Development trends and the tasks ahead

Bangladesh is one of the most densely populated countries in the world with a population of around 160 million. The economy is rapidly transforming from agriculture-based to industry- and service-based. Despite achieving significant landmarks in the fight against poverty, especially through the transformation of agriculture (increased yield), micro-credit expansion and RMG export, poverty still remains a daunting problem for a vast majority of the population.

This article deals with trends in the major fields of economic development and the challenges of faster growth and equitable development of the common people. The article does not include the most recent data and issues because it provides a historical perspective.

POVERTY: GROWTH NEXUS

During the decades since the 1990s, faster growth rate has been identified as one of the causes in reducing poverty. Graph 1 shows that the real GDP growth rate in 1990 was 5.94% and gradually increased to 6.12% in 2014. During the past two decades, the growth rate in some years was around 4%, but the overall trend was above 5% on the average.

Bangladesh experienced two devastating natural disasters (flood and cyclone) in 2007 and a subsequent food price shock in 2008. However, the country's real GDP growth was greater in the 2005-2010 period relative to previous periods. Poverty estimates based on the 2010 HIES show that the proportion of poor people declined from 48.9% in 2000 to 40% in 2005 and then to 31.5% in 2010. The decline in extremely poor people was from 34.3% in 2000, to 25.1% in 2005 and then to 17.6% in 2010 (World Bank, 2013). Around 12.4 million non-poor also remained highly vulnerable to poverty in 2010, so it is not just the poor but also those on the margins who are susceptible (World Bank, 2012).

During this period, growths in income and consumption expenditure were the main drivers of poverty reduction. In fact, growth during the first part of the decade (2000-2010) was more significant than redistribution in reducing poverty. In the first half of the decade, the faster reduction of poverty due to growth only has been accompanied by a worsening of income distribution.

Graph 1 also shows the condition of inflation and unemployment rates as well. With the shift of rural labour force from farming to non-farming activities, the predominance of non-tradable activities, especially outside agriculture, and the increasing rate of informal sector employment, the full benefits of faster growth and economic transformation did not benefit a vast section of the poor. The official figures for the unemployment rate show an increasing trend, but the labour force survey (LFS) data does not include the under-employed, self-employed, and unpaid family helpers in calculating the value. In reality, the unemployment rate is higher than what is depicted in Graph 1.

INFLATION

Estimation of historical changes in monetary policy (MP) and their subsequent impact on the economy, raise the difficult question of how changes in MP affect inflation, output, exchange and interest rates (Sargent and Sims, 2011). Commitment to a nominal anchor like inflation rate itself says nothing about what economic variables are best suited to play that role. Should it be money supply, exchange rate, CPI or a combination of all? With the emergence of floating exchange rate, many emerging economies, including Bangladesh, have chosen the inflation rate as a nominal anchor for MP.

In Bangladesh, the major issues are:

- Inflation acceleration in 2011-2012 led by food prices;

- Inflation affected by global prices of food commodities and prices of fuel, raw materials and intermediate goods (used in manufacturing industries);

- Growth of reserve money, broad money, credit to the private sector and to the government being more on the high side vis-à-vis growth and inflation rates. Government borrowing from the banking sector and Bangladesh Bank (which is alarmingly high) has not only created a "crowding out effect" in private sector investment, but has also created inflationary pressure because government expenditure is not always used for "real sectors".

- Over the last two decades, inflation has been somewhat contained. Recently, global prices of fuel and commodities have fallen, which may attribute to containing inflation.

PRIVATE SECTOR CREDIT GROWTH

Conventional wisdom says that there is a negative correlation between the real rate of interest and credit growth.

Graph 2 shows the relationship between the real growth of interest and private sector credit growth. The low interest rate does not automatically result in credit growth. There are periods when relatively low interest has not lead to high credit growth and vice versa. In effect, the current monetary policy framework should go beyond the conventional wisdom-based approach by broadening its scope to take into account aspects such as the concentration of employment in agriculture and informal sectors; asymmetric information flows; significant transaction costs; high risk premiums; and general lack of incentives on the part of the banks that limit availability of credit in employment-intensive sectors and activities. This will require the monetary policy to be broadened beyond monetary aggregates covering low inflation and stabilisation.

If we look at Graph 3, the share of agriculture declined from 30% in 1990 to 19% in 2013. The share of industry and service sector steadily increased. As mentioned earlier, an increasing amount of people are now employed in industry and other sectors, especially the non-farming sector. If the macroeconomic policy is to accelerate the pace of poverty reduction in Bangladesh, the development of non-farming enterprises (large, medium, small) should be accelerated so that a large portion of poor people can benefit.

For these processes to be effective, the macroeconomic policy has to focus on both the demand and supply sides. For example, the monetary policy should create a favourable condition for investment and consumption demand in order to boost the production. This in turn will result in increased employment and purchasing power of the poor. On the supply side, the monetary policy can remove the impediments of the access to finance faced by the poor. So the role of SME enterprises, expansion of agriculture credit and financial inclusion must be duly emphasised.

EXTERNAL SECTOR

The effect of the global financial crisis of 2007 on Bangladesh has been insignificant due to the prudent policies of Bangladesh Bank and the steady performance of the external sector. Graph 4 shows the growth of imports and exports. The negative balance of trade is offset by steady inflow of foreign remittances from migrant workers. Remittance steadily grew from USD 10.9 billion in November 2009 to USD 14 billion in FY 2014. Foreign exchange reserves also grew steadily from USD 10.7 billion in November 2009 to around USD 22 billion in March 2015. The external balances remain comfortable even with weak export growth and strong imports. Deficit in the current account emerged at USD 1.3 billion in July-January of FY 2015 compared to a USD 2.5 billion surplus during the same period in FY 2014. The deficit resulted from a weak export growth of 2.1% and a strong import growth of 16.4%. Slow export growth reflected the adjustment of the garment industry to stricter labour and safety standards (especially after the GSP suspension by USA and the Rana Plaza Tragedy) and slowed down demand from importing countries. The nominal taka-dollar exchange rate has been relatively stable, mainly due to interventions by Bangladesh Bank, although the real effective exchange rate (REER) has appreciated by about 33% since its trough in 2011.

CHALLENGES IN FISCAL MANAGEMENT

Fiscal performance and expenditure management has been weak in Bangladesh in recent times. Despite increasing budgets from one year to the next, very little has been done regarding the control of unsustainable government spending and borrowing and the need to increase revenue sources. The government is facing budgetary constraints and is running up the deficit. Total borrowing from the financial system as of FY 2011 was USD billion, of which USD 2.2 billion was from the domestic banking system. This amount represents a 40% increase over 2010. A significant portion of the government budget has been allocated to subsidies, which could put a dent in fiscal sustainability efforts if there are no price adjustments.

Revenue mobilisation has also been inadequate. Tax revenue mobilisation in this case is very low. The tax system, despite recent reforms, is still poor. Mobilisation of revenue is one of the lowest in the world, while old policies and rigid administrative practices mean that the system has been very slow in bringing in new income-generating activities within the tax net. Such weaknesses mean that a significant portion of activities remain untaxed in addition to rampant tax evasion. Bangladesh has the lowest tax revenues to GDP ratio in South Asia. Tax revenues have exhibited a very slow upward trend over 2004-2009. Compared to the world average of 13.5%, Bangladesh can collect revenues amounting to only 8.6% of GDP.

Massive leakage in the form of wasteful public expenditure and corruption also pose significant challenges for fiscal sustainability in Bangladesh. The Hall Mark incident of Sonali Bank and massive irregularities in Basic Bank, both state-owned banks, deserve special attention with respect to fiscal mismanagement. In the medium term at least, the government needs to commit to a budget that excludes certain forms of unnecessary spending and transfers. Revenue mobilisation has to take greater precedence, both from tax and non-tax sources. Total domestic savings as a percentage of GDP have remained stagnant, which means that not enough savings are being generated for investment, one of the few alternatives against which is to resort to public financing through borrowing. More effective financial regulation has to be put in place to ensure that credit/funds are being channelled into the productive sectors of the economy and are not concentrated in the hands of the select few.

MILLENNIUM DEVELOPMENT GOALS (MDGS)

The global poverty reduction efforts now rest on interrelated aspects:

Achieving MDGs by 2015;

Moving forward with social protection and safety nets for the poor.

Bangladesh has attained satisfactory progress in achieving the MDGs. The areas where Bangladesh achieved the targets include Goal 1: Eradicating extreme poverty and hunger; Goal 2: Achieving universal primary education;Goal 3: Promoting gender equality and empowering women; Goal 4: Reducing child mortality rate; and Goal 6: Combating HIV/AIDS, malaria and other diseases.

Experts found that Bangladesh has some weaknesses in Goal 5: Improving maternal health, specifically maternal mortality rate, and does not have any control over Goal Ensuring environmental sustainability and Goal 8: Developing a global partnership for development.

Besides these, Bangladesh has some weaknesses in employment generation (Goal 1, Target 1.B) and malnutrition (Goal 1, Target 1.C). These observations were brought up at a press briefing on 'Southern Voice on Post-MDG-Dhaka Expert Group Meeting' organised at the CPD auditorium in Dhaka in January 2013 (The Financial Express, 2013)

I would like to mention that we have challenges before us. We have to reduce the percentage of poor to 29% by 2015; we have to reduce maternal mortality rate to 139, child mortality to 31 and enrolment to primary school to 100% by 2015. The gap is more evident in the nutritional outcome of the MDGs. The poor in Bangladesh still suffer from nutritional deficiency, which can be improved by increasing the entitlement capacity of the poor to have a balanced diet. I shall not go into the various challenges and caveats we face, but I will single out one of the most important challenges, which is "institutional challenges". Impact of various efforts for improving the socio-economic conditions of the poor in the developing countries can be maximised through proper management and implementation of development projects. Effective project management and implementation are also crucial for sustainable development. Institutions, which encompass entities at the local level, community level, national level, and project management units, are integral parts of project management and implementation. However, despite strong statements and rhetoric about the essential role of institutions, and the realisation of its potential contribution in development efforts, the issues of institutions have received relatively little attention by policy makers, planners and implementers of development projects.

CHALLENGES

Political instability

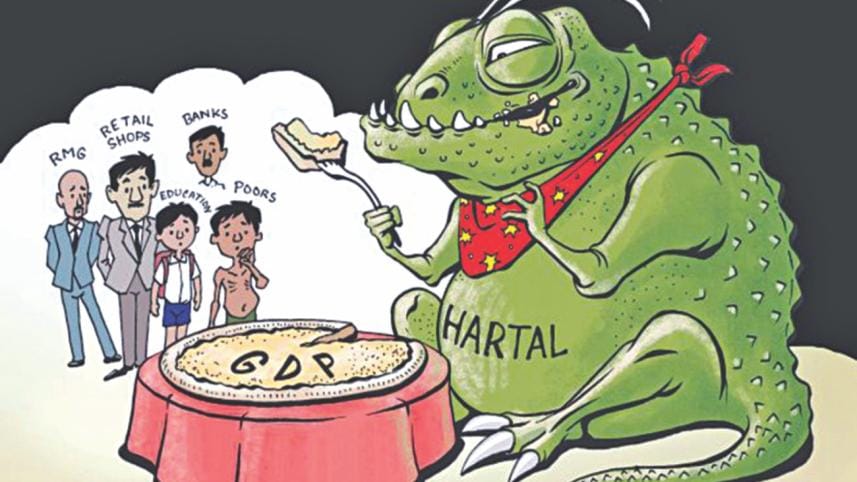

The main challenge is the prolongation and intensification of political turmoil. This affects the economy in both the short and medium terms. The lack of political stability results in a lack of good governance, transparency and accountability in the public and private sectors. The political turmoil of late 2013 and early 2015 has resulted in economic losses. Different estimates of GDP foregone range from 0.55% to 1.1% of GDP.

Lack of good governance

Corruption, nepotism, and political interference in economic activities result in inefficiencies, wastage of public fund and lower rate of growth, employment and poverty reduction.

Reform measures

Reforms in the financial sector, public enterprise and regulatory bodies should be carried out.

Growth rates

Average annual GDP growth rate needs to be increased to 7.5% to 8% in order for Bangladesh to reach middle-income status by 2021. For this, we require: (a) Investment to be increased to 32% from the current 26-27% of GDP; (b) Increased employment; (c) Increased quality of education and training; (d) Increased total factor productivity (TFP); (e) Increased export diversification; and (f) Introduction of improved technologies in all sectors.

Mitigating adverse impact of climate change

Bangladesh is vulnerable to environmental risks and climate change, which must be addressed properly.

Improved human welfare

While growth is necessary, attention to distributional aspects of income and assets among the people has to be addressed as well. This aspect coupled with higher allocation of resources to education, health, and social welfare will result in increased human welfare.

RISK FACTORS

In the backdrop of gradual international integration, it will be important for policy makers to monitor external factors since any external instability can easily be transmitted into the internal economy. The risk factors for the Bangladeshi economy include the following.

Insufficient infrastructure, i.e., insufficient public capital, mainly insufficient investment, in power generation could be a major threat for growth;

Constraints in domestic revenue mobilisation with continuing dependence on international trade tax, with direct tax collection increasing at a pace that is slower than the domestic Value Added Tax (VAT);

Low degree of monetisation hinders normal flourishing of the equity market. A shallow equity market is subject to easy manipulation. Low level of financial development is also characterised by the absence of effective bond and insurance markets;

Slow pace of complementary reforms to ensure improvement of environment for private investment including FDI; improvement of governance in public infrastructural facilities and utilities; regulatory framework for capital and debt market; contract enforcement through judicial process; and transparency in public expenditure;

Lack of human capital with adequate technical or vocational education;

Constraints in the opportunities of investment by non-resident Bangladeshis in productive sectors.

Within this context, faster GDP growth consistent with poverty reduction goals can be met if first, the efficacy and quality of regulatory bodies like Bangladesh Bank, Bangladesh Securities Exchange Commission, Bangladesh Telecommunication Regulatory Commission, and Bangladesh Energy Regulatory Commission advance significantly. Second, if the efficiency of government bodies like Planning Commission, Tariff Commission, and Bangladesh Bureau of Statistics, Implementation Monitoring and Evaluation Division of the Planning Ministry enhances considerably. Third, if the agencies responsible for promotion of business like the Board of Investment (BOI) and Export Promotion Bureau become more dynamic and pro-business. Fourth, if the bodies representing business interests like the Federation of Bangladesh Chambers of Commerce & Industry, and Bangladesh Garments Manufactures and Exporters' Association work in tandem with the government for sustainable and equitable development to ensure benefits of development to the poor and disadvantaged. Last but not the least, if and only if good governance with adequate transparency and accountability in both the public and private sectors is ensured.

To address these issues appropriate macro-policies, especially fiscal, monetary and trade policies combined with a set of heterodox policies, backed by political will and political stability (with democratic norms, rule of law and good governance), are necessary to enable the Bangladeshi economy to grow at an accelerated rate in the medium term and pave the way for Bangladesh to become a "success story" of overall development.

The writer is Former Governor, Bangladesh Bank (Central Bank). He is also a Professor at BRAC Business School, Dhaka, Bangladesh

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments