Bangladesh to be 2nd-largest LNG importer in South Asia by 2035: IEA

Bangladesh's liquefied natural gas (LNG) imports are likely to outpace Pakistan's by 2035, making it the second-largest importer in South Asia after India, according to a projection by the International Energy Agency (IEA).

Pakistan and Bangladesh together would import around 75 billion cubic metres (bcm) of LNG in 2035, up roughly 60 percent from 2024 levels, projected the intergovernmental organisation, which provides policy recommendations, analysis, and data.

"In the Stated Policies Scenario, LNG imports in other developing Asia—primarily Pakistan and Bangladesh—increase from 45 bcm in 2024 to 80 bcm in 2035," the IEA said in its latest World Energy Outlook 2025, published yesterday.

The Stated Policies Scenario reflects reading of country-specific energy, climate and related industrial policies that have been adopted or put forward, even if not yet codified in law.

Though the report did not specifically state the share of each country, the outlook data and infrastructural trends showed that Bangladesh would import around 42-44 bcm of LNG in 2035, while Pakistan would import around 33-36 bcm.

In 2024, Pakistan still imported slightly more LNG than Bangladesh. But by the early 2030s, the IEA projections suggest Bangladesh will pull ahead, driven by faster depletion of local gas and larger regasification capacity.

In India, LNG imports have been growing in recent years, driven by opportunistic buyers and strong potential growth in demand, especially in industry, as per the report.

In 2035, India would import 50 bcm of LNG, up from 35 bcm at present, it added.

Both Bangladesh and Pakistan are already dependent on LNG for power generation and industrial feedstock.

However, Bangladesh's expansion of regasification capacity and faster gas-field depletion are expected to lift its import needs beyond Pakistan's over the next decade, the projection suggested.

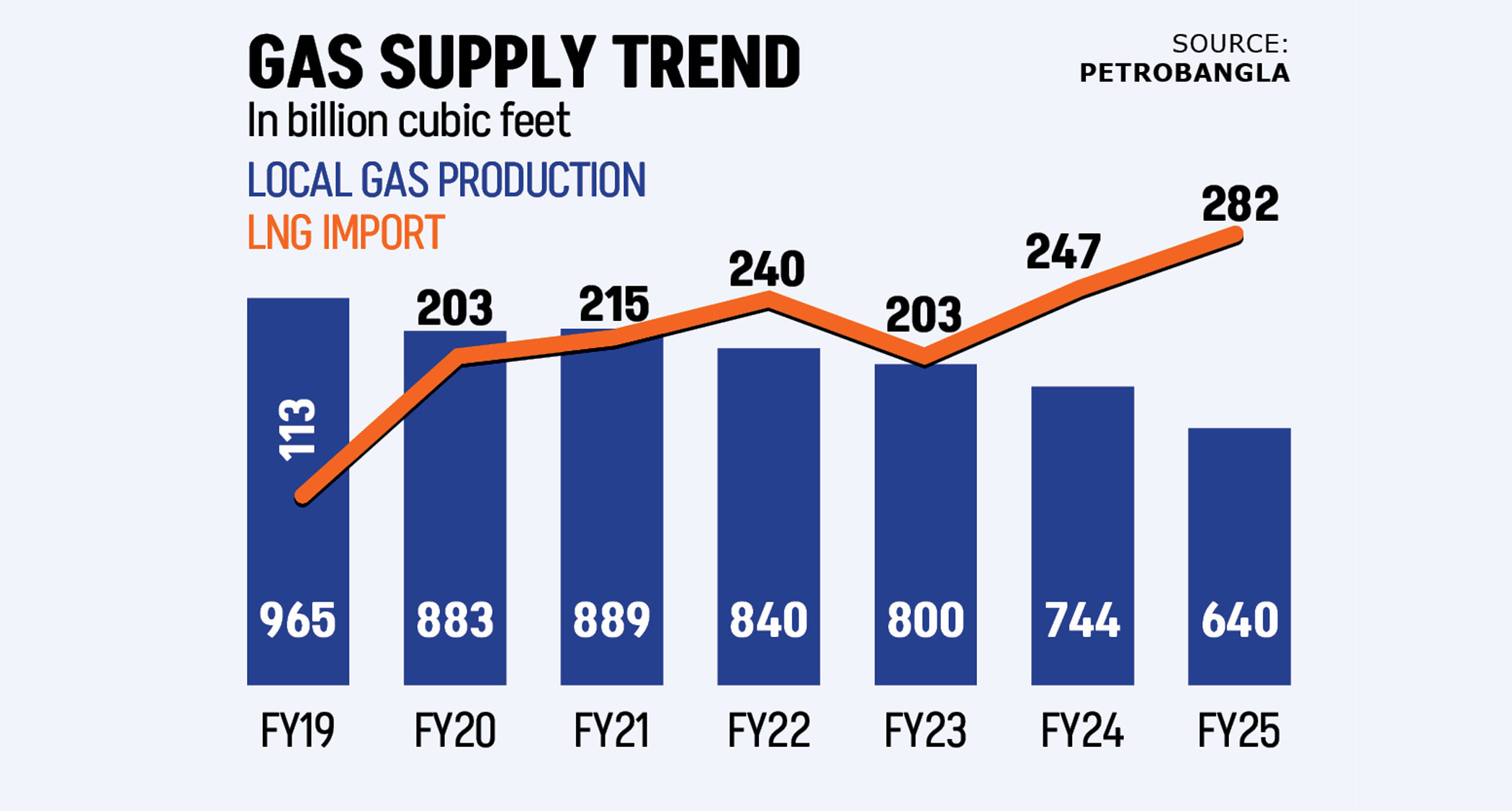

In Bangladesh, most onshore gas fields are in decline, while new exploration has lagged, driving a steady rise in LNG dependence for electricity generation, fertiliser production, and industries.

The country operates two floating storage and regasification units (FSRUs) and is expected to expand by two more floating and one land-based terminal.

In contrast, Pakistan has been facing financing constraints that have delayed terminal expansion and reduced LNG purchases in recent years.

In countries with mature domestic gas production, such as Thailand, Indonesia, Malaysia, Pakistan, and Bangladesh, LNG is a logical replacement for declining domestic gas, the outlook said.

The report said Asia will remain the key driver of global LNG demand growth amid slowing domestic gas production, accounting for more than 75 percent of total imports by 2035.

"These include Southeast Asia, where LNG imports rise from 35 bcm today to 135 bcm in 2035," it said.

"Lower-priced LNG flows to other parts of the world where affordability is a key consideration, notably India and other parts of South and Southeast Asia," it said, adding that the price would be 40 percent lower than today by that time.

The weighted average gas import prices in emerging markets and developing countries in Asia would be around $7.5 per million British thermal units (MMBtu) in the 2030–2035 period.

For importers like Bangladesh, this glut offers an opportunity to secure long-term supplies at more competitive prices, though the agency warns that excessive dependence on imported gas could expose developing economies to volatility in global markets.

"Even at prices near to the short-run marginal cost of supply, LNG remains a premium fuel in a number of markets in Asia," it said.

"Abundant supply may offer these countries significant optionality for security-of-supply reasons and may help them manage periods of system stress," it said.

"…but the economics of LNG make it difficult to penetrate these markets as a baseload fuel in the long run," it warned.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments