Can monetary policy rescue the economy?

Recently, the Bangladesh Bank announced its monetary policy for the first half (July-December) period of FY2025-2026. Unlike the finance ministry's budget speech that had praised the government and blamed the past regime, the monetary policy statement (MPS) remains professional and sober. The goal is clear: the monster of high inflation, whose 12-month average is still 9.8 percent in July 2025, must be reined in even at the cost of a bitterly high policy repo rate of 10 percent.

BB indicated the possibility of a reduction in the policy repo rate only if inflation falls below seven percent. Meanwhile, the exchange rate—the amount of taka per US dollar—will remain broadly market-based, although BB may intervene to iron out market volatility, so that stability is ensured in the foreign exchange market. The question remains whether this policy can rescue the economy from the doldrums and place it firmly on the path of vibrancy.

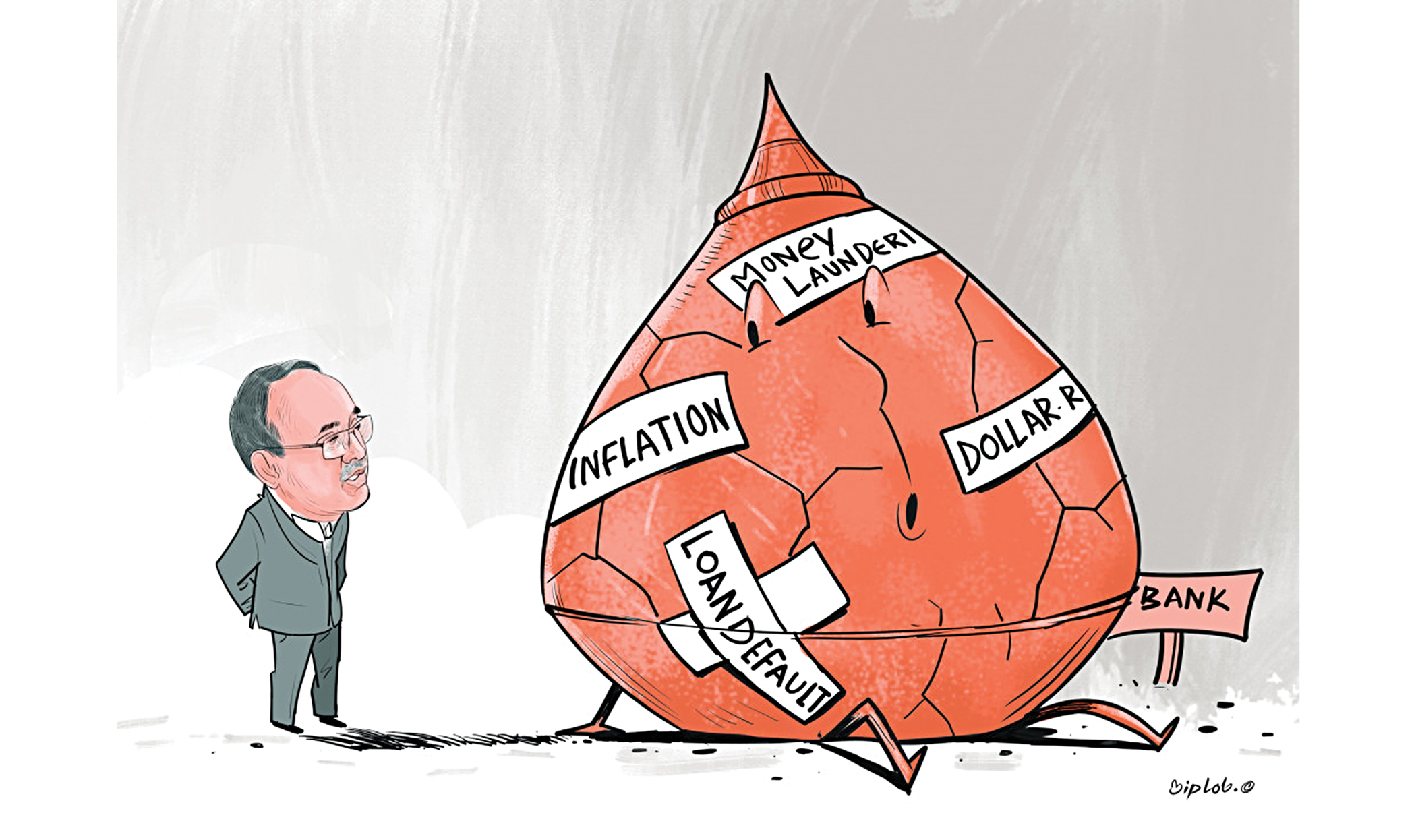

If the morning shows the day, BB has made commendable progress in achieving its goal. Not all arms of the government are functioning well enough to earn that level of accolade. Some agencies related to law and order have performed poorly, and that puts the financial industry on the ropes. But BB has spearheaded efforts against all odds by prioritising its foremost duty of fighting inflation under the leadership of Governor Dr Ahsan H. Mansur. He assumed office at a time marked by a two-year-long decline in foreign reserves that threatened national stability. He turned the trend around by adopting knowledge-based tools that previous bureaucratic governors had often overlooked, whether deliberately or negligently.

The current level of reserves stands at $25.2 billion, while it was $20.5 billion in early August last year. The increase of around $5 billion is not a tremendous achievement, but reversing the trend from a decline to a crescendo is a feat worth recognising. And that marks the best success of Dr Mansur's leadership at the central bank. Still, BB has miles to go before it can really celebrate its success.

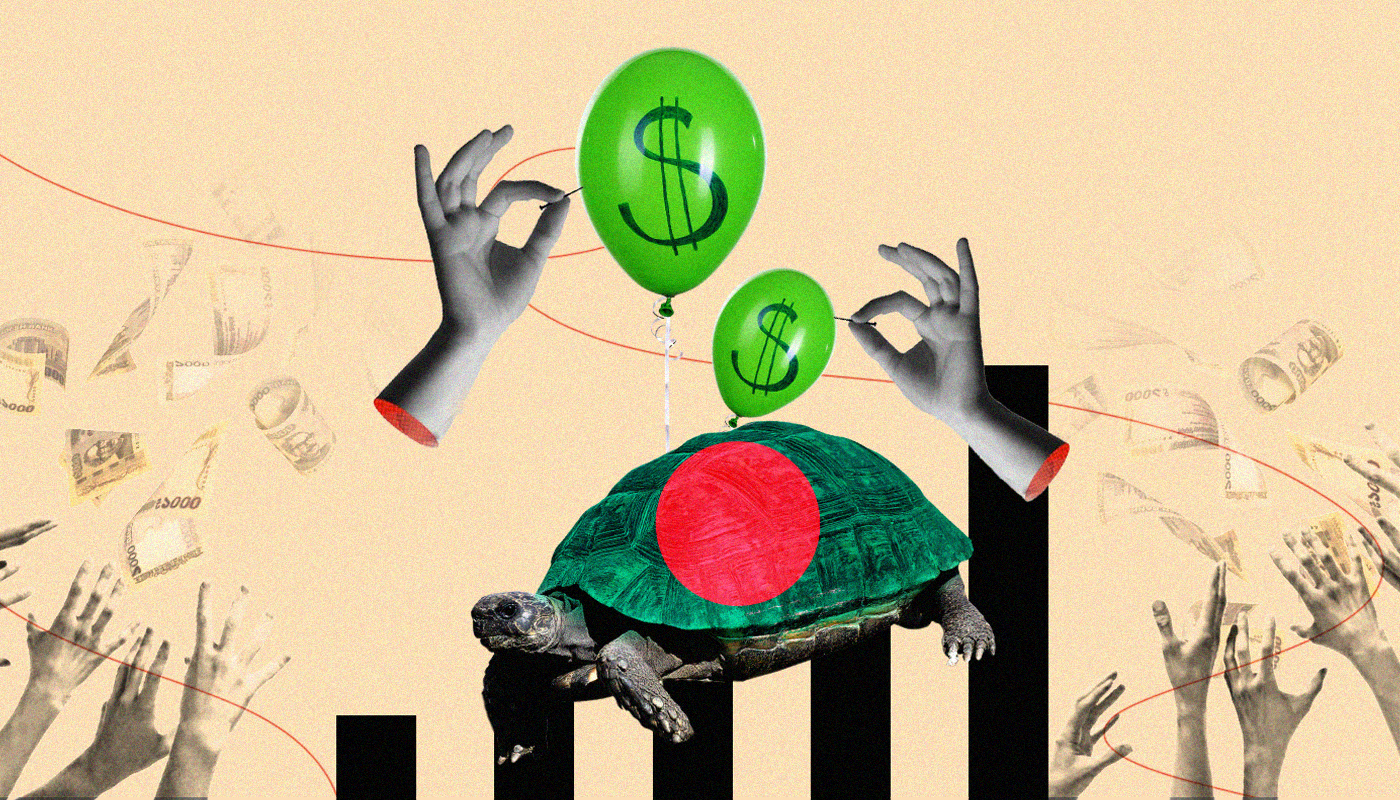

Given an import bill of around $6 billion per month, the current reserves can cover about four months of imports—an inadequate buffer, especially when compared with some comparable economies, given heightened geopolitical tensions surrounding Bangladesh. India's economy is usually eight to ten times larger than Bangladesh's, but its current reserves are around 25 times greater. Of course, countries like China and India maintain high reserve levels because of their strategic positions. Bangladesh, staying in between these two global giants, must insulate itself by maintaining a safe level of reserves—which may be eight months' imports, as is the global average.

India's import cover was equivalent to 11 months in May last year, while China's was as high as 15 months last July. Bangladesh's monthly import bill of around $6 billion is currently much lower due to a sharp 25 percent decline in capital machinery imports. Hence, the monthly import bill could be around $8 billion once normalcy returns, straining our reserves again. So, BB cannot feel complacent until reserves hit around $40 billion, which would still be less than the highest level of reserves held in August 2021.

The central bank's dual mandate is to maximise employment or growth after maintaining a tolerable level of inflation, which seems to be around four percent for a developing economy. Given the interim government's weakness in handling mob violence and political uncertainty surrounding the election, most investors remain conservative or nervous about what happens next. Domestic private credit growth slowed to as low as 6.5 percent in June 2025—the lowest in two decades. BB aims to achieve private credit growth of 7.2 percent by December 2025 and 8 percent by June 2026. But that seems inadequate to support the government's target of 5.5 percent GDP growth in FY2026, which BB also intends to comply with.

Public sector credit growth remained high at 13.5 percent in June 2025—twice the rate of private sector credit growth—suggesting that the government is again encroaching on monetary space that private investors could otherwise utilise. Growth is targeted to reach even higher, at 20.4 percent in December and 18.1 percent in June 2026, reflecting fiscal incapacity and growing inefficiency of the government in collecting revenue. Fiscal trespassing into the banking space had been a persistent concern during the Awami League regime, and the current monetary policy does not show any credible improvement in this regard.

BB's policy objective is to tame inflation by reducing credit growth, a task that requires raising the policy rate substantially. But unchecked credit expansion in the public sector may fuel inflation again, jeopardising the policy objective of BB. If inflation is not contained, it could prompt further depreciation of the exchange rate and consequently another round of imported inflation. This raises the question of where BB is compromising its intent to reduce inflation through its own actions.

Average inflation was 9.9 percent in July last year. It peaked at 10.34 percent in January 2025 and then fell to 9.8 percent in July 2025. This decrease, despite being desirable, is not quite encouraging. Rather, it suggests a state of inflation persistence, requiring an investigation into whether monetary policy alone can weaken inflation. Probably not.

Additionally, institutional factors such as syndication, extortion, threats, and business insecurity have formed hidden rigidities that prevent inflation from falling. Monetary policy cannot handle these institutional and political factors, which are contributing to the sustenance of high inflation, debilitating investment spirits, low revenue, and rising unemployment. Thus, the effectiveness of monetary policy remains constrained despite the pressing need for low inflation, respectable GDP growth, and increased job opportunities.

Dr Birupaksha Paul is professor of economics at the State University of New York in Cortland, US.

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments