How to make the Bangladesh Bank autonomy ordinance effective

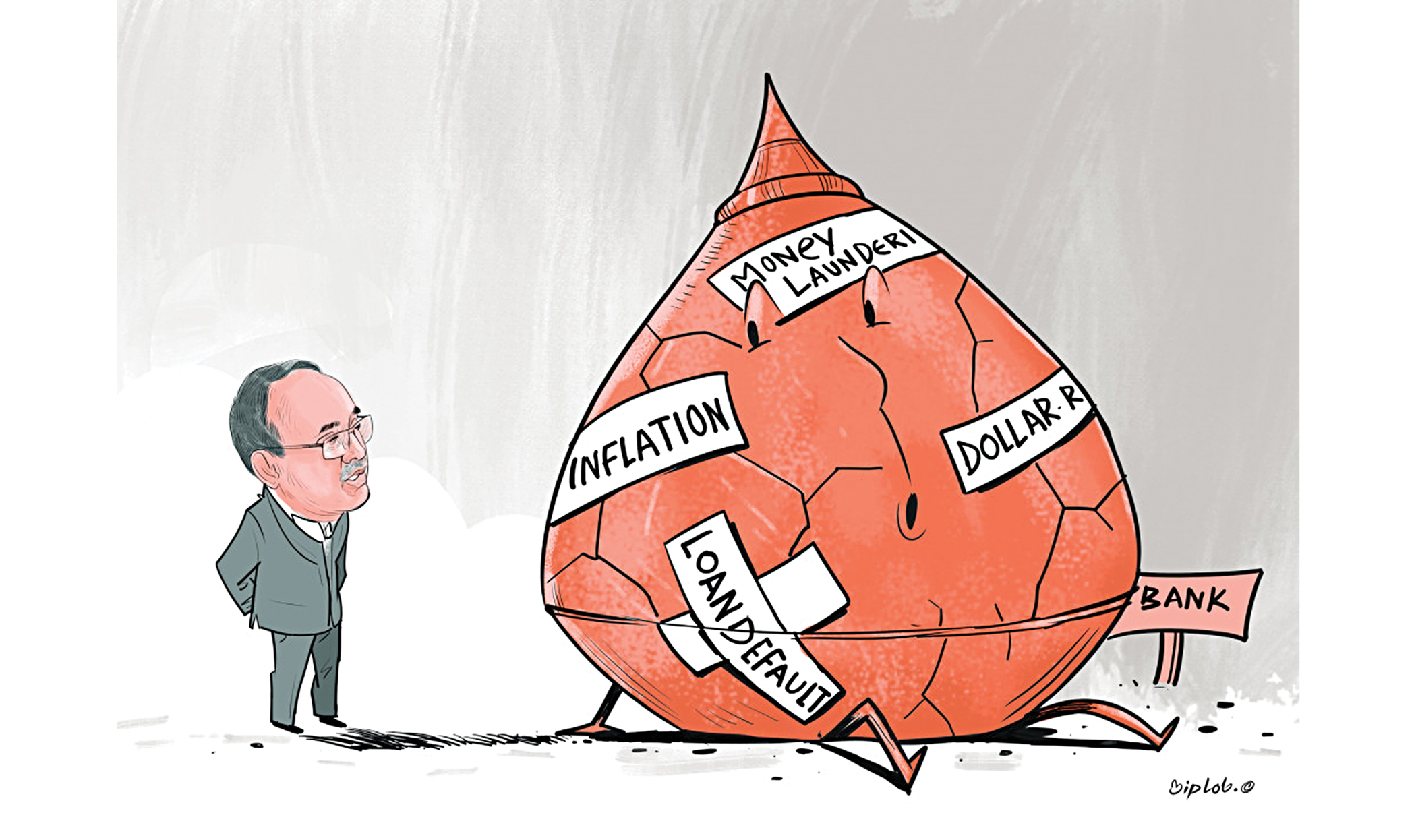

While most reform initiatives under consideration by the interim government have achieved little progress or, at best, a fragile consensus, its banking reforms have gathered ample momentum among economists and civil society. The most notable among them is the long overdue Bangladesh Bank Ordinance (Amendment), 2025, which is designed to award long-coveted autonomy to the central bank. The ordinance seems good enough to fend off the finance ministry should it try, as it did during the Awami League regime, to use the Bangladesh Bank (BB) as its money-printing press in the name of deficit financing. If enacted, the amendment can bring a revolutionary change over the Bangladesh Bank Order of 1972, which has fallen behind the art of modern-day central banking.

The main points of the proposed ordinance include: a) the governor's status which is to be equivalent to that of a minister; b) a search committee which will propose three names for the governor's post; c) the prime minister's advice to the president for the governor's appointment; d) parliamentary approval for the appointment and removal of the governor; e) exclusion of any government bureaucrats from the BB board; f) the governor and deputies to be sworn in by the chief justice; and g) the governor's tenure which is to be increased to six years from four.

While most of them reflect the necessities of modern-day central banking, some of them require corrections so that the governor's appointment remains fair and authentic to uphold the central bank's institutional integrity. The ordinance must clarify how the six-member search committee, which will propose three names for the governor's post, should be formed. The committee members must possess adequate expertise, banking-related knowledge, and ample reputation for wisdom to ensure fairness.

It is likely that a highly politicised committee will eventually choose the names suggested by the prime minister, either directly or indirectly. Therefore, the formation of the search committee is immensely crucial, as it would accept nominations or applications for the governor's position. The governor candidates must be known to society for their scholarly contribution in the fields of economics, finance, banking, and macro policymaking. The search committee must be transparent in its recruitment guidelines and sequential decision-making in the selection process.

Next, these three names should go to parliament for open discussion among the lawmakers. US Congress members engage in open debate about the potential Fed chair's background and credentials. After debate, the parliament should determine the order of its preference from one to three and give the list to the prime minister, who can select only two names from them and then hand over the shortlist to the president for the final selection. Here, judgement is expected to be invoked at every stage, and every entity has a role to play rather than being used like a rubber stamp. This level of rigour and integrity is required to select a central bank guru who will form a parallel government alongside the political regime.

The governor, being a constitutional position, is to be sworn in by the chief justice under the new ordinance. But why the deputies, too? Deputy governors are appointed internally through promotion and sometimes favouritism. They are in-house professionals who are supposed to support the governor. Deputies would never go through the same selection process a governor would be required to.

The initial draft-makers seem to have cultivated bias from the central bank's point of interest without understanding the ground reality in a country where both fiscal and monetary policies must work in tandem. Hence, ignoring the political government and the bureaucratic apparatus quite enthusiastically has turned impractical. The task of forming the BB board must involve other government officials to make the central bank's policy measures work fruitfully. As the draft ordinance says, the BB board of directors would comprise the governor, two deputy governors nominated by the governor, and eight other directors appointed by the government from a list submitted by the governor. This sounds like a one-man show by the governor. To be fair, there should be two lists: one from the governor and the other from the search committee. The government can choose from both lists to maintain a balance.

In addition, the inclusion of the finance secretary, NBR chair, BIDA chair, and BSEC chair is imperative since all of them are key policymakers for the economy. The success of the Bangladesh Bank's policymaking hinges on deep coordination with these institutions. BIDA, NBR, BSEC, and the finance ministry are all integral parts of the central bank's prime responsibilities involving inflation control, deposit mobilisation, credit expansion, investment promotion, reserves maintenance, employment maximisation, and ensuring macro stability.

The provision for the BB governor's removal should be equally important. The finance adviser supported BB's autonomy but insisted that security and accountability must be ascertained. Many central bank governors are fired when inflation breaks an upper ceiling set for their respective economies. The BB governor must use tools like the policy and exchange rates to ensure a healthy level of reserves and sound macro stability that can attract foreign investors. Hence, there should be another section in the documentation that includes clear guidelines for measuring accountability. Authority without accountability breeds malpractice and corruption.

There are three basic changes that demand consideration. First, monetary policy should be presented at parliament, just like the budget. The coverage of monetary policy in GDP is no less than that of the annual budget. Second, the proposed ordinance can be named as the Bangladesh Bank Autonomy Act, which clarifies the objective and justifies the move. Third, the time has come to think about changing the name of our central bank. Simply the "Bangladesh Bank" sometimes sounds like a private or public commercial bank, particularly overseas. Rather, the "Bangladesh Central Bank" sounds more appropriate to reflect its great stature as the supreme financial commander and the reserve bank of the country.

Dr Birupaksha Paul is professor of economics at the State University of New York in Cortland, US.

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments