Imports rebound on rising exports, remittances

Bangladesh's imports have returned to positive territory after two years of decline, driven by higher demand for consumer goods and industrial raw materials to meet the needs of rising exports -- a trend an economist views as a sign of an economic turnaround.

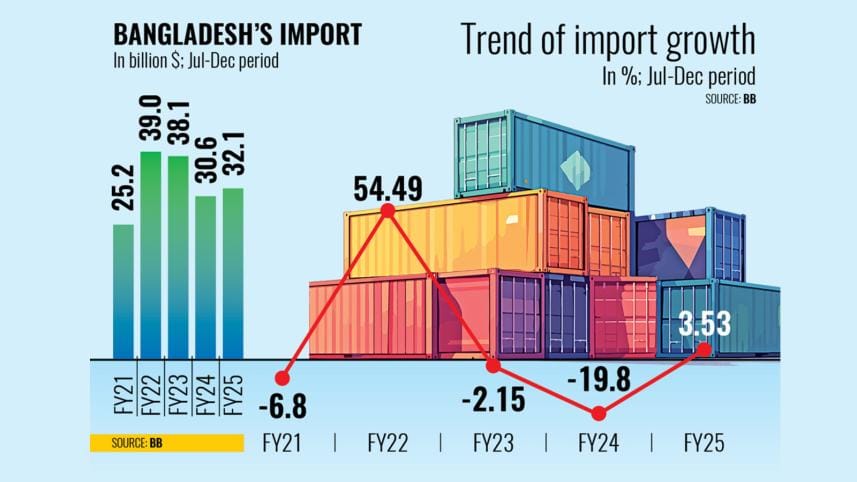

Imports grew by 3.53 percent year-on-year to $32 billion in the first half of fiscal year (FY) 2024-25, rebounding from a 20 percent drop during the same period the previous year.

This growth was largely supported by a 30 percent year-on-year surge in imports in December 2024.

"Our exports and remittance inflows have improved. This has helped imports recover," said Ahmed Shaheen, additional managing director of Eastern Bank.

Bangladesh's imports fell in FY23 as the country faced a foreign exchange crisis caused by soaring import bills due to rising global prices following the outbreak of the Russia-Ukraine war in February 2022.

With fast-depleting forex reserves and a shortage of US dollars, the decline continued for a second consecutive year in FY24, which weakened the local currency significantly.

In the face of depleting reserves, the Bangladesh Bank imposed restrictions on imports of non-essential items. Banks also became reluctant to open letters of credit (LCs) for imports.

Central bank data showed that imports turned positive in August 2024 and this growth continued until October. After a dip in November, imports surged in December.

"Banks have loosened their grip on opening LCs in FY25 as remittances and exports grew," Shaheen said, adding that the import of industrial raw materials for export-oriented industries drove overall import growth.

"It is positive, as data shows," the banker said. "It appears that our international business has improved."

However, several domestic market-oriented industries have slowed, he added.

Central bank data showed that both the opening and settlement of LCs for importing industrial raw materials increased in the first six months of FY25. This growth continued into January.

"I think the growth will continue because of rising exports and the shifting of some work orders from China to Bangladesh," the banker said, referring to the US-China tariff war.

Bangladesh recorded a nearly 12 percent year-on-year increase in exports during the July-January period of FY25.

However, Ashraf Ahmed, former president of the Dhaka Chamber of Commerce and Industry, said LC openings, in terms of the dollar value of imports, rose slightly as the country imported more food grains and other consumables in preparation for Ramadan, which will begin in March.

"This is a combination of higher prices and possibly volume," Ahmed said.

"Ramadan will come early this year so we needed to complete imports by the December-January months compared to the January-February period last year," he added.

"The import of capital machinery, however, is showing an alarming drop," the trade leader said, citing a 33 percent decline in LC openings during the July-January period of the current fiscal year.

Ahmed, who is also the chief executive officer of Riverstone Capital Ltd, said the real problem of sluggish investment is still dragging on.

Md Deen Islam, associate professor of Economics at the University of Dhaka, said the over 3 percent growth in imports during the first half of FY25 marks a turnaround from the previous fiscal year, when import restrictions, foreign exchange constraints, political turmoil and natural disasters slowed trade activity.

"This recovery suggests improving economic conditions, especially in terms of domestic demand, industrial production and external trade dynamics," the economics teacher said.

"Higher imports signal increased business confidence and investment, which can contribute to GDP growth by boosting production, employment and trade activities. Besides, higher imports can increase customs duty collection, supporting the government's fiscal position."

"Most importantly, this rebound in imports is accompanied by higher growth in exports in the same period. Hence, the recovery in imports and exports is a positive sign for economic stabilisation and industrial revival. But it must be matched with strong reserve management and financial sector stability to ensure a sustainable external balance," Islam added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments