Understanding Biden’s big bet on India

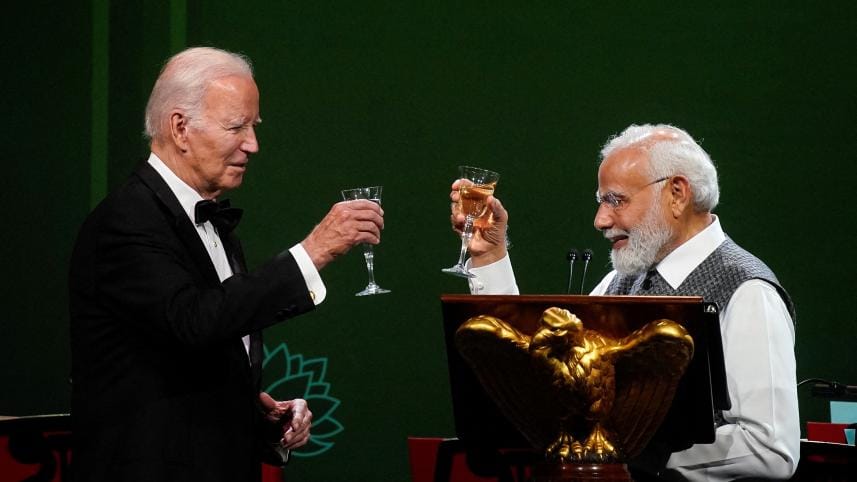

The unprecedented lovefest between India and the United States has been striking and, frankly, puzzling. Following the pageantry of US President Joe Biden hosting a state dinner for Indian Prime Minister Narendra Modi, and of US Speaker of the House Kevin McCarthy inviting Modi to address a joint session of Congress for a second time, one wonders if America is giving away the store and getting very little in return.

After all, symbols such as these are the least of it. Among other things, the US is transferring sensitive military technology to a non-treaty partner, nudging its companies to invest in India, easing visa restrictions for Indian nationals, and desisting from publicly chastising Modi's government for its democratic backsliding. In effect, the US has drawn India into a one-sided quasi-alliance: it seems to have taken one, at most one and a half, to tango. The strategic rationale, of course, is the need to counterbalance China. But what is the Indian quo for the American quid?

Former US diplomat Ashley J Tellis believes the US is making a "bad bet," because India will never participate in coalition warfare with the US against China unless its interests are directly threatened. In a Sino-American conflict over Taiwan, India would remain on the sidelines, despite the generosity the US has shown it. Even US National Security Adviser Jake Sullivan has acknowledged this.

But India experts such as Pratap Bhanu Mehta, a former vice-chancellor of Ashoka University, point out that the US will increasingly need India as its own hegemony erodes. The new axis of autocracies includes not only China, Russia, and Iran, but also Saudi Arabia and even Turkey.

Faced with this geopolitical development, the US at least needs to forestall any potential cooling with India, lest it find itself more isolated. Not only is America's adversary count rising, but its allies leave something to be desired. Europe is predictably inconsistent and ambivalent, especially when it comes to China, and though Japan and South Korea are reliable allies, their demographic decline deprives them of real heft.

But more to the point, it is not clear that the US needs to go to such lengths to prevent India from joining the axis of autocracies. After all, China is a hostile neighbour, Saudi Arabia is a global financier of militant Islam, and Russia – its primary military supplier – is headed for disorder. Partnership with such countries is not remotely enticing for India. Likewise, India, with its influential diaspora and basic congruence of economic and military interests, has little to gain by openly snubbing the US.

So, the US is giving away quite a lot either for something that India will never sign up to (military engagement against China), or for something that India would do regardless of the enticements on offer. What are American strategists thinking?

One plausible explanation is simply the economic arithmetic of hard power. Democrats and Republicans alike have concluded that China poses an existential threat that cannot be neutralised, only counterbalanced. According to the International Monetary Fund (IMF), US GDP in 2023 will be $26.9 trillion, whereas China's will be $19.4 trillion (at market exchange rates). But over the next two decades, that 30 percent American edge will likely narrow.

Yet, for all the euphoria around India's growth prospects, it is still a long way from matching Chinese economic and financial capabilities. China's GDP is more than five times greater than India's at market exchange rates, and about 2.7 times greater at purchasing-power-parity rates. Moreover, China's military spending is three to four times greater, and its foreign exchange reserves (to the extent that they can now be measured) are easily six to seven times larger. The multiple on China's total trade over India's is similar, and its lead in global development lending is astronomical.

China's overwhelming economic advantage helps explain why India often appears helpless in the face of provocations, like China's extensive land grabs along the countries' border in the Himalayas. Such episodes make it painfully evident that India is no counterbalance to China.

But America's wager is based not on the present, but on the expectation that China and India's fortunes may change over the long term. Owing to long-standing structural and demographic challenges, not to mention Chinese President Xi Jinping's increasingly repressive approach to the private sector, China's long-run growth rate could well fall to about 2.5 percent. At the same time, India could continue to grow at perhaps five to six percent per year.

Though by no means guaranteed, this scenario is plausible if India develops better policies and stronger institutions. It would not eliminate the large China-India hard-power differential, but it could narrow the gap enough to force China to re-calibrate its decision-making. For example, if China's five-fold GDP advantage over India was to be halved over the next two decades, Chinese leaders could no longer afford to discount the possibility of India retaliating on trade or along the border.

Moreover, the future is a process, not some hypothetical endpoint. If Chinese growth were to wane and India's were to remain durably robust, its relative attractiveness as a partner, market, and investment destination would increase. In that case, the strategic calculus would change well before India reached a size sufficient to counterbalance China.

True, whether India can grow at six percent will be determined by Indian, not American, policymakers. But the US believes it is providing an important nudge at a critical geopolitical moment to boost India's fortunes. With China becoming more aggressive as its long-term growth prospects are revised downward, US actions also could encourage more capital to exit the Chinese market. And while re-shoring is the preferred outcome, the US will not object if fleeing capital decamps to India. US actions could also help upgrade India's military capabilities. In effect, the US is proclaiming to the world that India is "one of us." The fact that India is being coy about openly embracing that status ultimately may be less important.

Properly understood, Biden's "India Bet" is not about securing Indian military support in a hypothetical standoff with China, nor is it designed to prevent India from drifting towards the axis of autocracies. Rather, it is a calculated prod aimed at narrowing the real and perceived power gap between India and China. The smaller their hard-power imbalance, the more effective the counterbalance for the US vis-à-vis China.

Arvind Subramanian, distinguished fellow at the Center for Global Development, is currently advising the Tamil Nadu government in India on power sector reform and the green transition.

Copyright: Project Syndicate, 2023

www.project-syndicate.org

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments