Politically-motivated lending causing bad loans to spiral: WB

The amount of bad loans has been spiralling in Bangladesh owing to rampant politically-motivated lending and inadequate credit risk management, according to a World Bank report.

"Non-performing loans (NPLs) are rising, triggered by widespread related-party and politically directed lending on the back of weak credit risk management," it said.

The global lender prepared the report as a project information document for a $400 million loan project for Bangladesh, which is still under scrutiny. This project is designed to support financial stability and inclusion by enhancing financial sector infrastructure and safety net and fostering access to catalytic private sector finance in Bangladesh.

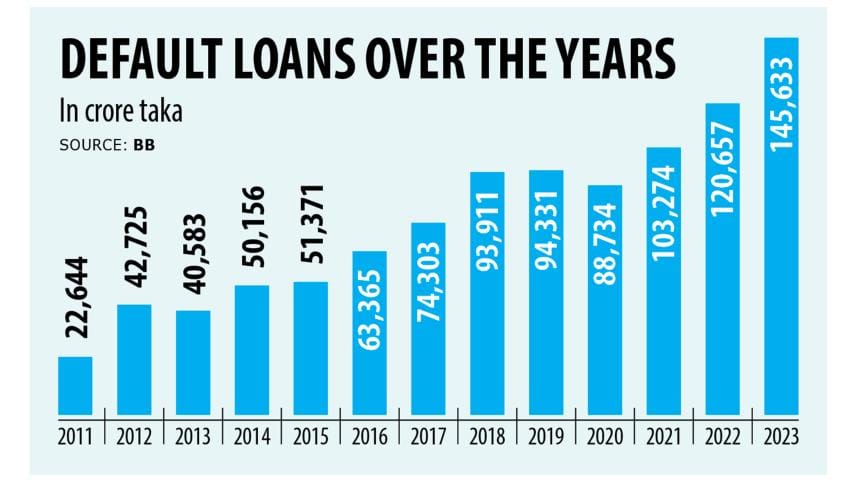

The WB said NPLs had officially increased by 20.7 percent year-on-year at the end of December 2023 to 9 percent of the loan portfolio, but that was significantly understated due to lax NPL definition, poor accounting and disclosure standards and regulatory forbearance.

State-owned banks account for almost half of the NPLs, it added.

"Growing NPLs and rising cost of funds lower banks' returns and ability to build additional capital buffers, while the requirement to distribute dividends even by loss-making banks further depletes banks' reserves and increases risks to depositors and creditors," it added.

The WB said the four watchdogs who regulate the financial sector -- namely Bangladesh Bank, Insurance Development and Regulatory Authority, Bangladesh Securities and Exchange Commission, and Microcredit Regulatory Authority -- lack operational independence, powers, skills, and the modern legislation necessary for sound financial sector development.

Despite recent efforts supported by the World Bank and other international financial institutions, much of the financial sector regulatory framework still needs to be brought in line with international standards, it said.

The banking sector's risks are also being triggered because of long-standing poor governance, weak market discipline, and low capital buffers, according to the report.

"The reported aggregate banking sector capital adequacy ratio (CAR) – 11.64 percent in December 2023 – is too low given the high level of risks in the banking sector. At least 16 banks are undercapitalised, with special BB waivers for deferred loan loss provisions (LLP) and capital increases."

Besides, the existing framework for intervening in ailing financial institutions is weak, with authorities relying on mergers and capitalisation using state money to deal with failing banks, it said.

In December 2023, the central bank adopted a new Prompt Corrective Action (PCA) framework, supported by the WB, but it will not be fully in force until April 1, 2025, it said.

As a way forward, the World Bank said broad-based financial sector reforms are crucial for mobilising the private capital necessary to drive further growth.

"This in return requires the authorities to address in a timely and orderly manner the persistent financial sector vulnerabilities which distort credit flows and, if left unattended, may lead to large losses to the budget and the people's savings."

The WB also said the financial sector safety net and crisis preparedness framework need to be strengthened in the face of rising stability risks.

The deposit insurance system (DIS) for banks and non-bank deposit-taking institutions, while established under BB two decades ago, is not fully operational and does not comply with international standards, according to the report.

It said deposit insurance coverage is low and the payout mechanism is undeveloped and was never tested. While BB revoked the licences of several banks in the past, it did not trigger insured deposits despite a large accumulated DIS fund of nearly $ 1.2 billion as of the end 2023.

"The crisis response framework remains fragmented, non-transparent, and underdeveloped, including access to lender of last resort, least cost resolution and liquidation tools, use of government funds to bail out domestic systemically important banks, mandate and operations of financial stability committee, and crisis communications framework."

Upgrading the regulatory and supervisory capacity of the central bank is also required to safeguard market confidence and foster sustainable financial intermediation, it said.

The global lender added that while the banking sector has shown rapid growth in loans and deposits over the past decade, private sector access to credit is now constrained by tightened liquidity in the banking sector and rising interest rates.

Private sector credit growth slowed to 9.9 percent in the first nine months of FY24 from 16.2 percent in the same period a year earlier.

New letters of credit declined from $8 billion per month in FY22 to $5 billion per month in FY24, according to the report.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments