Sugar, edible oil imports surge as dollar supply improves

Bangladesh remains heavily dependent on imports for sugar, palm oil, soybean oil and wheat

16 December 2025, 18:00 PM

Jute goods exports show signs of recovery after four-year slump

Recovery began in July, following an overall export decline of 4 percent in FY2024-25

14 December 2025, 18:48 PM

Brazil becomes Bangladesh’s top cotton supplier, surpassing India

India was the second-largest supplier with 1.4 million bales, followed by Benin

8 December 2025, 18:00 PM

Rice output fell in FY25 despite historic high Boro harvest

The decline is owed to a reduction in Aush rice acreage, which is harvested during the monsoon

12 November 2025, 18:00 PM

Banks’ lending to SMEs falls to four-year low

Banks’ lending to small and medium-sized enterprises (SMEs) has fallen to a four-year low, putting the brakes on the rising trend in loan disbursements, as political uncertainty and the economic slowdown have dampened borrowing appetite among entrepreneurs.

30 October 2025, 18:00 PM

Favourable weather, higher acreage boost Aman outlook

Farmers and agriculturists said repeated floods and unfavourable weather affected Aman season paddy last year

20 October 2025, 18:54 PM

Nutrition becomes luxury for the poor amid high prices

The long queues at OMS trucks depict a harsh reality as Bangladesh continues to struggle with high inflation

15 October 2025, 18:00 PM

Why is Bangladesh’s inflation highest in South Asia?

Bangladesh Bank has hiked the policy rate on 11 occasions since May 2022

4 October 2025, 14:51 PM

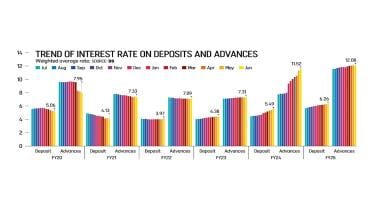

As bond yields fall, will lending rate decline?

Bangladesh Bank has been maintaining a contractionary monetary policy stance for nearly two years to bring down inflation

2 October 2025, 14:40 PM

Treasury yields sink, raising hopes for rate cuts

The yield on 10-year bond dropped below 10%

17 September 2025, 18:00 PM

Shrinking cropped area raises food security concerns

Bangladesh’s net cropped area, the total land sown with crops during a particular agricultural year, has been declining over the past few years, raising concerns among agricultural officials and experts about food security for the growing population.

13 September 2025, 19:02 PM

Govt restricts raw jute export, sparking debate

New export conditions on raw jute to support domestic market

9 September 2025, 18:00 PM

Uncertainty continues to weigh on private credit growth

Sluggish investment demand stalls private credit growth in Bangladesh

8 September 2025, 18:00 PM

Matarbari: The island where Bangladesh is building its economic future

The deep-sea port project in Matarbari promises to transform regional trade

29 August 2025, 18:00 PM

Bangladesh's exports stuck in EU, US orbit

Non-garment exports struggle with quality standards and logistics bottlenecks

23 August 2025, 18:00 PM

With acreage and output falling, is there any prospect for wheat in Bangladesh?

Falling wheat acreage raises questions about food security amid climate change

18 August 2025, 18:00 PM

Inside the food baskets of Bangladesh

Modern farming practices reshape Bangladesh's traditional farmlands

15 August 2025, 18:00 PM

NOAB and CA's office: Is press freedom just a promise?

At least 496 journalists faced harassment between August 2024 and July 2025

12 August 2025, 04:56 AM

Export data gap balloons to $4b despite 2024 reset

The mismatch has prompted fresh calls among economists for investigations.

29 July 2025, 18:00 PM

Farmland expands in 16 districts, defying national decline

Bangladesh is losing farmland. There are multiple reasons behind the shrinkage—from the construction of homes and the establishment of factories to the development of other facilities.

21 July 2025, 18:00 PM