Sharp fall in consumer loans

Consumer borrowing growth has seen a sharp fall in June thanks to the tightening of the belts by the lenders when a cash crunch hit the sector in January this year.

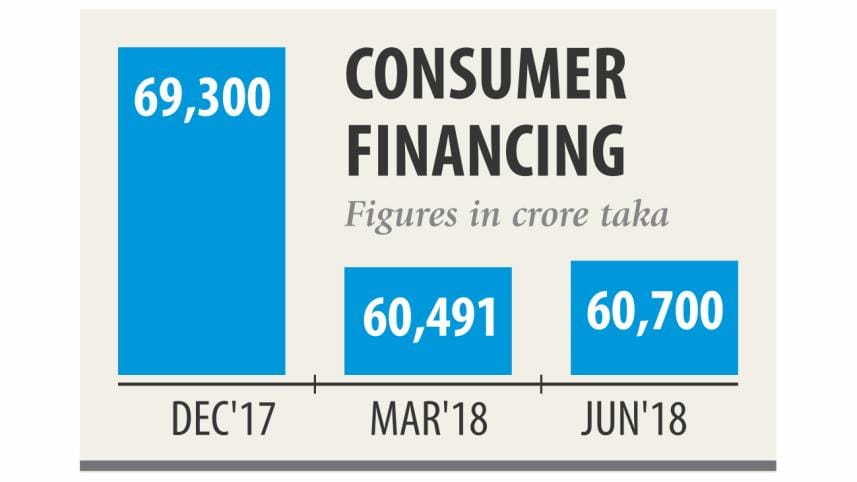

Consumer loan outstanding slid by 12.41 percent in six months to Tk 60,700 crore in June this year.

However, the outstanding grew 24.48 percent in the previous six months to Tk 69,300 crore in December last year.

Experts have attributed the decline in the loan growth to a rise in interest rates.

The interest for consumer loan has seen a rise by 1-1.5 percentage points since the second quarter of the year because of the cash crisis, said Arup Haider, head of retail banking at the City Bank. The crisis has pushed banks to invest less in consumer loans, causing a slowdown in the growth, he added.

The interest rate on industrial loan was revised down to single digit after the relaxation of the cash reserve ratio in April, but consumer loan rate remained almost unchanged.

After the relaxation, Tk 20,600 crore came into the banking system in June but most of the liquidity went to state banks.

The share of consumer loan in total loan also fell to 7.17 percent in June from 8.74 percent in December last year, according to Bangladesh Bank data.

Banks have invested less in consumer loan to adjust the high advance deposit ratio this year, said Tarek Reaz Khan, head of SME and retail banking at Mutual Trust Bank.

Interest rate has remained higher as some banks are still suffering from the cash crunch, he said.

Consumer loan consist mainly four types of products -- home loan, auto loan, personal loan and credit card loan.

Of the products, interest rate on credit card is above 20 percent when personal loan is being given at above 13 percent. Both auto and house loans are being offered at 10 to 12 percent, according to banks.

At present, most banks offer industrial loans at 9 to 9.5 percent, down from 11 to 12 percent at the beginning of 2018.

Both Rupali and Sonali—two state banks—offer funds to consumers at 13 percent and industrial loans at 9 percent now.

Despite having huge excess liquidity, state banks did not cut interest rate on consumer loans as they have less focus on this segment, said a senior executive of Rupali Bank. The high interest rate will discourage the consumers and ultimately leave a negative impact on economy, said Md Arfan Ali, president and managing director of Bank Asia.

“However, Bank Asia has already lowered the interest rate for consumer loans.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments