Why Bangladesh's export diversification has not improved in two decades

Bangladesh's exports surged past USD 50 billion in the last fiscal year which marks a major milestone for the burgeoning exports of the country. Our quest to become a developed economy by 2041 will require our exports to exceed USD 300 billion in 19 years' time, according to economic observers.

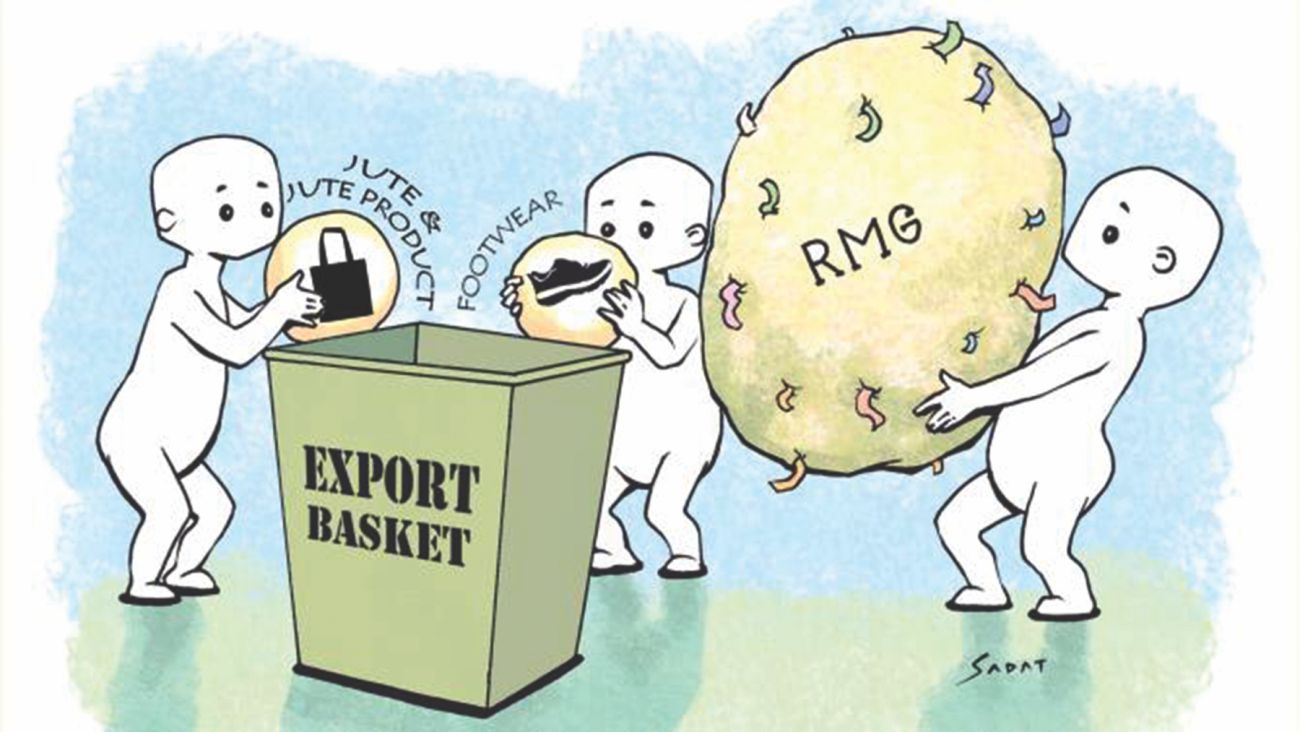

This six-fold increase in exports will be a gargantuan task in every way. It becomes all the more onerous when we see that more than four-fifths of our exports come from a single industry: readymade garments (RMG). This over-dependence of our export basket on a single sector has been pointed out as a major vulnerability of our export-led growth strategy since the late nineties. The government, with the help of the multilateral development partners, took up many projects in the last two and half decades to help diversify the export basket and reduce RMG hegemony over it, but obviously with little success.

Recently, a local think-tank identified 16 non-RMG sectors that show promise to grow into multi-billion dollar export industries, for a more even-keeled export growth. Their paper also pointed out many stumbling blocks in our economy such as high logistics costs, high tariffs, low FDI, and poor ranking in global competitiveness.

These are systemic issues, the amelioration of which require complex solutions involving multiple government agencies and other stakeholders. They must be tackled with the full force of the nation – public and private sectors working hand-in-hand – if we are to see any meaningful traction towards achieving our growth targets.

However, there are areas where modest efforts can bring significant improvements in deepening exports. Some of these are so obvious as to defy belief that the government has not acted on them for so long.

In the IT products and services sector, we have seen healthy growth of exports, particularly in the last 10 years. IT exports today are estimated at USD 1.40 billion, though there is some confusion over disparity in export data from different sources. But even if we conclude that IT exports are around USD 1.5 billion, it is still far less than the current estimate of IT imports into Bangladesh.

This hits like a stab in the back of our export achievements, especially when we consider that the bulk of our IT software and service imports are for run-of-the-mill database applications.

Software and IT services firms from Bangladesh have been exporting to discerning clients in four continents of the world for nearly three decades now. Companies such as Apple, Google, Microsoft, and Samsung, and many public organisations in the most technologically advanced countries are among our regular customers of software and IT services.

So, to see that even the most mundane database applications (core banking systems, enterprise resource planning systems, e-government systems, and revenue management systems) are being imported, expending billions of dollars, our whole IT export repertoire seems like a sham.

Only with a bit of planning and a "buy-local" intent, we can easily replace the bulk of our software and IT services imports with home-grown versions.

There are numerous examples, especially in the public sector, where such systems bought with thousands of crores of taxpayer money have been shelved and written off. So, import substitution in such cases can save the nation billions in costs and years of wasted effort in terms of customisation. We can easily increase IT exports by at least 50 percent if we only encourage import substitution for non-essential IT imports. It so happens that the latest ICT Policy of the government, adopted in 2018, mandates this.

Such import substitution can also greatly boost exports in many other sectors, such as light engineering products, electrical appliances, construction materials, processed foods, imitation jewellery, engineering design services, etc.

The other obvious measure that could have boosted exports from diverse sectors is preferential policy support to thrust sectors – sectors which show promise of rapid growth.

The fact on the ground is that all other manufacturing sectors that have sizable exports do not get policy support that is even at par with the RMG sector. Bonded warehouses, low-cost credit, and a low income tax bracket are just a few facilities enjoyed by the RMG sector, and which are not proportionately offered to thrust sectors.

If we want other manufacturing sectors to have a seat at the table of export titans, we must give them the same, nay, better policy support than what is enjoyed by the lone behemoth of Bangladesh's export arena.

Carefully executed import substitution policy across all sectors and providing preferential policy support to all thrust sectors can see our export basket grow into a healthy mix of several export titans within a decade from today. These measures are critically important also because we must quickly find alternative industries for job opportunity growth, as the RMG sector has been experiencing jobless growth in the last few years due to increased investment in automated machinery.

Bangladesh has been employing an export-led economic growth strategy since the 1980s, and this strategy will need to continue up to 2041, when we can hope to achieve the rank of being a developed economy, as per the present government's vision.

Habibullah N Karim is a digital entrepreneurship promoter, investor, and writer.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments