Janata Bank

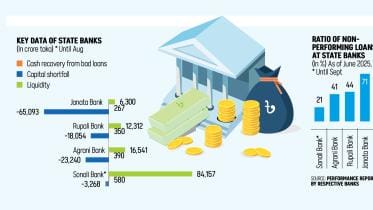

Janata Bank struggles while Sonali recovers

Biannual report to BB shows Sonali Bank’s strong liquidity and asset quality

13 December 2025, 18:00 PM

Janata Bank moves to auction Beximco assets amid reopening plan

The announcement came amid ongoing discussions over a proposed $20 million investment to reopen several Beximco Group factories.

23 November 2025, 19:57 PM

Janata Bank reports massive Tk 3,066cr loss in 2024

The bank’s net interest loss amounted to Tk 3,042 crore last year

11 June 2025, 10:44 AM

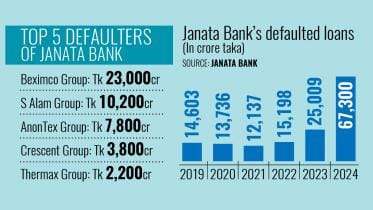

Janata Bank crippled by record default loans

Janata Bank’s defaulted loans surged to a record Tk 67,300 crore by the end of last year, as politically exposed persons and business conglomerates became defaulters following the recent political changeover, reflecting the fragile condition of the state-run bank.

8 February 2025, 18:00 PM

Janata Bank puts S Alam Refined Sugar’s land for auction

The S Alam Group concern owes Tk 1,777 crore to the state-owned bank

30 December 2024, 07:29 AM

Janata allowed to lend more to defaulter Beximco

State-run Janata Bank has been partly exempted from the Bank Companies Act-1991 so that it can lend money to Beximco Group, a loan defaulter.

14 December 2024, 18:00 PM

Beximco seeks extension of loan tenure by 10 years

Beximco has sought support from the government to extend the repayment period of its liabilities to Janata Bank over the next 10 years, including a two-year moratorium.

22 September 2024, 18:05 PM

S Alam drains Janata branch dry

As much as 90 percent of the loans disbursed by a branch of state-run Janata Bank was for S Alam Group, in yet another instance of how the Chattogram-based business giant exerted its influence on the country’s banking sector.

17 August 2024, 18:00 PM

Beximco leaves Janata Bank in poor health

What is the purpose of a single borrower exposure limit? It is to ensure that a bank’s fortune is not tied to the ebb and flow of a conglomerate’s business.

14 August 2024, 18:00 PM

When will Janata Bank’s troubles end?

The state-owned bank's failure to meet any of the performance targets set by the central bank raises a red flag.

26 November 2023, 14:30 PM

Our banking sector, where no rules apply for vested quarters

In the banking sector of Bangladesh, exemptions from rules and regulations for powerful loan defaulters seem to be the default rules.

25 September 2023, 03:00 AM

Why keep on awarding errant defaulters?

Janata Bank must answer for its poor handling of AnonTex’s loans

15 September 2023, 15:27 PM

Janata’s great leniency to an errant client

Troubled state-run lender Janata Bank continues to be overly lenient towards AnonTex Group, one of its five large borrowers, despite negligible loan recovery in 13 years from the garment manufacturer.

12 September 2023, 18:00 PM

Wilful defaulters are bleeding the banks dry

Is the government ever going to stop them?

3 July 2023, 06:21 AM

Over Tk 13,110cr anomalies in Janata Bank

State-owned Janata Bank indulged in 31 counts of “serious financial irregularities” from 2015 to 2020 involving Tk 13,110.8 crore, which is 22.85 percent of the lender’s liabilities, found a recent audit.

2 July 2023, 01:00 AM

Janata Bank’s profit tumbles

The bank's profit fell 55.5% year-on-year to Tk 80.89 crore in 2022

7 May 2023, 14:23 PM

Bangladesh Bank looked away as tycoons borrowed at will from 2 banks

On edge -- is what best describes the sensation surrounding the banking sector. But the Bangladesh Bank higher-ups were warned as early as October 2021 that such a situation might transpire. Yet, no definitive action was taken then.

18 December 2022, 01:00 AM

Bank cashier held for Tk 2 crore embezzlement

Police arrest a cashier of Janata Bank in Noakhali on charge of misappropriating nearly Tk two crore.

3 March 2020, 14:37 PM

BB seeks explanation from Janata MD

Bangladesh Bank has sought explanation from Janata Bank Managing Director Md Abdus Salam Azad for extending loan rescheduling facilities to two companies, including the notorious AnonTex Group, by breaching rules.

9 February 2020, 18:00 PM

Sonali, Janata banks get new chairmen

Two state-owned banks -- Sonali Bank and Janata Bank -- get new chairmen, according to a letter issued by the finance ministry.

21 August 2019, 09:32 AM