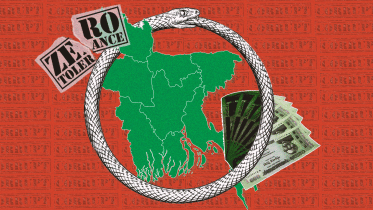

whitening black money

Real estate still a haven for black money

The scope for legalising undisclosed income without facing any questions remains as the tax administration has not scrapped the provision of whitening black money in case of the purchase of flats and land, raising criticism.

4 September 2024, 18:00 PM

NBR scraps provision to whiten black money

The tax administration issued a notification in this regard today.

2 September 2024, 13:29 PM

Govt decides to cancel provision for whitening black money

The interim government has decided to cancel the provision for whitening black money.

29 August 2024, 09:00 AM

The paradox of whitening black money while fighting corruption

Has the government redefined corruption by excluding the concept of black money?

6 July 2024, 06:56 AM

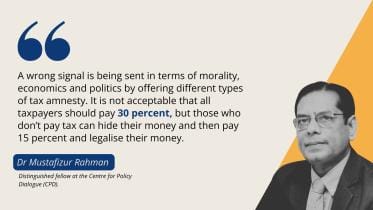

A wrong signal is being sent by offering tax amnesty

Bank defaulters or tax evaders receive a number of amnesty and benefits for whitening black money.

7 June 2024, 09:00 AM

Whitening black money, raising taxes won’t fix our economic ails

These measures are a slap in the face of honest taxpayers who diligently pay taxes on their legitimate income every year.

5 June 2024, 12:30 PM

Opposition MPs slams govt for keeping scope of whitening black money

Opposition lawmakers criticise the proposed budget specially for keeping the scope for whitening undisclosed money while treasury bench hails it.

23 June 2019, 15:20 PM

Scope likely for whitening black money again

The government may once again offer scope for whitening black money through investment in industries to boost private investment, say finance ministry officials.

9 June 2019, 18:00 PM