The future is electric Charting the global trends in the EV market

The electric vehicle (EV) market is experiencing a period of rapid transformation, with countries worldwide charting their course towards a more sustainable transportation future. This article delves into the key trends shaping the global EV landscape in 2024, highlighting the interplay between government policies, technological advancements, and economic factors.

Leaders charging ahead: Norway and China pave the way

Norway has emerged as a global leader in EV adoption, thanks to its unwavering commitment. Comprehensive government incentives, including tax exemptions, toll waivers, and extensive charging infrastructure development, have created a highly supportive environment for EVs. This commitment extends to a national goal of phasing out fossil fuel vehicles entirely by 2025. The results are undeniable: in 2023, over 80% of new car registrations in Norway were for battery electric vehicles (BEVs) and plug-in hybrids (PHEVs), showcasing a dominant market share for electric mobility.

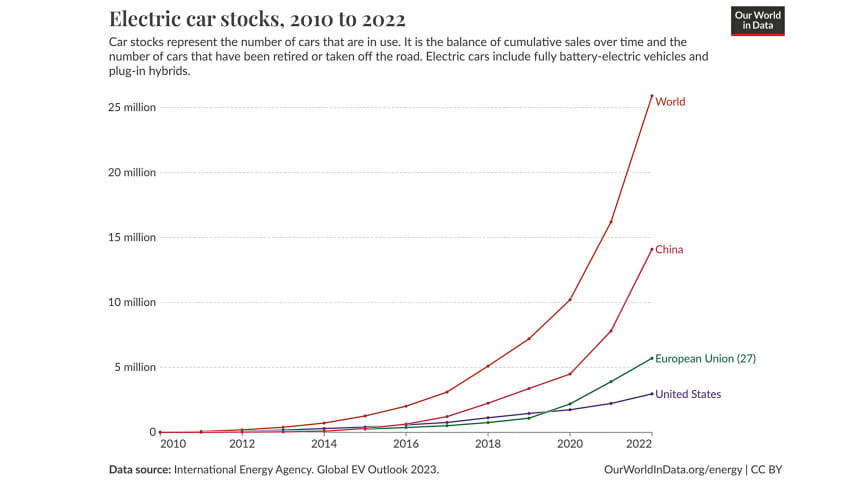

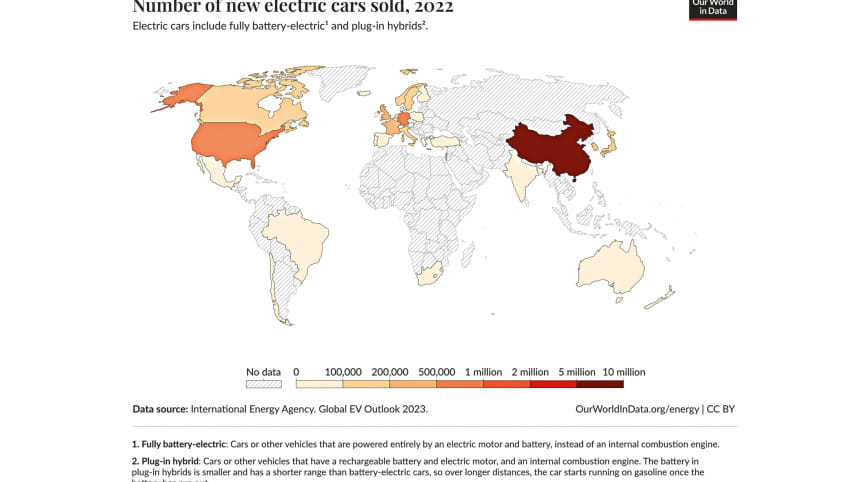

China, the world's largest auto market, has also taken significant strides. Ambitious government policies, including quotas for electric vehicle production and sales, coupled with subsidies and tax breaks, have fostered a booming domestic EV market. China is now a global leader in EV manufacturing, with domestic car makers like BYD challenging established players.

Contrasting approaches in major economies: A multi-speed race

The United States presents a mixed picture. While states like California, with its stringent emission standards and generous incentives, boast a high EV market share, others lag behind. This disparity highlights the critical role of state-level policies in driving EV adoption. The federal government's recent move to prioritise the development of a domestic EV supply chain through targeted incentives in the Inflation Reduction Act signals a potential shift towards a more holistic approach.

The European Union (EU) has adopted a comprehensive strategy, combining regulations, incentives, and investments in charging infrastructure. Stringent emission targets for new cars and vans, coupled with support for innovation, are propelling EV adoption across member countries. The EU's focus extends beyond just tailpipe emissions, with some countries like France considering the environmental impact of the entire EV production process when structuring incentives.

Germany, a traditional automotive powerhouse, has seen a steady rise in EV adoption. However, the government's recent reduction in financial incentives suggests a shift towards a more autonomous EV market. Local incentives and continued infrastructure expansion will be crucial in maintaining momentum.

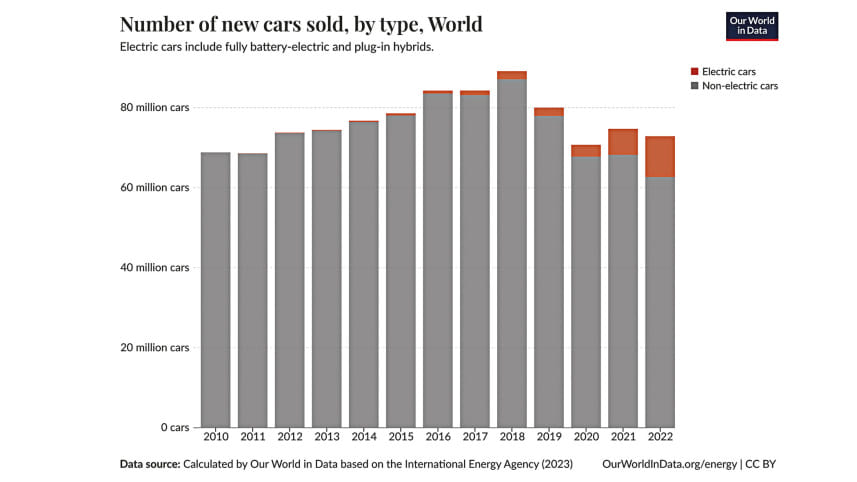

The electric vehicle (EV) market is experiencing a growth spurt, leaving the internal combustion engine in the dust. After a record-breaking year in 2023, with global sales exceeding 1.5 million units by September, the industry is poised for a period of transformation in 2024. While the breakneck pace of growth might ease slightly, several key trends will continue to shape the EV landscape:

Slower growth, not stagnation

Having witnessed a surge in demand, the EV market is expected to experience a moderation in growth rates in 2024. This can be attributed to a few factors. First, the industry is looking to expand beyond early adopters and attract more price-conscious mainstream buyers. Several manufacturers implemented significant price cuts in 2023, with Tesla leading the charge by slashing prices on its Model 3 and Model S cars by 25%.

Secondly, some countries are phasing out financial incentives for EV purchases. This, coupled with high consumer uncertainty and economic headwinds, might lead to a temporary plateau in growth. However, this doesn't signal a slowdown in EV adoption. Analyst predictions from UBS suggest a shift in growth rates, with sales in Europe and the US expected to climb 10-15% in 2024, compared to the impressive 25-50% witnessed in 2023.

Legacy automakers like Volkswagen, Toyota, and Ford are scrambling to launch competitive EV models. However, their agility pales in comparison to pure-play EV manufacturers like Tesla, BYD, Nio, and XPeng. These companies are laser-focused on electric vehicles, allowing them to move faster and capitalise on technological advancements.

Traditional automakers face the additional challenge of navigating the transition from combustion engines to electric powertrains. This involves dealing with cost pressures and potential labour unrest as the workforce adjusts to new production methods. As a result, we've seen companies like Ford, GM, and Mercedes Benz scaling back production plans and revising their EV sales forecasts for 2023.

In contrast, Tesla has been able to cut production costs for its Model Y, currently on track to be the best-selling car globally in 2024, while maintaining higher profit margins than most traditional gasoline-powered vehicles. Additionally, China's BYD, having transitioned to solely producing EVs in 2021, overtook Volkswagen as China's best-selling car brand this year and is closing in on Tesla's global EV sales lead.

Chinese EVs accelerate global expansion

Having established a strong domestic market presence, Chinese EV manufacturers are setting their sights on international expansion to hedge against a potential economic slowdown at home. China boasts the world's fifth largest EV market share, trailing only Norway, Iceland, Sweden, and the Netherlands. However, its sheer size as the world's largest car market translates to a clear lead in total sales. In 2022, China accounted for a staggering 22% of global EV sales, which translates to 4.4 million units, far exceeding the combined sales of the rest of the world.

Looking ahead to 2024, global sales of electric, hybrid, and fuel cell vehicles are expected to reach 17 million units, with a significant contribution from China.

This strategic push for international expansion can be attributed to a few factors. Firstly, Chinese automakers lagged behind other countries in producing traditional gasoline-powered vehicles. However, they recognised the potential of EVs early on and invested heavily in battery production and EV development.

Secondly, the Chinese government actively supports EV adoption to reduce air pollution and dependence on oil imports. This translates to a resilient domestic EV market even amidst a broader economic slowdown. Finally, the "Made in China 2025" industrial strategy sets a goal for China's two largest EV manufacturers to generate 10% of their sales abroad by 2025. This ambitious target is driving a surge in international expansion efforts.

The battle for the electric truck market heats up

2024 will witness a fierce competition for dominance in the nascent electric truck market. Advancements in battery technology have finally made viable electric trucks a reality, boasting impressive range and towing capabilities. This has spurred major automakers to enter the fray with their offerings.

Tesla will finally begin mass production of its highly anticipated Cybertruck in 2024. Its angular design, powerful tri-motor drivetrain, and substantial towing capacity have captured the imagination of auto enthusiasts. However, the Cybertruck will face stiff competition from established players like Ford with its updated F-150 Lightning models, GM's Chevrolet Silverado boasting a 450-mile range, and GMC's Sierra pickup.

Ram is not backing down either, introducing a new electric pickup with a standard 168-kilowatt hour battery pack offering a 350-mile range, with the option to upgrade to a class-leading 500-mile range.

Battery swapping as a potential game changer

One of the major hurdles to widespread EV adoption is the limited availability of charging infrastructure, particularly in non-urban areas. While there are ongoing efforts to expand traditional charging networks, battery swapping stations are emerging as a potential solution to bridge the gap.

This technology allows drivers to quickly replace depleted battery packs with fully charged ones, significantly reducing charging times. China's Nio has been at the forefront of battery swapping, establishing a network of over 2,000 stations across China and venturing into Europe with plans to expand further in 2024.

Recognising the potential of this technology, established automakers like BMW and Mercedes-Benz are collaborating to install a network of at least 1,000 battery swapping stations in China. Stellantis, another major player, has partnered with US-based Ample to introduce battery swapping for its Fiat 500e models in a pilot program scheduled to begin in Madrid, Spain, in 2024.

The widespread adoption of battery swapping, along with bi-directional battery charging that allows EVs to power homes or buildings, could significantly enhance the convenience and practicality of electric vehicles.

Shifting tides in battery chemistry

Battery swapping could also play a role in mitigating a short-term decline in driving range caused by a shift in battery chemistry. Most EVs currently use lithium-ion batteries with a cathode made of nickel-based materials like NMC or NCA. While these offer higher energy density and longer range, concerns about volatile market prices and the environmental impact of sourcing the necessary metals are prompting a search for alternatives.

Lithium-iron-phosphate (LFP) batteries are regaining popularity due to their stability and lower reliance on critical materials. Additionally, companies are actively developing technologies for silicon anode, solid-state lithium-ion, and sodium-ion batteries. These advancements promise more stable chemistries with reduced reliance on nickel, cobalt, and graphite.

For instance, SK On Company, a South Korean battery manufacturer, is developing solid-state electrolytes with plans for mass production by 2028. Similarly, Toyota is collaborating with Idemitsu Kosan to establish a supply chain for solid-state electrolytes in the coming years.

Governments fine-tune incentives

With EVs becoming more mainstream, governments are re-evaluating their incentive programs. The US Inflation Reduction Act, for example, aims to bolster domestic EV production by offering tax credits only for vehicles with battery components sourced from North America. This is intended to reduce reliance on foreign suppliers and strengthen the domestic EV supply chain.

Australia is another example, with some states phasing out purchase incentives for new EVs due to price reductions by manufacturers. However, these funds are being reallocated to expand charging infrastructure, ensuring continued growth in EV adoption.

On the other hand, Thailand has extended its EV subsidies for consumers while reducing their value as the domestic EV market matures. This strategy aims to balance affordability with long-term sustainability. France is taking a unique approach by introducing cash incentives based on the environmental impact of a vehicle's entire life cycle, from raw material sourcing to manufacturing and disposal. This approach encourages the production of EVs with a lower environmental footprint.

The road ahead

The year 2024 promises to be a period of significant transformation for the EV market. While growth rates might moderate in the short term, the underlying trend towards electric mobility remains undeniable. New vehicle models, government incentives tailored for a maturing market, and technological advancements in batteries and charging infrastructure will all play a crucial role in accelerating EV adoption and paving the way for a cleaner transportation future.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments