Govt sets Tk 4.99 lakh crore target for NBR in FY26

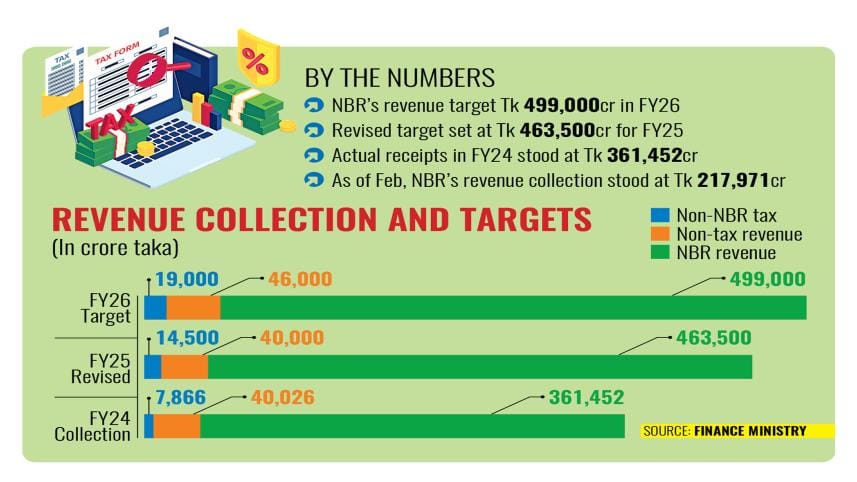

The government has set a revenue collection target of Tk 4.99 lakh crore for the National Board of Revenue (NBR) in the upcoming fiscal year 2025–26 — a 7.6 percent increase from the revised target for this year.

The decision came from a meeting of the Fiscal Coordination Committee, chaired by Finance Adviser Salehuddin Ahmed, on Tuesday this week, according to finance ministry officials.

Although the numerical jump compared to the current year's revised target appears modest, the new target has raised eyebrows, given the underwhelming performance in revenue collection so far.

Until fiscal year (FY) 2023–24, the tax authority had missed its annual targets for 12 consecutive years.

This year appears no different. Revenue collection remains sluggish, with receipts falling far short of expectations.

Many within the finance ministry, the revenue board, and among independent analysts believe the FY26 target is overly optimistic and out of step with the current capacity of the tax administration.

To achieve the revised target for the current fiscal year, the revenue board would need to collect at least 28 percent more than what it managed in the previous fiscal year.

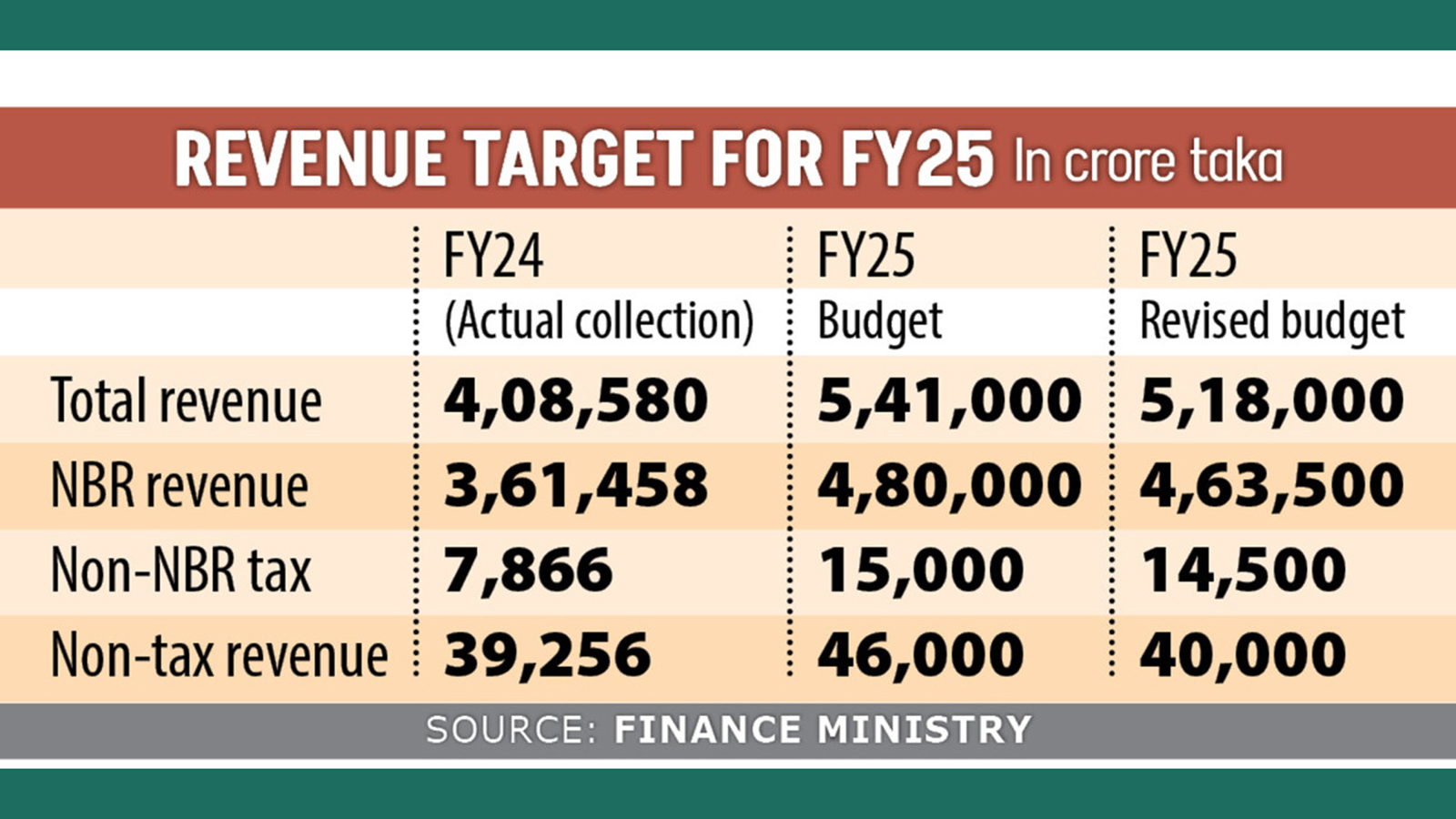

The revised target for FY25 has been set at Tk 4.63 lakh crore, while actual receipts in FY24 amounted to Tk 3.61 lakh crore, according to finance ministry data.

The shortfall is already evident. In the first eight months of the current fiscal year, the NBR collected just Tk 2.18 lakh crore — reflecting a year-on-year growth of only 1.76 percent.

Given this sluggish performance, the NBR has already informed the Finance Division that it will not be able to meet the revised target for FY25.

Pressure from the International Monetary Fund (IMF) has been a major driver behind the push for higher revenue. The multilateral lender has urged the government to increase collections — a key condition tied to an ongoing $4.7 billion loan programme.

For FY26, the IMF has set a revenue collection target of Tk 4.55 lakh crore for the NBR, alongside an additional Tk 57,000 crore to be raised through reducing tax exemptions and introducing further hikes.

Earlier, a top NBR official described the target as "high, ambitious, and unrealistic."

However, following negotiations, the NBR managed to revise the additional collection figure down to Tk 40,000 crore.

"After negotiations, the visiting IMF officials informally agreed to the new figure," a senior NBR official told The Daily Star yesterday.

Although the finance ministry has acknowledged an economic slowdown due to political instability and other adverse factors, it maintains that a gradual recovery is underway.

Finance ministry officials believe this will help strengthen revenue flows in the months ahead.

Besides, a raft of reforms aimed at boosting revenue is expected to be fully implemented in the next fiscal year, improving the NBR's performance, according to a senior finance ministry official.

A former top official of the NBR welcomed the new target but said the tax authority must rise to the challenge.

"Bangladesh has one of the lowest tax-to-GDP ratios in the world, even compared to its South Asian neighbours. That means the NBR is not utilising its full efficiencies," he said, requesting anonymity.

"If the NBR needs any capacity support, they should ask the government. But they should move fast, as this is high time to catch the big fishes," he added.

He also expressed doubts about the NBR's current approach, saying, "We are not witnessing a proactive approach to addressing tax evasion."

In addition, an ambitious target is also being set for non-NBR tax collection in the upcoming fiscal year.

Against a revised target of Tk 14,500 crore for the current year, just Tk 3,755 crore was collected in the first half — slightly below the Tk 3,780 crore collected during the same period last year.

The target for FY26 has been set at Tk 19,000 crore.

Meanwhile, non-tax revenue is also projected to rise, buoyed by collections from state-owned enterprises and other sources.

The government is aiming for Tk 46,000 crore in FY26, up from the revised target of Tk 40,000 crore in the current year.

Collections in the first half of FY25 reached Tk 32,497 crore — a 31 percent increase from Tk 24,708 crore in the same period last year.

The target for total revenue, including both NBR tax and non-tax sources, has been set at Tk 5.64 lakh crore in FY26, an 8.88 percent increase from the revised target of Tk 5.18 lakh crore for FY25.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments