NBR split may complete before Feb 12 election: finance adviser

6 January 2026, 13:09 PM

Business

NBR surpasses VAT registration target in December

3 January 2026, 10:25 AM

Business

Utilisation permission issuance made automated today

1 January 2026, 11:43 AM

Business

NBR extends tax return filing deadline again

28 December 2025, 05:34 AM

Business

Proof of return submission: when and why it's necessary

16 December 2025, 13:39 PM

Business

Opinion / Borrowed money in cash? A tax notice may come as taxable income!

2 December 2025, 12:55 PM

Business

Govt amends three key tax laws to dissolve NBR

8 November 2025, 15:39 PM

Business

South Korea urges Bangladesh to ease visa, customs and tariff barriers

19 October 2025, 16:20 PM

Business

How Bangladesh’s surcharge and wealth tax system works

18 October 2025, 18:01 PM

Business

NBR collection jumps 20% in first quarter of FY26

17 October 2025, 11:21 AM

Economy

Govt forms taskforce to strengthen tax system, mobilise domestic resources

The nine-member taskforce will formulate recommendations to reform and reorganise the tax structure to raise the tax-to-GDP ratio

6 October 2025, 18:16 PM

Made with US cotton? Pay less at US customs

US customs will apply a tariff rate only to the non-American portion of a product's value

2 August 2025, 18:01 PM

Businessman brought Tk 730cr as remittance to evade tax

A businessman has brought Tk 730 crore under the guise of remittances from abroad and claimed a tax break, creating suspicions of tax evasion among officials of the National Board of Revenue (NBR).

17 March 2025, 18:00 PM

44 vehicles, including 24 belonging to ex-MPs, to be auctioned off

Customs did not release the vehicles as those who imported them are no longer MPs and cannot release them under the duty-free facility

27 January 2025, 19:25 PM

Most SMEs cite tax structure as main barrier

Around 57 percent of surveyed small and medium enterprises (SMEs) cited the existing tax structure as the main obstacle to doing business in compliance with the law, according to a report by the SME Foundation

24 November 2024, 15:34 PM

VAT claims against S Alam firms: Govt submits replies to HC rules

The government today submitted before the High Court replies to the rules which questioned the legality of its demand for unpaid VAT and the consequent fines of over Tk 7,000 crore from S Alam Vegetable Oil Ltd and S Alam Super Edible Oil Ltd

15 July 2024, 16:51 PM

HC questions govt demands of unpaid VAT from S Alam companies

The High Court today questioned the legality of government's demand for unpaid VAT and the consequent fines of over Tk 7,000 crore from S Alam Vegetable Oil Ltd and S Alam Super Edible Oil Ltd

1 July 2024, 15:02 PM

Container of cigarettes seized in Ctg

Chattogram Custom House and Customs Intelligence seized a container of cigarettes on Thursday midnight, which was imported under false declaration

27 June 2024, 21:35 PM

Tax from Google, FB: HC issues contempt of court rule against NBR chief

The High Court yesterday issued contempt of court rule against the NBR chairman for not complying with its verdict in 2020, which ordered to submit a report on collection of taxes from Google, Facebook, YouTube, Yahoo, Amazon and other web-based companies before it every six months

11 June 2024, 19:50 PM

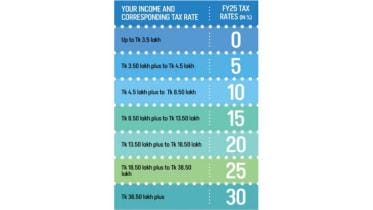

Who will actually have to pay 30 percent income tax?

What is a progressive tax system? Well, it means that the income tax rate climbs up as the income increases. But that still doesn't mean that the raised income tax rate will apply for the entirety of someone's income

8 June 2024, 13:01 PM

C&F staff halt work at 4 container depots

Staffers of clearing and forwarding (C&F) agents stopped working at four leading inland container depots (ICDs) in the port city since the early hours today following a dispute with customs officials, which eventually led to a clash between C&F staff and staff of an ICD

21 May 2024, 17:40 PM

Tk 600Cr Income Tax : SC asks HC to rehear Grameen Kalyan’s petitions

The Supreme Court yesterday asked its High Court Division to hold further hearing on two writ petitions that challenged the NBR orders asking Grameen Kalyan to pay around Tk 600 crore as income tax.

11 March 2024, 18:00 PM

Pvt univs have to pay income tax

The Appellate Division of the Supreme Court yesterday scrapped a High Court verdict that declared illegal the government orders which imposed 15 percent income tax on private universities and private medical, dental and engineering colleges.

27 February 2024, 18:00 PM

Newspaper owners demand cut in customs duty, tax

The Newspaper Owners' Association of Bangladesh (Noab) places budget proposals to NBR

4 February 2024, 16:41 PM

Int'l Customs Day celebrated in Cumilla

Customs, Excise and VAT Commissionerate of Cumilla celebrated “International Customs Day-2024” with the theme of “Customs engaging traditional and new partners with purpose" at Hotel Elite Palace in Cumilla’s Jhawtala on Friday.

27 January 2024, 15:26 PM

CIID seizes export goods over fake documents

Customs Intelligence and Investigate Directorate (CIID) seized a consignment of export goods after a readymade garments company tried to send products of higher value than their declaration

25 January 2024, 15:39 PM

Tk 21,500cr VAT cases pending in courts: NBR

Around 10,000 cases for recovering a combined Tk 21,500 crore in value added tax (VAT) remains held up in different courts across Bangladesh, according to data of the National Board of Revenue (NBR).

6 December 2023, 18:00 PM

NBR exempts withholding tax on interest payment of foreign loan

The National Board of Revenue (NBR) has provided exemption to the withholding tax on the interest earnings of foreign lenders who are lending to local firms for three months, according to a notification.

5 December 2023, 18:00 PM

Shahnaz Rahman among top taxpayers of FY 23

The Daily Star Editor Mahfuz Anam, Prothom Alo Editor Matiur Rahman also on the list

5 December 2023, 11:39 AM

E-payment mandatory for depositing VAT of Tk 10 lakh and above

Businesses will have to deposit value-added tax (VAT) of Tk 10 lakh and above through electronic payment or automated chalan from the first day of January next year, the National Board of Revenue (NBR) said yesterday.

29 November 2023, 18:30 PM