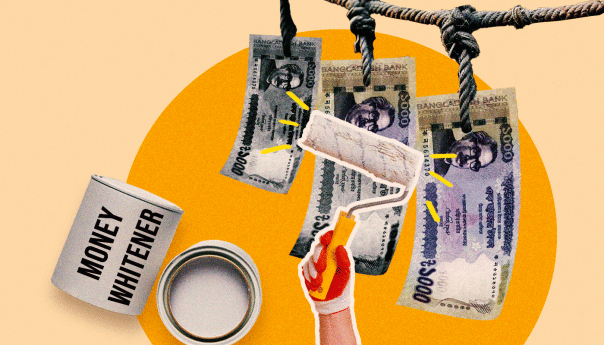

Whitening black money, raising taxes won’t fix our economic ails

The possibility that the government may offer financial criminals a special facility to "whiten" their black money with just a flat 15 percent tax and full amnesty has raised concerns not just among the country's economists and civil society but also the common people. And rightfully so, for the honest breadwinners have to pay an income tax at 25 percent at the highest slab. Adding VAT and other indirect taxes that ordinary taxpayers are required to pay, this plan of whitening black money—which, unfortunately, is not a new phenomenon in Bangladesh—is ill-judged and unjust at the very least.

The Income Tax Act, 2023 allows legalising illegally amassed money by paying a mere 25 percent tax and a 10 percent fine on the tax amount. This time around, however, what's raising eyebrows is the nature of the special offer: no questions asked, just a 15 percent tax, and illegally earned money becomes legal.

Some may argue that bringing black money back into circulation would be good for our economy's health. But at what cost? It is a no-brainer that allowing such impunity to black money hoarders will encourage the practice further, and discourage honest taxpayers from paying their taxes compliantly. The maths is simple: it is a 50 percent saving on taxes if one simply turns their legitimately earned income into undisclosed money and then whiten it—no strings attached and no repercussion involved.

It has been suggested that such an unconditional scheme to legalise black money is required, as the last time such a facility was offered in FY2020-21, a record Tk 20,600 crore was legalised—enabling the National Board of Revenue (NBR) to collect Tk 2,064 crore in taxes—by about 12,000 individuals, including government employees, doctors, businesspersons, and bank sponsor directors, among others. But once this scheme was lifted, in the subsequent years, fewer people availed the offered options for whitening black money.

Does this mean that the facility anticipated to be offered again would reduce the tax collection pressure on the NBR and inject more money into the economy? Not necessarily. We must remember that due to the travel and communication restrictions during the Covid pandemic, which essentially limited the hundi channels, people had little option but to keep their dirty money home, hence many availed the golden opportunity. The context in 2020-21 was different from that in 2024-25, and expecting to generate the same response from dirty money owners based on a general clemency and a flat tax rate might be a folly.

While unbridled inflation is feared to have pushed around five lakh people into extreme poverty, the salaried individuals are also bearing its brunt. A recent media report quoted leading economist Dr Ahsan H Mansur as saying that out of every Tk 100 earned by a salaried individual, they can only take about Tk 35 home after considering all tax deductions, including VAT and other advance taxes. Hence, reimposing the 30 percent tax on the population with a minimum income of Tk 16 lakh per year would be a biting blow for them, the simple reason being inflation.

Interestingly, in this budget, the government is also planning to raise the highest tax slab back to 30 percent. While some may argue that such an increase is just and the right thing to do, we need to take a closer look at a few data points to understand how this would impact the salaried individuals.

As per the current slab, an individual with an annual income of Tk 3.5-4.5 lakh has to pay income tax at five percent. In the second slab, individuals with an income up to Tk 7.5 lakh need to pay income tax at 10 percent. An annual income up to Tk 11.5 lakh requires payment of 15 percent income tax. Those earning up to Tk 16.5 lakh have to pay 20 percent income tax. Anyone earning more than Tk 16.5 lakh per year has to pay 25 percent of their income as income tax.

At a time when food inflation stands at 10.22 percent (as of April 2024), income growth is falling behind inflation, the taka has depreciated against the US dollar by around 36 percent (since January 2022), utility bills are rising, and health spending has surged by over 202 percent, this tax regime is a staggering burden.

Some may argue that in India, the tax-free income is up to 300,000 rupees per year, and the highest tax slab is 30 percent for an annual income of 15 lakh rupees and above. If we compare our tax regime with India's, we should also factor in the inflation rates in both countries: in Bangladesh it is 9.74 percent (April 2024), while in India it is 4.83 percent.

While unbridled inflation is feared to have pushed around five lakh people into extreme poverty, the salaried individuals are also bearing its brunt. A recent media report quoted leading economist Dr Ahsan H Mansur as saying that out of every Tk 100 earned by a salaried individual, they can only take about Tk 35 home after considering all tax deductions, including VAT and other advance taxes. Hence, reimposing the 30 percent tax on the population with a minimum income of Tk 16 lakh per year would be a biting blow for them, the simple reason being inflation. In 2014, when the 30 percent tax was slapped on this slab, the inflation rate was 7.35 percent. When the same was reduced to 25 percent in 2020, the inflation rate was 5.65 percent.

Back in 2020, Leave Fare Assistance (LFA) and income from Workers Profit Participation Fund (WPPF) were tax-free as long as they were within Tk 50,000. Both are now taxable, reducing further the disposal income of salaried individuals who fall in the 25 percent bracket. There are about 89,290 taxpayers who fall in this tax category, according to BBS. How is it just to tax someone earning Tk 16.5 lakh and someone earning, say, Tk 1 crore in the same slab?

If one assumes that the government is considering raising the tax slab back to 30 percent to ensure social equity and fair taxation, it should consider two points. First, it should expand the range for each slab and reduce the tax burden on each of these slabs, expanding the tax-free limit to up to Tk 5 lakh, so that the middle-class taxpayers can meet their basic necessities with dignity.

Secondly, the government should further break the current highest tax slab into several brackets and impose a super tax—a tax in addition to a normal tax, upon an annual income above a certain amount—on the rich and wealthy. The concept of super tax is gaining popularity globally as a tool to ensure social justice and could get the NBR the much-needed extra tax that it needs to extract from the right people.

Instead of taking the easy way out and burdening the already struggling segment of the taxpaying population, it is vital that the government look for a way to efficiently utilise the tax money it collects every year. A study by the Policy Research Institute (PRI) of Bangladesh reveals that a whopping 43 percent of taxpayers' money is spent on salaries, pensions and other benefits for government officials.

At the same time, the government must focus on containing the rampant corruption that enables the shameless plundering of taxpayers' money through various projects.

It is understandable that the government needs money to pay off its debts and meet its expenses, but allowing wholesale legalising of dirty money and taxing people further are not the solutions to this problem. Our policymakers must come out of this tendency to take shortcuts and figure out how we can sustainably steer our growth aspirations forward.

Tasneem Tayeb is a columnist for The Daily Star. Her X handle is @tasneem_tayeb

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments