As bond yields fall, will lending rate decline?

After the yield on the 10-year Bangladesh government bond fell below Bangladesh Bank's (BB) policy rate of 10 percent last month, the 15-year bond followed suit. Its yield dropped further to 9.67 percent, the lowest since October 2023.

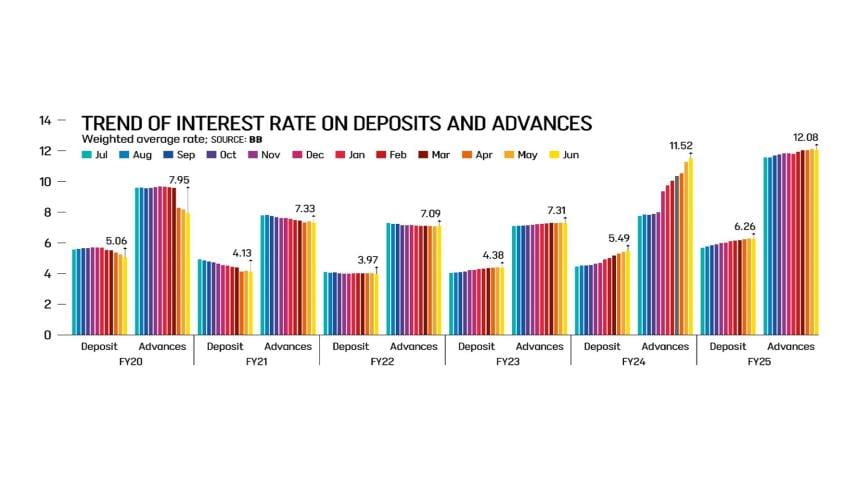

On the other hand, the weighted average interest rate on loans and deposits rose further in August. The interest rate on deposits stood at 6.39 percent and advances at 12.15 percent, the highest since July 2019.

Now the question that comes to mind is: will the interest offered by banks and financial institutions decline?

"Definitely," said Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank PLC. "It is expected that the overall interest rate will come down," he said.

However, there is a condition — the policy rate has to decline.

The BB has been maintaining a contractionary monetary policy stance for nearly two years to bring down inflation.

The annual average inflation rose to 10.03 percent in June from 9.73 percent a year ago. The central bank hiked the repo, or policy rate, to 10 percent in October 2024, the 11th time since May 2022.

Bankers said yields on treasury bills and government bonds have been falling over the past three months, ending the upward trend that began two years ago.

A number of factors are behind this.

Amid sluggish demand for private credit, banks with surplus funds are more inclined to invest in government securities. Other institutional investors find investment in bonds more attractive than stocks.

At the same time, the BB's purchase of US dollars from the forex market caused a spike in liquidity flow to the market.

Overall, investment opportunities have declined. So, banks are investing in bonds, he said.

The BB data showed that private credit grew 6.52 percent year-on-year in July this year, up slightly from 6.49 percent in June, the lowest in four months, because of political uncertainties, high borrowing costs, and sluggish business sentiment.

There was slack demand for funds from the government too, particularly because of a slow start in the implementation of the annual development programme. All this contributed to the fall in yields on bonds and bills, said one chief of treasury at a private bank.

"Besides, our import business has declined. This is a major reason behind the fall in private credit growth," he said.

After a 1.75 percent rebound in imports in fiscal year (FY) 2024-25, the opening of letters of credit for imports grew 8.28 percent year-on-year in the July-August period of FY26, according to BB data.

Ashim Kumar Saha, deputy managing director of Mercantile Bank PLC, said liquidity flow has increased due to the purchase of US dollars by the central bank in recent months.

The BB bought more than $1.7 billion since July by paying for the US dollars with the local taka from the market.

"Some banks have started reducing the interest rate. But it is yet to have an impact on the overall market. We expect the interest rate on deposits to drop, but it may take some time," he said.

SM Galibur Rahman, head of research and strategic planning at Shanta Securities, said after reducing the interest rate on deposits, banks usually take two to three months to cut lending rates.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments