BB keeps policy stance tight to tame inflation

The Bangladesh Bank (BB) has maintained its tight monetary policy stance for the second half of the current fiscal year (FY) 2024-25 to tame the stubbornly high inflation.

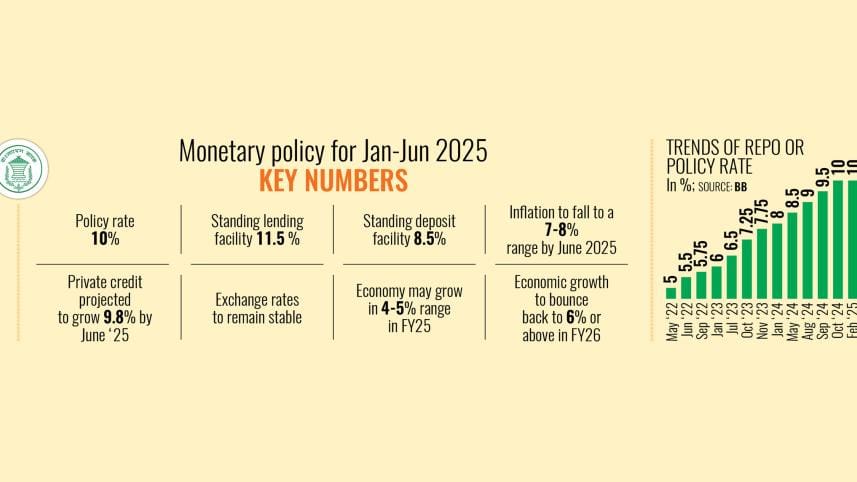

To this end, the policy interest rate, a key tool of monetary policy, has been kept unchanged at 10 percent for the January-June period of FY25.

Besides, the standing deposit facility (SDF) and standing lending facility (SLF) rates -- at which commercial banks deposit with and borrow from the BB -- will remain at 8.5 percent and 11.5 percent, respectively.

During the announcement of the Monetary Policy Statement (MPS) at the BB headquarters in Dhaka yesterday, central bank Governor Ahsan H Mansur said that contractionary measures would continue until the desired level of inflation is achieved.

The governor said that the central bank kept the policy rate unchanged as inflation has begun to decline slightly. Price pressures, which crossed 11 percent in July 2024, fell to 9.94 percent in January 2025.

"We are now seeing the result of the tight monetary stance," said Mansur, adding that such results usually take six months to one year to become visible in other countries. "Therefore, it would take 12 to 18 months for us to achieve the target."

Inflation declined in December and further in January this year. We expect it would drop consistently in upcoming months.

Inflation declined in December and further in January this year. The BB governor hoped that it would continue to decline consistently in the coming months.

"Our expectation is to bring down inflation to 7-8 percent by the end of June this year and we still stand by our expectation," he said.

The central bank has been raising the policy rate for nearly two and a half years since May 2022 in its battle against spiralling prices, which have eroded people's purchasing power and affected domestic demand.

Mansur, who assumed the role of central bank governor in August last year after the political changeover, has raised the policy rate, or repo rate, three times.

In December last year, the International Monetary Fund (IMF) said that near-term policy tightening is crucial to address the emerging external financing gap and persistently high inflation.

The BB expects the country's gross domestic product (GDP) growth in the current fiscal year to decelerate to 4-5 percent, due mainly to natural and industrial disruptions.

While replying to a query, the BB governor said the current situation is not for growth, as the government is now focusing its efforts on containing high inflation.

He also said that exchange rate stability is a must for economic stability, as the inflation target cannot be achieved without it. "As a result, the central bank is now also emphasising its attention on stabilising the exchange rate."

According to the governor, the banking regulator has already been able to stabilise the exchange rate, as the balance of payments is now in a stable position.

The difference between supply and demand would not widen ahead of Ramadan, he mentioned, saying that a huge number of letters of credit (LCs) have already been opened for importing goods and essential commodities for the month of fasting.

"The seasonal demand has already slowed this month," said the BB governor.

For the second half of FY25, the target for private sector credit growth has been increased to 9.8 percent. As of December last year, private sector credit growth stood at 7.3 percent.

Credit to the public sector decreased to 17.5 percent from an actual 18.1 percent as of December last year, according to the MPS.

While highlighting good governance in the banking sector, the MPS outlined the initiative for an asset quality assessment review programme to evaluate the scope and scale of banks' tangible assets, providing essential data for future policy adjustments.

Addressing this issue, the BB governor said both banks and the regulator share the responsibility of ensuring good governance in the banking sector.

"If there is poor governance within banks, external oversight alone cannot keep them in check. If a bank deliberately mismanages itself, no regulatory body can force it to perform well. Yes, we can shut it down or take legal action, but by that time, the damage will already be done."

CONTRACTIONARY POLICY WORRIES BUSINESSES

In its immediate reaction, the Dhaka Chamber of Commerce & Industry (DCCI) expressed concern over the decision to maintain a contractionary monetary policy.

"While aimed at curbing inflation, this rigid stance hampers private sector credit growth and economic expansion. The private sector relies heavily on banks for investment and high interest rates raise production costs and fuel inflation," said the DCCI.

Ashraf Ahmed, a former president of the DCCI, said the latest MPS maintains a high interest rate and tight liquidity regime, while public borrowing is crowding out the private sector.

"Private sector credit growth is already lower than inflation. A combination of high interest rates and constrained working capital supply could possibly lead to higher non-performing loans (NPLs), economic growth of less than 4 percent and job losses."

Zahid Hussain, former lead economist at the World Bank Dhaka office, said maintaining a tight monetary policy is indeed justified, though the business community prefers a more lenient approach.

"The BB cannot afford such a risk with inflation rates remaining unacceptably high. Non-food prices have risen every month for the past three months, mirroring the trend from the previous year, indicating that inflation has become endemic."

However, he cautioned that maintaining a 10 percent policy rate for an extended period cannot be the sole strategy to blunt inflation. "Effective inflation management necessitates coordination with other economic policies, such as fiscal policy and market management."

Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh, said further tightening of the monetary framework is unnecessary.

He said the government needs to be cautious, as ongoing political instability could lead to supply chain disruptions, which might complicate the price pressure management.

[Md Asaduz Zaman and Jagaran Chakma contributed to the report.]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments