Janata Bank crippled by record default loans

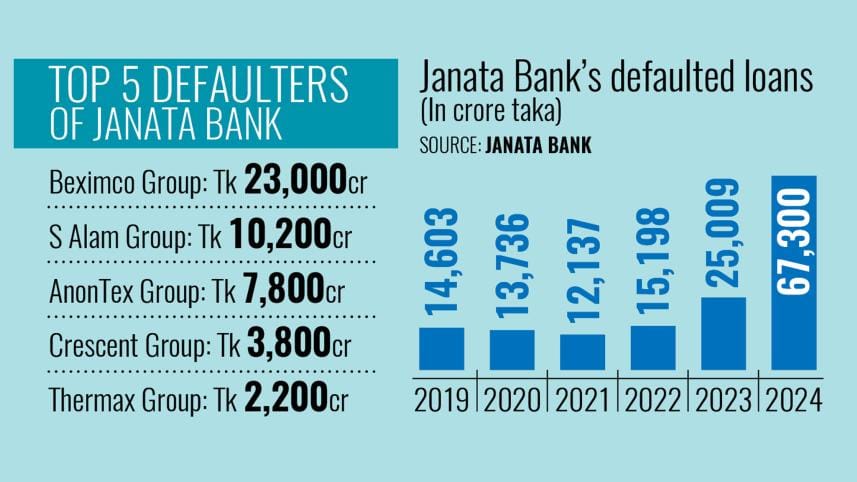

Janata Bank's defaulted loans surged to a record Tk 67,300 crore by the end of last year, as politically exposed persons and business conglomerates became defaulters following the recent political changeover, reflecting the fragile condition of the state-run bank.

Janata Bank now holds the highest amount of defaulted loans in the banking sector.

As of December 2024, the bank's total outstanding loans stood at Tk 1,00,800 crore, with 66.8 percent, or Tk 67,300 crore, classified as defaulted, according to internal data from the bank.

Just three months earlier, in September 2024, Janata Bank's defaulted loans stood at Tk 60,345.30 crore.

The bank's bad loans have escalated sharply since the political shift in August 2024, as loans granted to politically exposed individuals and industrial conglomerates affiliated with the former Awami League-led government became classified as defaults—loans that had previously remained concealed, bank officials said.

In June 2024, defaulted loans stood at Tk 48,000 crore, but by December, they had risen by Tk 19,300 crore in just six months.

A significant portion of Janata Bank's defaulted loans is concentrated among a few large borrowers, with the top five defaulters accounting for around 70 percent of the total bad loans.

Among them, Beximco Group, led by Salman F Rahman, who was the private industry and investment affairs adviser to former prime minister Sheikh Hasina, has the highest amount of defaulted loans.

Janata Bank's total exposure to Beximco stood at Tk 23,000 crore, which became fully defaulted in the October-December quarter of 2024.

S Alam Group is another major defaulter, with its defaulted loans at Janata Bank reaching Tk 10,200 crore.

AnonTex Group followed with a default of Tk 7,800 crore, while Crescent Group had Tk 3,800 crore in bad loans.

Thermax Group defaulted on Tk 2,200 crore, and Sikder Group's defaulted loans stood at Tk 850 crore at the end of 2024.

A senior Janata Bank official, speaking on condition of anonymity, confirmed that the total defaulted loans at the bank rose sharply due to the full default of loans taken by Beximco Group and S Alam Group in the October-December quarter.

Additionally, some borrowers who were previously regular in loan repayments have now defaulted.

For example, a small portion of Bashundhara Group's loans became classified as defaulted in December 2024, although the conglomerate is reportedly working to reschedule them.

As of December, Bashundhara Group's total loan exposure at Janata Bank stood at Tk 1,700 crore.

Orion Group, another top borrower of the bank, had a total funded and non-funded exposure of Tk 3,500 crore at the end of last year.

Industry insiders pointed out that the bank was in deep financial trouble due to its high exposure to large conglomerates.

Beximco Group's loans at Janata Bank saw a steep increase over the years: from Tk 2,045 crore in 2015 to Tk 6,400 crore in 2020.

By June 2024, the figure had reached Tk 25,000 crore. This exposure is nearly 950 percent of the bank's paid-up capital, far exceeding the legal limit of 25 percent for a single borrower.

Between July 2021 and July 2022, Beximco opened nine new companies, and in just one month of 2022, it created eight more companies to secure additional loans.

Documents indicate that Salman F Rahman leveraged his influence within the former Sheikh Hasina administration to obtain special approval from the central bank for these large loans, Janata Bank officials alleged.

Janata Bank was once regarded as one of Bangladesh's most reputable banks, but its financial health deteriorated following a series of loan scams involving AnonTex Group and Crescent Group.

Between 2010 and 2015, the bank disbursed Tk 3,527.9 crore in loans to 22 companies under AnonTex Group. Later investigations by Bangladesh Bank uncovered massive irregularities in loan approvals.

In 2017, Janata Bank's total defaulted loans stood at Tk 5,818 crore. In just seven years, that figure has now skyrocketed to Tk 67,300 crore.

Financial analysts and industry experts are urging a forensic audit of Janata Bank to identify the officials and board members involved in the massive loan irregularities.

Due to its deteriorating financial health, Janata Bank is facing a severe liquidity crisis and recently requested Tk 20,000 crore in emergency funds from the interim government and the central bank.

The funds are needed to maintain normal cash flow and restore depositor confidence, the bank stated.

Bank officials warned that Janata's ability to borrow from the money market has weakened due to a lack of sufficient securities, raising concerns about a potential cash reserve ratio (CRR) and statutory liquidity ratio (SLR) shortfall.

Md Mazibur Rahman, the newly appointed managing director of Janata Bank, recently stated that the bank was making all possible efforts to recover the bad loans.

He also confirmed that legal action would be taken against major defaulters to retrieve the funds.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments