Bangladesh National Budget FY2024-25

Tk 7,97,000 crore budget passed in parliament

The parliament today passed the Tk 7,97,000 crore national budget for the 2024-25 fiscal year with the aim of achieving 6.75 percent GDP growth rate and keeping annual inflation at around six percent

30 June 2024, 08:50 AM

Budget ambitious, but achievable: Ficci

But extra duty and tax on telecom, carbonated beverages, water purifiers to hurt potential FDI, it said.

10 June 2024, 12:23 PM

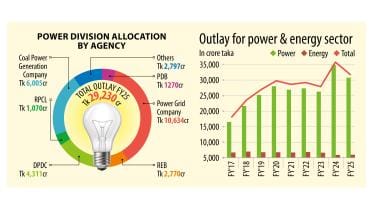

Power Grid gets large sums as govt prioritises transmission, distribution

In Bangladesh, the power generation capacity increased to 30,277 megawatts in 2023-24 from 4,942 MW in 2009, said Finance Minister Abul Hassan Mahmood Ali in his budget speech.

8 June 2024, 21:24 PM

Textile, garment makers urge govt to reconsider their demands

Textile millers and garment makers in Bangladesh yesterday demanded that the government include some of their recommendations in the new national budget as many of the issues they raised remain unaddressed.

8 June 2024, 18:16 PM

Power gets a third of Tk 108,240cr subsidies

More than a third of the subsidies allocated in the new budget is for the power sector due to what experts say is the huge spending on capacity charges.

8 June 2024, 18:00 PM

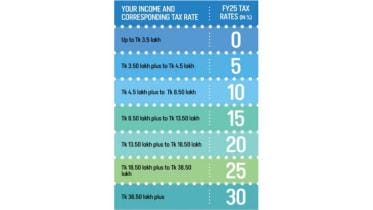

Who will actually have to pay 30 percent income tax?

What is a progressive tax system? Well, it means that the income tax rate climbs up as the income increases. But that still doesn't mean that the raised income tax rate will apply for the entirety of someone's income

8 June 2024, 13:01 PM

An uninspiring budget proposal

It fails to commit to reforms and address people’s sufferings

8 June 2024, 05:00 AM

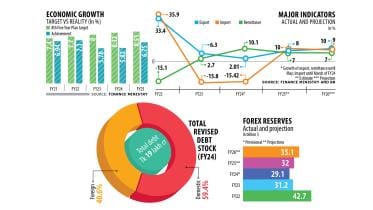

No concrete steps to address inflation, low reserves: CPD

The proposed national budget for fiscal 2024-25 lacks concrete measures for addressing the current economic concerns, such as runaway inflation and depleting foreign exchange reserves, the Centre for Policy Dialogue (CPD) said yesterday.

7 June 2024, 18:00 PM

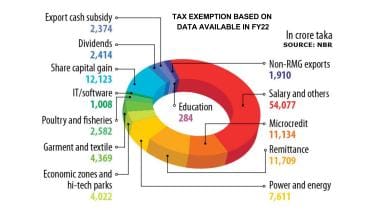

Tax exemption in FY25 rises to Tk 163,000cr

Tax exemptions provided by the National Board of Revenue (NBR) are estimated to rise to Tk 163,000 crore in fiscal 2024-25 as the tax administration looks to ease the pressure on individuals and facilitate higher economic growth.

7 June 2024, 18:00 PM

Implementing Budget For 2024-25: It’ll be challenging

Implementation of the new budget will be highly challenging in the current context of the Bangladesh economy, Metropolitan Chamber of Commerce and Industry (MCCI) said in a post-budget reaction yesterday.

7 June 2024, 18:00 PM

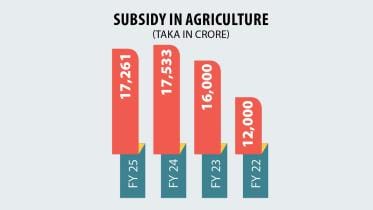

Cut in agri subsidy will hurt farmers

Economists say allocation for the agriculture sector in the new budget is inadequate, and it will not only hurt farmers but may also affect food production.

7 June 2024, 18:00 PM

Govt measures will tame rising inflation

Finance Minister Abul Hassan Mahmood Ali yesterday expressed hope that the government would be able to curb high inflation on the back of budgetary measures and the central bank’s steps.

7 June 2024, 18:00 PM

PM defends budgetary proposal for whitening black money

Prime Minister Sheikh Hasina today supported the budgetary provision for legalising black money saying that it should be brought to the legal network first

7 June 2024, 15:28 PM

Measures to reduce inflation and give relief to poor inadequate: CPD

The Centre for Policy Dialogue (CPD) today said that the government's target to reduce inflation to 6.5 percent in the fiscal year 2024-25 appears overly ambitious

7 June 2024, 06:09 AM

The only budget I care about is one that reduces my bills

Budget day is turning into our very own Groundhog Day.

7 June 2024, 05:00 AM

Budget at a glance

Budget at a glance

6 June 2024, 18:00 PM

Social Safety Net: Share of the poor dwarfed by others

Under the FY24-25 social safety net programme of Bangladesh, the pension for retired government employees and savings scheme interest payments account for nearly the same allocation as social assistance for the poor, the old and the disaster-struck.

6 June 2024, 18:00 PM

Bad loans hit historic high

Default loans in the banking sector of Bangladesh hit an all-time high of Tk 182,295 crore, but no reform programme to reduce it has been announced in the budget for the upcoming fiscal year.

6 June 2024, 18:00 PM

A fresh blow to stock investors

In yet another blow to stock market investors, the government plans to impose a capital gains tax on them from next fiscal year.

6 June 2024, 18:00 PM

Breakdown of money spent over 13 years

The food ministry spent less in fiscal 2022-2023 compared to fiscal 2009-2010, according to data on expenditure over the last 13 years.

6 June 2024, 18:00 PM