BSC to buy 6 ships for $330m to build container fleet

The Bangladesh Shipping Corporation (BSC) is going to purchase six modern container ships from South Korea at a cost of $330.32 million to break the stranglehold enjoyed by non-Bangladeshi feeder vessels, which results in the loss of a substantial amount of foreign currency in freight costs.

Yesterday, the state-run corporation announced that it had received primary approval from the Planning Commission to acquire six container vessels from South Korea, each with a capacity of 2,500-3,000 twenty-foot equivalent units (TEUs).

This will be the first addition of container ships by the national flag carrier in more than a decade, with previous purchases having been out of commission for a long time.

The new ships, each capable of carrying 2,500-3,000 TEUs, will be bought at a cost of Tk 3,836 crore from two South Korean ship-building firms, with approximately 92 percent of the cost will be financed through a foreign loan.

BSC Managing Director Commodore Mahmudul Malek told The Daily Star that South Korean EXIM Bank would provide Tk 3,500 crore as a loan for the project while the remaining funds would be financed by BSC.

He added that the government has approved a feasibility study on the purchase, to be conducted by Korea's Economic Development Cooperation Fund (EDCF).

According to a disclosure on the Dhaka Stock Exchange website, a concept paper has been signed between EDCF, Korea, and BSC, under which EDCF is conducting the feasibility study for the project.

With approval from the Korean side, the feasibility study is expected to take two to three months, after which a contract will be signed, he anticipated.

The six new vessels are expected to be added by 2027.

Initially, BSC plans to operate the ships between Chattogram and transshipment ports in Singapore and Malaysia, though they may also be chartered for other global routes.

Malek expressed confidence that the six new container ships would generate an additional Tk 700 crore to Tk 800 crore in annual revenue, transporting over 500,000 TEUs of containers each year.

FOREIGN FEEDER SHIPS DOMINATING THE SCENE

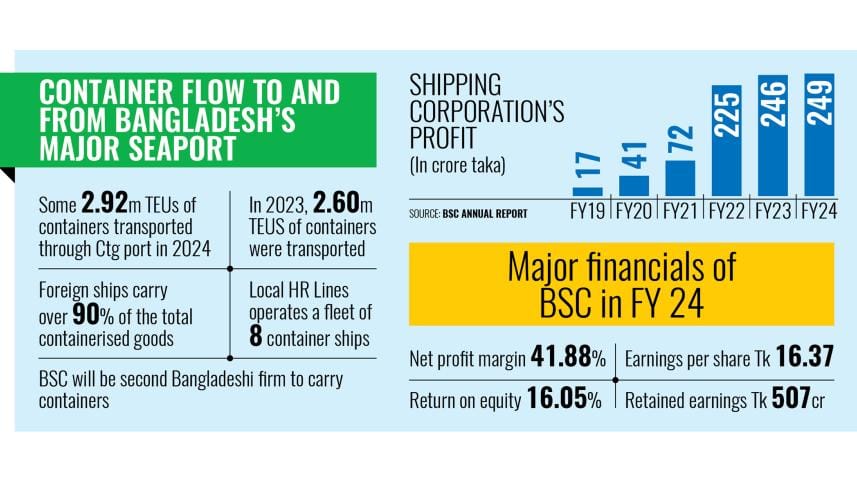

At present, around 80 feeder vessels transport containerised cargo between transshipment ports and Chattogram port, which handles 98 percent of the country's total containerised goods transport.

Last year, a total of 2.92 million TEUs of import, export, and empty containers were transported through Chattogram port, according to shipping agents.

Yet, Bangladeshi feeder-vessel operator HR Lines Limited, a subsidiary of Karnaphuli Group, is the only local firm that operates container ships at present, with its eight ships having a combined carrying capacity of 11,840 TEUs.

Through its latest initiative, the BSC will become the second Bangladeshi firm to venture into container shipping in recent years.

The state-run corporation was a pioneer in this regard, acquiring the first container ship owned by the country, named "Banglar Shikha", in 1991. It also operated two multi-purpose ships for container shipping.

However, all three of those vessels ceased operations over a decade ago.

Bangladesh Shipping Agents Association Chairman Syed Md Arif noted that private Bangladeshi firms had previously entered the container shipping business but could not sustain their operations.

As a result, the sector became entirely dependent on foreign-owned vessels for several years.

Bangladesh Freight Forwarders Association Vice-President Khairul Alam Suzan echoed that sentiment, saying foreign feeder vessels were currently dominating the trade, leading to a significant outflow of foreign currency due to freight costs.

With the inclusion of BSC's new ships, the country will not only save substantial foreign currency but also create more employment opportunities for local seafarers, he opined.

Referring to the sizes of the new vessels, Suzan mentioned that the BSC, with these cellular ships, would have the option to launch direct shipping to European destinations, significantly reducing both time and costs in foreign trade.

BSC'S STORIED HISTORY

The BSC began its journey with only two ships in 1972 and got listed in the stock market in 1977.

In 2018, six new ships, comprising three oil tankers and three bulk carriers, were purchased. However, one of the six new ships, "Banglar Samriddhi", was damaged in a bomb attack at a Ukrainian port in 2022.

At present, the BSC owns five vessels, featuring two bulk carriers and three chemical and oil tankers.

And despite a 5 percent drop in revenue to Tk 487 crore, the national flag carrier reported a solid profit last year.

In the financial year 2023-24, freight revenue from lighterage and time charter decreased year-on-year due to off-hire and dry docking of ships, which ultimately reduced the company's total revenue.

Its freight revenue dropped by over 9 percent to Tk 392 crore.

Despite this, the company reported a record net profit of Tk 249.69 crore in FY24, the highest in its 53-year history.

Just three years ago, the company's net profit was below Tk 100 crore. The surge in the past three years has been attributed to the increase in its fleet size in 2018.

BSC's net profit margin is comparatively high among neighbouring countries, standing at around 42 percent in FY24, compared to 12 percent for the Shipping Corporation of India, 44 percent for Pakistan National Shipping Corporation, 20 percent for Singapore Shipping Corporation, and 19 percent for Malaysia's Shin Yang Shipping Corporation.

The net profit margin, or simply net margin, measures how much net income or profit a company generates as a percentage of its revenue.

BSC's earnings per share rose to Tk 16.37 last year from Tk 16.15 in the previous year. The company's retained earnings nearly doubled to Tk 507 crore, up from Tk 284 crore in FY23.

The state shipping corporation also plans to purchase six more container ships following this project. With these 12 ships, the company aims to expand its fleet to a total of 22 ships by 2030.

Stocks of the company grew 1.8 percent to Tk 87.9 yesterday at the DSE.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments