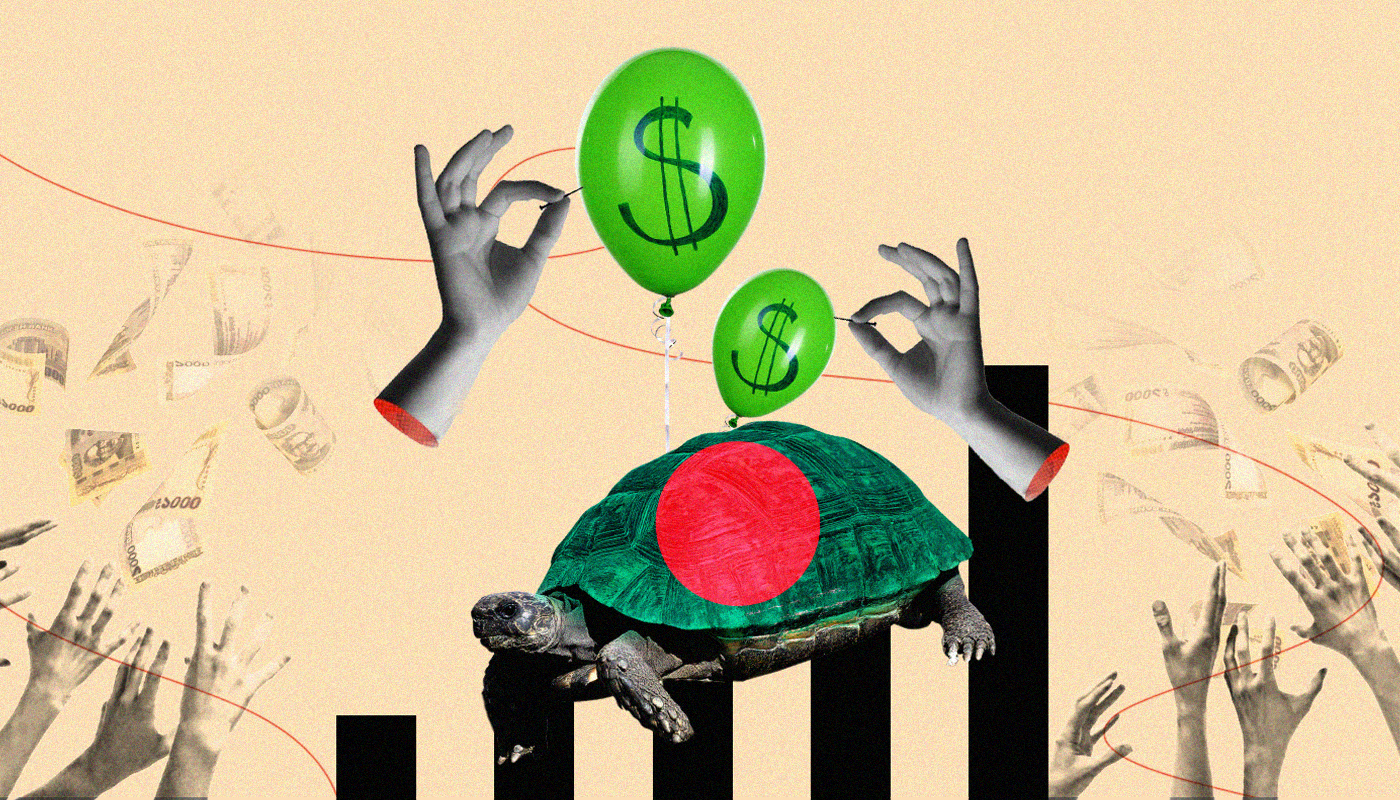

Why is Bangladesh’s inflation highest in South Asia?

Over the past couple of months, inflation in Bangladesh has been easing, providing a bit of relief to consumers and policymakers.

Yet, when one looks at the inflation figures through a regional lens, the level of inflation is much higher than that of any regional peers.

In fiscal year 2024-25, when the country recorded an annual average inflation of 10 percent, the highest at least since FY13, its closest neighbours in terms of prices were the Maldives and Pakistan.

Both had inflation at 4.5 percent, according to the September issue of the Asian Development Outlook (ADO) of the Asian Development Bank (ADB).

Nepal had inflation at 4.1 percent, followed by Bhutan and India.

The ADB projects an easing of Bangladesh's inflation to 8 percent in FY26, assuming favourable weather, lower global oil prices, and tighter monetary and fiscal stances.

Yet, as per the ADB's projection, consumer prices in Bangladesh will be the highest in the South Asian region.

The question remains as to why this is happening even though Bangladesh Bank (BB) has been maintaining a hawkish monetary policy stance while commodity prices are relatively stable in the global market.

The central bank has hiked the policy rate for the 11th time between May 2022 and October 2024 to 10 percent to curb the price spike.

"We started taking tightening measures late," said Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD).

"We would have seen better results had we taken the appropriate measures at the right time. It appears that the idiom 'too little, too late' has proved to be true," she said.

Besides, monetary policy alone cannot bring the desired results. Inflation here is not demand-driven only; it is also supply-led, owing to Bangladesh's high dependency on imports of key commodities and the depreciation of its currency, the taka.

Since FY21, the taka has lost 43 percent of its value against the US dollar.

This has had a significant pass-through effect on domestic prices, especially for imported goods and inputs, amplifying inflation despite subsequent currency stabilisation, said the BB in its latest monetary policy.

"Additionally, higher inflation expectations emerged from rising food prices over a prolonged period," it said.

The central bank blamed supply chain disruptions caused by political turmoil and severe floods in August and September 2024 for food prices remaining volatile while food inflation stayed elevated during the first half of FY25.

Imperfect market conditions, such as limited competition in key commodity markets, have also hindered the complete transmission of policy measures, it added.

"There is a gap between the prices received by farmers and those paid by consumers. Markets in our country are manipulated in many cases," said Khatun.

Another reason, she said, was the gap between monetary and fiscal policies. "Fiscal policy was not in tandem with monetary policy. Of late, we see some consistency," she said.

Birupaksha Paul, a professor of economics at the State University of New York in the US, has a different view.

"It is undoubtedly Bangladeshi authorities who are fuelling inflation. This government has taken a half-hearted approach. There is duality in their approach," he said.

"On one hand, it is pursuing monetary contraction by keeping the interest rate high, and on the other, it is printing money," said Paul, who was a chief economist at the BB, citing dollar purchases and liquidity support to ailing banks.

The BB bought more than $1.7 billion since July by paying for the US dollars with the local taka from the market.

There are other internal reasons, such as extortion, which also impact prices.

Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh, said the monetary policy was previously relaxed and this has since been addressed.

"This led to downward pressure on the price level in recent months. But we don't see a sharp downturn because there were two dynamics at play: political instability and exchange rate depreciation," he said.

"Political unrest over the past year has disrupted the supply of commodities, while losses in the value of the taka led to increased import costs," he said.

He said businesses have kept investment decisions on hold in anticipation of national elections.

"This has also had an impact on the supply of goods in the market and on prices. Inflation may ease if political stability is restored after the general election, scheduled to take place in February next year," he said.

However, in its country report on Bangladesh released in June this year, the International Monetary Fund said cost pressures due to depreciation are projected to keep inflation above the target range in FY26.

"A possible increase in US trade tariffs will likely require some exchange rate adjustment, which will counteract a faster deceleration of inflation," it said.

The BB aims to bring down inflation below 7 percent this fiscal year.

There is a risk.

CPD's Khatun said a pay hike for public sector employees and increased spending by election candidates ahead of the election might stoke inflation.

"So, 2026 is not going to give any comfort, at least in prices. It will be tough to manage inflation."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments