How can we increase our remittance?

Remittances sent by expatriate Bangladeshis are one of the vital sources of foreign currencies for the country's economy. Needless to say, remittance plays a crucial role at both macro and micro levels. At the macro level, remittance improves the balance of payment position, helps pay import bills, builds foreign exchange reserves, helps debt servicing, and boosts economic growth – thereby promoting employment. At the micro level, remittance adds to household income back at home, helps improve the standard of living, reduces poverty, promotes savings and investment, and develops human capital through productive investment in education.

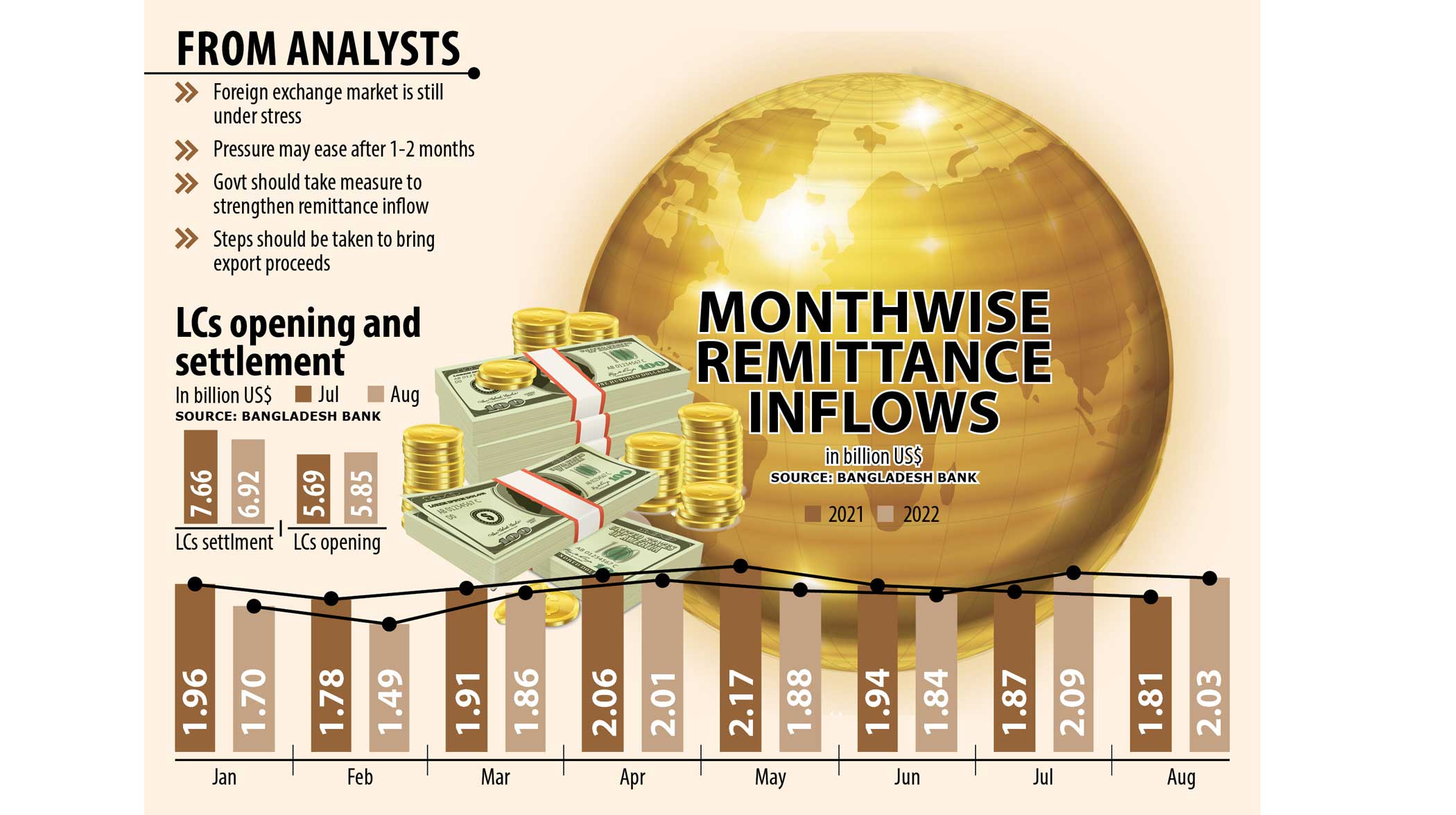

Seemingly, in recent months, the official aggregate inflow of remittance portrays a moderate uptrend in terms of both the US dollar and local currency, amid some fluctuations. It must be noted that remittance inflow is sensitive to external shocks. For example, around 60 percent is from temporary migrant workers in the oil-exporting Middle East countries. Ups and downs in crude oil prices in world markets exert positive and negative influences on the inflows, respectively. In the post-pandemic period, the number of temporary migrant workers has significantly increased, which is good for Bangladesh. During 2021-22, the number steeply rose to 877,371 (till May) from 280,258 in 2020-2021 – from 530,578 in 2019-20 and 692,978 in 2018-2019. The reasons include depreciation of the local currency and the government granting a 2.5 percent cash bonus to the recipients. Both measures are likely to motivate the expatriates to remit more money through the official channel.

Another remedial measure to further grow the number is to offer secured bank loans at reduced rates to potential temporary migrant workers to cover all travel-related costs. Notably, the Probashi Kallyan Bank (PKB) has financed Tk 1,793 crore to 98,754 migrant workers as yet since its inception. Other banks also financed them to limited extents, but their role is expected to be scaled up. This way, people will not be forced to sell their properties at abnormally low prices and borrow from the informal market at exorbitant interest rates to go abroad to earn a living. This will save them from local loan sharks and real estate price manipulators. Such measures are imperative since the official inbound remittance makes enormous positive contributions to the economy of Bangladesh.

In contrast, remittance coming through unofficial channels such as hundi and other illegal means are not directly productive at the macro level. The volume of remittance coming through unofficial channels is anybody's guess. So, substantial amounts of key foreign currencies are available in the shadow market for illicit capital outflows and financing of illegal trading activities. Curtailing illegal capital inflows is imperative and should be an urgent policy concern.

The reasons for going through unofficial channels may be multiple: many temporary migrant workers live in remote areas of the labour-importing countries, with no access to banking services; a sizable number of them have no legal status, which deters them to remit through official channels; some may not have national ID (NID) cards; they may lack financial literacy; and time and travel costs may be high, among others. Hundi business operators take undue advantage of the above through their door-to-door or person-to-person informal and wide network.

In terms of some remedies, banks and exchange houses in host countries should have migrant workers install apps on their mobile phones, through which they can send money electronically as and when they want. Financial literacy of migrant manpower and familiarity with the benefits of mobile banking before going abroad are of utmost importance to scale up the inflow of remittance through the official channel. Teaching them how to open and operate bank accounts should be taken into consideration prior to sending them abroad. To this end, some sort of in-person and/or online training should be given due attention.

At the same time, they should be made aware of the potential pitfalls of illegal remitting. So, vocational training centres offering training to potential temporary migrants in urban and rural areas can include financial literacy in their curriculum. The Bureau of Manpower Employment and Training (BMET) can provide training on relevant financial issues before giving immigration clearance. Budding temporary immigrants may participate any time in this training well ahead of their travel. Banks and financial institutions may design more innovative deposit and investment products with financial and non-financial benefits to cater to the requirements and choices of the expatriates. In addition, networking with the temporary migrant workers abroad should be vastly widened to make obtaining NID cards easy for them. Illegal immigrants as well as businesspersons with more income than their allowed limit may be permitted to send money from the accounts of legal immigrants till their legal status is confirmed.

Migrant workers must be treated well at airports at home and must not be harassed when receiving due services inside and outside the country. In particular, they deserve more humane treatment from Bangladesh embassies and consular offices abroad. Exchange houses and correspondent banks in host countries should be more active in keeping touch with them on a regular basis. They must keep in mind that these hardworking people make the backbone of an aspiring Bangladeshi economy.

To state some of the current financial measures, the government together with Bangladesh Bank has created an opportunity for non-resident Bangladeshis (NRBs) to invest in various bonds. The Wage Earner's Development Bond (WEDB), US Dollar Premium Bond, and US Dollar Investment Bond are popular investment instruments for skilled and professional remitters living abroad. However, the prevailing cap on buying bonds up to Tk 1 crore, and limits on reinvestment opportunities are likely to demotivate them. In this regard, my opinion is that they may be allowed to invest more foreign currency in these secured bonds, if necessary, by reducing the interest/coupon rate by a few basis points.

Strengthening the diaspora communities would also help entice larger inflows of foreign currencies. These communities should be encouraged to increase foreign direct investment (FDI) as well as foreign portfolio investment (FPI). Direct investment opportunities exist in sectors like textiles, ICT, light engineering, jute, leather, pharmaceuticals, ceramics, bicycle, and ship-building. The ICT sector is a highly potential sector. IT experts among the NRBs may be motivated to invest in this sector. They have the opportunity for direct investment singularly or in joint ventures with their preferred local entrepreneurs.

FPI can also be a useful conduit for attracting investment from the diaspora communities. However, making investment safer, offering hassle-free services and adopting a one-stop investor centre would be conducive. Introduction of innovative equity and other financial products in the capital market like preferred shares, diaspora bonds, etc may be the need of the hour to attract investment from the NRBs. As an example, the exchange rate adjusted return in Bangladesh in dollar terms for NRBs in the US should be higher than the US return on investment, since the returns in two different currencies are not comparable.

It should be noted especially that the Bangladesh missions abroad might be required to play a major role to scale up remittance inflow by communicating all benefits and pertaining policies as well as technical support available for the diaspora communities. Arranging discussions, seminars and workshops by the missions from time to time will be beneficial in this respect. They must remember that traditional foreign diplomacy has now transformed into economic diplomacy.

Dr Prashanta Kumar Banerjee is a professor at the Bangladesh Institute of Bank Management (BIBM).

The author is grateful to Prof Matiur Rahman of McNeese State University, US and Dr Md Akhtaruzzaman, director general of BIBM, for their comments in this article.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments