas foreign exchange reserves are on the decline. Now, the government is trying to raise tax revenue.

"However, it should curb corruption first because without curtailing grafts, a higher tax will only add to the suffering of the people where the tax revenue growth will not pick up. The solution lies in controlling corruption," said Prof Taslim.

If the government gets the amount that people are already paying in the form of bribes, and the proper tax can be collected from taxpayers, the receipts will be much higher, he added.

MA Razzaque, research director of Policy Research Institute, thinks the next six to nine months will be critical for Bangladesh when the government will need to work intensively to stabilise the economy.

"If the government can do it effectively, a soft landing will be easier."

He said the government will have to control public spending, otherwise, the policy aimed at stabilising the economy will be undermined.

If the government can't limit public spending, it might have to borrow from either commercial banks or the central bank. The problem is the loans from the central bank fuel inflation.

Razzaque said the central bank has adopted a contractionary monetary policy. Now, the fiscal policy will have to be aligned with it, in order to bring down consumer prices.

"Without taming inflation, other macroeconomic indicators can't be put back on track."

In 2022-23, the average inflation rate was 9.02 percent, far higher than the average of 6 percent in recent years. The Consumer Price Index grew by an average 9.73 percent in the first 10 months of FY24, which was 8.64 percent during the identical period a year prior, data from the Bangladesh Bureau of Statistics showed.

"At present, higher inflation is the main challenge facing the country. Therefore, the poor and the fixed-income people are suffering. The government should address this in the budget," said MK Mujeri, executive director of the Institute for Inclusive Finance and Development.

He also called for a supportive contractionary fiscal policy to contain inflation and reduce non-productive costs.

The former chief economist of the central bank advised the government to allocate more resources for social protection programmes owing to higher price levels.

The National Board of Revenue will have to find innovative ways to generate revenue without impacting low-income and middle-income groups, Mujeri said.

"Bringing macroeconomic stability, raising foreign exchange reserves, and boosting export and remittance receipts should be a priority."

Prof Taslim said the loan-driven development policy has made the macroeconomic situation complex and the cost-push inflation has fuelled it.

"Due to this development policy, the debt burden has widened, and the interest payment has gone up. So, the fiscal space has been squeezed, forcing the government to borrow from the central bank."

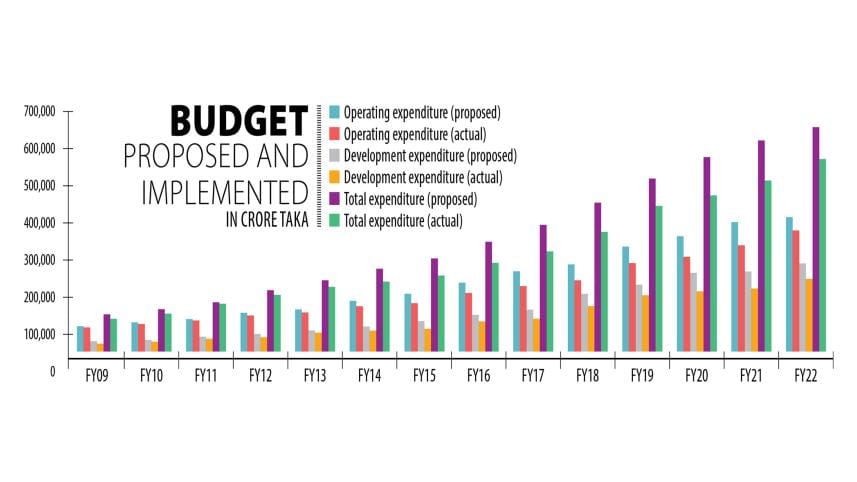

Finance ministry data showed that interest payments rose 26 percent year-on-year to Tk 60,555 crore in July-January of FY24. The payments on the domestic front were up 15 percent while it climbed three-fold against foreign loans.

"The cost-push inflation has compelled the central bank to limit imports and curb the money supply. This negatively affected production and caused the supply of goods to shrink, stoking inflation. It takes time to overcome this type of situation."

Razzaque suggested cutting development expenditures except for high-priority projects.

Yesterday, the Centre for Policy Dialogue said the political economy dynamics of Bangladesh have frequently impeded substantial reforms, even when the stakeholders have acknowledged their needs.

For example, political economy factors have played a significant role in the postponement, cancellation, and reversal of revenue mobilisation-related reforms and automation.

In addition, the government must review public expenditure and devise a strategy to ensure value for public money, the think-tank said.

"It goes without saying that good governance and political buy-in from the highest level is a prerequisite in this regard."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments