Window stays open to keep lending rates at low level

There is a lot of talk over a recent hike in interest rates but there is still scope to keep lending rates at a low level, said Md Afzal Karim, managing director of Sonali Bank.

The state-run bank did not abruptly hike the lending rate in spite of a withdrawal of the cap on interest rates by the central bank. The highest lending rate charged by Sonali Bank is 12.90 percent, he said in an interview with The Daily Star recently.

Bangladesh Bank scrapped the SMART formula in May to make interest rates fully market-based, less than a year after the Six-month Moving Average Rate of Treasury Bills (SMART) was introduced and the 9 percent lending rate cap was lifted.

Speaking on Sonali Bank's lending strategy, Karim said they were now focusing on enterprises which run small-scale operations.

It provides loans to entrepreneurs of cottage, micro, small and medium enterprises at an interest rate of 7 percent to 8 percent, he said.

"We are lending money to this priority sector at a low interest rate, even lower than the inflation rate," he said.

Sonali Bank provides finances at a 4 percent interest rate to a segment of the agriculture sector that produces import alternatives, said Karim.

Low interest loans are also available for projects encompassing clusters of enterprises, he added.

Since January, the lender started to build up a large portion of its loan portfolio catering to the sector comprising small-scale businesses, said Karim.

Two years ago, this sector accounted for around 7 percent of Sonali Bank's loan portfolio but now it stands at around 16 percent, he said.

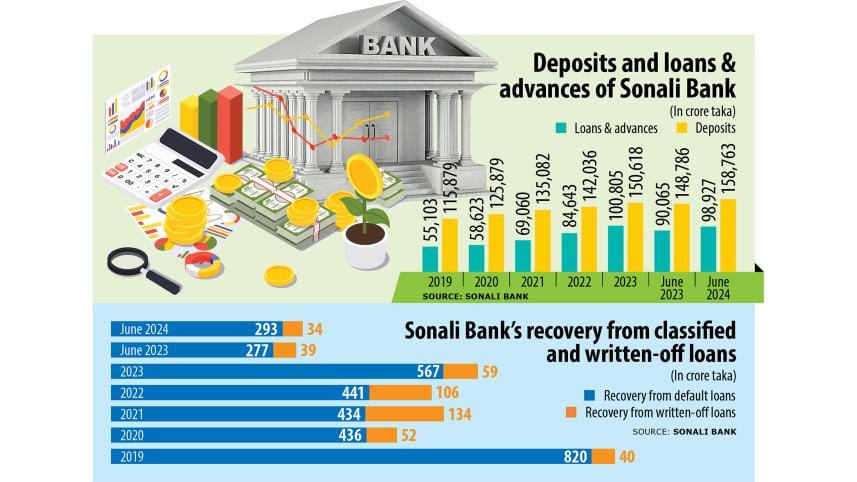

Loans and advances of the lender stood at Tk 98,927 crore as of June this year while its total deposits stood at Tk 1,58,763 crore, as per data of the bank.

Informing of the bank's operating profits, meaning the money left after paying all business costs but before paying taxes and meeting provisioning requirements, he said it rose to Tk 2,252 crore in the first six months of this year.

It was Tk 1,679 crore at the end of the same period last year, he added.

"We recovered defaulted loans amounting to Tk 293 crore, there was a good credit growth and the bank's bad loans were kept at a tolerable level, which helped boost our operating profits," explained Karim.

Net interest income, meaning the difference between revenue generated from interest-bearing assets and expenses associated with paying interest-bearing liabilities, was now in the positive on hovering in the negative since 2021, he said.

The bank did not write off any loan in the last couple of years, he added.

Regarding digitalisation, he said mobile app Sonali e-Wallet had become very popular and won a "best innovation award" of the Financial Institutions Division of the Ministry of Finance.

"We launched 'Taka Pay debit card' with some private commercial banks, which has a lot of benefits for users," said Karim.

On steps taken to recoup from the Hallmark Group loan scam, one of the worst financial scandals perpetrated in the country, he said they were trying to recover the loans.

The state lender's Ruposhi Bangla Hotel branch had lent Hallmark Group and five other companies Tk 3,547 crore between 2010 and 2012 based on fake documents.

The businesses, in collusion with some bank officials, embezzled the whole amount belonging to depositors.

"We identified the mortgaged properties, collected documents and expedited the legal procedures to recover the fund," said Karim.

Speaking on the ongoing forex crisis, Karim said the interbank exchange market had become more vibrant as the central bank introduced a crawling peg exchange rate and set the mid-rate at Tk 117 per US dollar in May.

The crawling peg system is a transitional measure towards a fully flexible, market-based exchange rate system, aiming to stabilise exchange rate movements while preparing for broader market liberalisation.

"We provide 37 services to the government, including opening letters of credit for government institutions and projects, and that is why the bank faces pressure over a lack of US dollars," said Karim.

Regarding dealing with red flags of another financial indicator, or its capital shortfall, which results from having inadequate funds in comparison to financial obligations, he said it had now come down to Tk 4,400 crore.

It was around Tk 6,900 crore in 2007 and underwent fluctuations before reaching Tk 6,800 crore in 2021, he said.

However, the number of branches incurring losses stood at 15 as of June this year whereas it was 10 during the same period last year. Sonali Bank has around 1,200 branches at present.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments