GDP growth accelerates, led by industrial expansion

Bangladesh’s economy rebounded in the first quarter of the current fiscal year of 2025-26 due mainly to stronger agricultural and industrial production.

14 January 2026, 00:00 AM

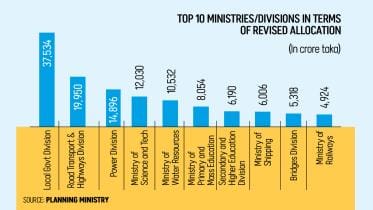

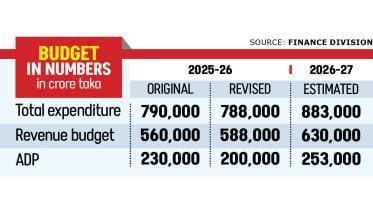

Govt to slash ADP allocation drastically

The government is set to slash allocations for development spending by 12.5 percent in the current fiscal year 2025-26 (FY26), as the originally allocated fund remains largely unspent in the first five months.

12 January 2026, 00:00 AM

TCB’s income deficit rises 460% amid expanded food support

TCB's deficit reached Tk 7,876 crore on a revised basis at the end of FY2024-25

6 January 2026, 18:00 PM

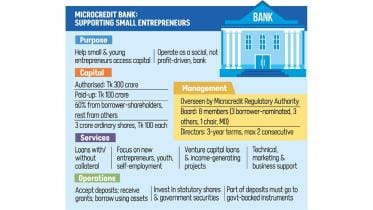

Microcredit bank plan stirs debate over profit vs social goals

Sector leaders question capital rules, dual regulation and investor influence, while authorities say review is underway for clarity

6 January 2026, 18:00 PM

The economy Khaleda Zia trusted others to build

Economists say many of the changes that transformed the country's economy began during her years in power

30 December 2025, 18:00 PM

Govt to expand Eastern Refinery with Tk 35,465cr

The government has finally approved the long-pending modernisation and expansion project of Eastern Refinery Limited (ERL), the country’s only fuel oil refinery, opting to implement it with state financing after shelving an earlier joint venture plan with S Alam Group.

23 December 2025, 18:00 PM

Revised budget targets record-low deficit

The revised budget for the current fiscal year could see the deficit fall to a record low of 3.3 percent of GDP due mainly to ambitious revenue collection targets and cuts in development spending.

23 December 2025, 18:00 PM

A year of economic repair

The interim government has pulled the economy back from the brink, but investment remains in the doldrums

22 December 2025, 18:00 PM

Govt may announce revised budget ahead of February polls

A decision on this matter may be taken on December 22 at a meeting expected to be attended by the chief adviser

21 December 2025, 15:18 PM

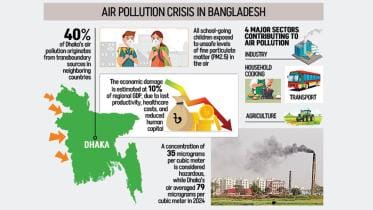

Bangladesh tops South Asia in air pollution

A new World Bank report has ranked Bangladesh as South Asia’s worst-hit country by air pollution, with 100 percent of schoolchildren in Dhaka and nearby areas exposed to unsafe levels of fine particulate matter (PM2.5).

18 December 2025, 18:00 PM

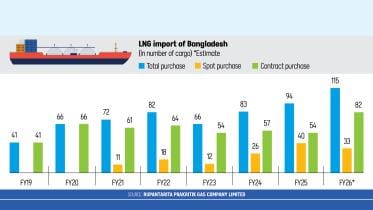

Bangladesh to boost LNG imports on lower global prices

Falling spot prices, weak demand in Asia prompt Dhaka to look beyond its initial import plan

16 December 2025, 18:00 PM

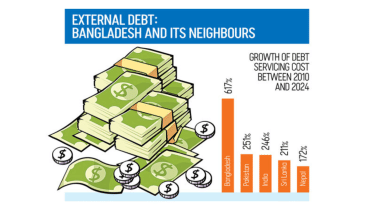

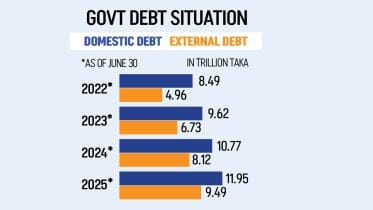

Bangladesh’s debt repayments jump 617%, fastest in South Asia

With exports failing to keep up, rising repayments have crossed IMF risk thresholds

9 December 2025, 18:00 PM

New bank coming for small entrepreneurs

The bank is expected to have an authorised capital of Tk 300 crore

9 December 2025, 16:26 PM

Mega project costs surge in currency shock

Higher bills for foreign-funded projects due to taka devaluation strain budget, and may force government to borrow again

3 December 2025, 18:00 PM

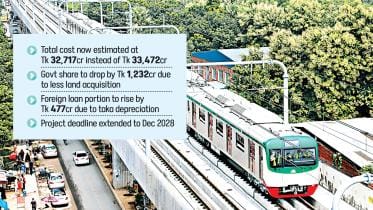

Metro Rail Line-6: Revision proposes cost cut by Tk 755cr

The country’s first metro rail project is set to see a cost reduction of around Tk 755 crore as the Planning Ministry prepares to place the third revision of the Metro Rail Line-6 proposal before the ECNEC tomorrow for approval.

28 November 2025, 18:45 PM

Govt spending set to balloon with first pay hike in a decade

The interim government wants to implement a portion of the recommendations made by the commission during its tenure.

25 November 2025, 18:34 PM

Revenue goal hiked by Tk 24,000cr on strong Q1 performance

Going against the usual practice and history, the interim government has raised the revenue collection target for the current fiscal year (FY) by 5 percent, or Tk 24,000 crore.

20 November 2025, 18:00 PM

EC, govt going full steam ahead with polls prep

Chief Adviser reaffirmed the interim govt's commitment to holding a free, fair, and festive election in the first half of February.

18 November 2025, 18:12 PM

Bangladesh Bank moves to tighten grip on banks

The centrepiece of the reform package is the abolition of a category that designates state-owned lenders as "specialised banks"

15 November 2025, 18:08 PM

Govt debt tops Tk 21 trillion

For the first time, Bangladesh’s outstanding government debt has surged past the Tk 21 trillion mark, pushed upward by chronically weak revenue collection and years of ambitious development spending.

14 November 2025, 18:37 PM