FY2025 budget can be our chance to stabilise economy

The national budget for FY2024-25 remains a widely anticipated subject for all concerned economic actors. Given that the economy has been under growing stress over the last two years, it is essential that we understand the critical drivers of this growing macroeconomic tension if we want to craft the measures that can stabilise economy and support a sustainable turnaround in economic performance. This makes the adoption of a right strategic direction for the upcoming FY2025 budget a core developmental imperative for Bangladesh, especially if we want to avoid the pitfalls of the infamous "middle-income trap," which strongly stems from the policymakers' inability to adequately manage macroeconomic tensions and undertake needed structural reforms.

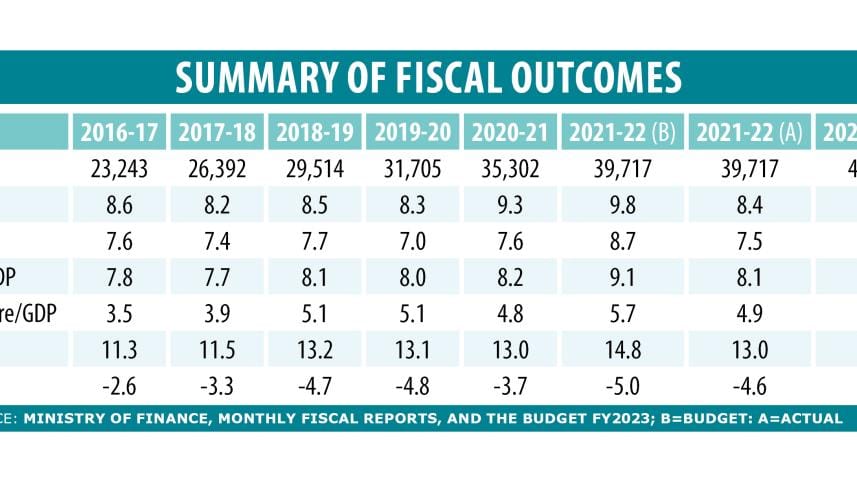

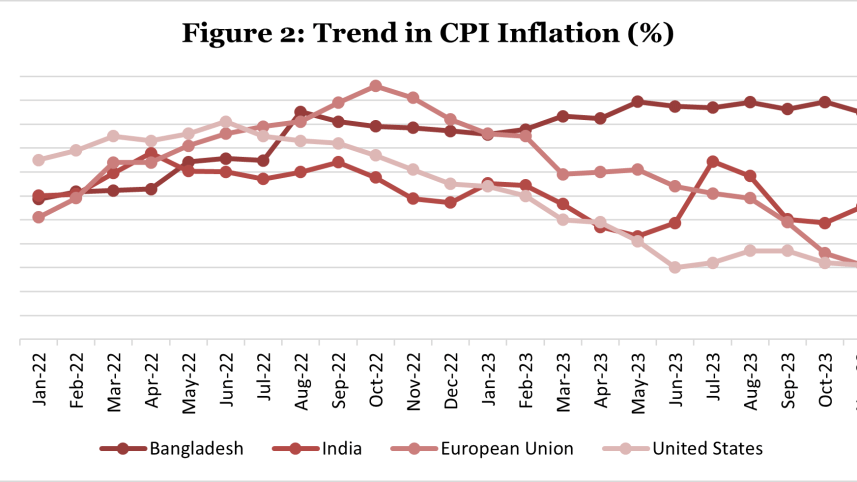

As things stand, the economic pressure we currently observe has four key drivers. First, inflation has remained almost double-digit over the last 20 months. Second, foreign exchange reserves continue to deplete as Bangladesh has lost approximately $24 billion over the last 24 months. Third, the fiscal space is almost nil as the entire development budget is now financed through domestic and international borrowing (see table)—which is an unsustainable strategy due to the rising domestic and international interest rates—while the entire government revenue (i.e. tax and non-tax revenue) is exhausted by the wages and operating expenses, growing subsidies, and interest payments. Fourth, the banking sector is in a perilous situation, which seriously limits the government's ability to borrow from there, and there is a lack of clarity concerning how the defaulted loans and capital shortfalls of the 10 banks—shortlisted for voluntary merger—will be financed.

Against this backdrop, it is imperative that the government boldly undertakes a strong change in its strategic direction by bringing the following decisive measures: i) commit to contractionary demand management through tightened fiscal and monetary policy (i.e. keeping budget deficit at three to four percent of GDP); ii) improve fiscal capacity by removing tax exemptions, increasing the share of direct taxes, modernising property tax system, etc; iii) rationalise administrative expenditure—if necessary, merge some small- and medium-sized ministries, such as the ministries of industries textiles and jute, for example; and iv) consider freezing all public sector employment for at least the next two years.

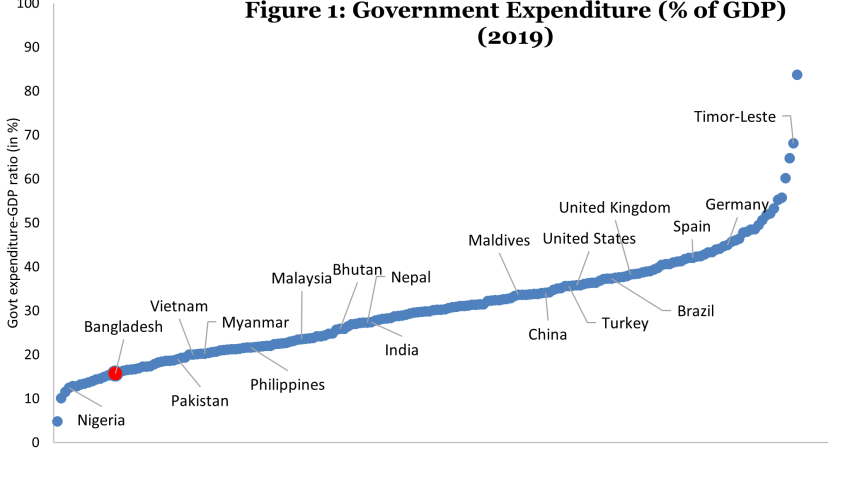

To improve fiscal capacity, it is essential to recognise that Bangladesh currently has one of the lowest tax-to-GDP ratios in the world, which is increasingly deepening our reliance on progressively expensive domestic and foreign debt to support developmental expenditures. It is also pertinent to acknowledge that no country has ever transformed into an upper-middle-income or high-income country, as Bangladesh aspires to be, with a weak fiscal capacity that limits the scope of mobilising necessary public investments on institutions, human capital, infrastructure, and technology transfer.

The PRI Centre for Domestic Resource Mobilization (CDRM) recently pointed out measures that could significantly boost revenue over the short and medium terms. They are as follows:

- A deliverable long-term plan should be developed for the restructuring and automation of tax administration.

- The National Board of Revenue (NBR) should seriously consider removing tax-exemptions in the FY2025 budget to boost revenue mobilisation. If the NBR rationally amends the rebates, discounts, exemptions, exclusions, and reduced rates of taxation, then this should directly increase revenue.

- The NBR should improve the monitoring of the withholding of advance income tax from wages and salaries of employees. This should also increase revenue.

- We also recognise that increasing the share of direct tax revenue in total revenues significantly is fundamental if we want to bring the country in line with other countries at a similar level of income.

- Reforming and increasing the effectiveness of capital gains, property and other wealth taxes should also receive NBR's serious reflection. This should ideally ensure that accumulation of wealth is properly taxed, while also encouraging a shift of speculative investment funds from land to the productive sector of the economy.

- The finance ministry should reflect on reforming the VAT system so that it operates like a true VAT regime by eliminating the complexity created by having multiple tax rates on the same products at different stages of production. This would reduce the scope for evasion and so boost revenues, and also discourage the vertical integration of firms and support the SME sector through subcontracting by large enterprises.

- The government should also recognise the importance of rationalising tariffs and reducing anti-export bias within our tariff structure. The NBR should ideally reduce dependency on import tariffs for revenues over the medium term, as this would encourage the diversification of our export basket, adding higher resilience to our exports.

- As part of reforms, the government should establish a separate tax policy division in the finance ministry, staffed by experts in tax policy (as opposed to tax administration). The NBR should focus exclusively on tax administration. This separation should help ensure that the tax changes needed to increase revenues are made in ways that are effective, efficient and equitable, and not only revenue-focused.

We are encouraged by the recent press reports that the new budget will entail a very modest nominal growth over the outgoing budget, entailing a reduction in real terms, after adjusting for inflation. This contractionary fiscal stance will help reinforce the contractionary monetary policy stance adopted very recently by the Bangladesh Bank. After long delays and initial hesitancy, the central bank has announced major shifts in its monetary and exchange rate policies to support macroeconomic stability. They include: i) unification of the exchange rate in the interbank market and adoption of a market-based crawling peg system; ii) abandoning the six-nine caps and the successor SMART system for interest rate determination and restoring the market determination of interest rates by banks and financial institutions; and iii) a 50-basis-point increase in Bangladesh Bank's policy rate.

These major policy shifts need to be implemented without unnecessary market interventions, and should also be supported by: i) continuing the current policy of refraining from central bank financing of the budget deficit, despite the expected pickup in budgetary spending in the final months of FY2024; ii) halting the existing practice of offering excessive liquidity support to commercial banks; and iii) increasing the Bangladesh Bank policy rate by 0.50 percentage point every month till it reaches 10 percent by July-August 2024.

Finally, the state of governance in the banking sector has become an Achilles heel for the entire financial sector, which is creating substantial uncertainty concerning how wilful plundering of banks will be addressed—and the exact fiscal and monetary mechanisms that will be used to recapitalise the sector.

On the whole, while clarity has been achieved to some degree regarding the direction of economic policy in the coming fiscal year, the FY2025 budget—to be announced on June 6—will certainly play a critical role in shaping the strategic direction that the government's economic team will craft to trigger a sustainable bounce back from the current economic stress. The noted strategic direction for the upcoming budget needs both political commitment and patience. If the history of economic progress and crisis has taught us anything, it is that an economic turnaround is always possible if policymakers have the appetite to embrace the historically tested policies and reforms that have worked during such economic downturns.

Dr Ahsan H Mansur and Dr Ashikur Rahman are executive director and senior economist, respectively, at the Policy Research Institute (PRI) of Bangladesh. They can be reached at ashrahman83@gmail.com.

Views expressed in this article are the authors' own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments