Policy rate in Bangladesh

Tight monetary policy to raise production costs: BUILD

The continuation of a tight monetary policy by keeping the policy rate unchanged at 10 percent could lead to higher production costs, public-private dialogue platform Business Initiative Leading Development (BUILD) said yesterday.

12 February 2025, 18:00 PM

BB keeps policy stance tight to tame inflation

The Bangladesh Bank (BB) has maintained its tight monetary policy stance for the second half of the current fiscal year (FY) 2024-25 to tame the stubbornly high inflation.

10 February 2025, 18:00 PM

Economy poised to encounter substantial hurdles in H2 of FY25: BB

Despite various monetary and fiscal tightening measures, inflation has remained persistently high, staying above 10 percent

10 February 2025, 09:10 AM

BB keeps policy rate unchanged as inflation begins to ease

The central bank said it would keep its key policy rate unchanged at 10 percent for the January-June period of 2025

10 February 2025, 09:06 AM

Could lower policy rate if inflation is reduced: BB governor

Ahsan H Mansur says in a meeting with a delegation of the Dhaka Chamber

27 August 2024, 14:39 PM

‘Market-based interest rates will be painful for businesses’

CPD Distinguished Fellow Mustafizur Rahman says

8 May 2024, 19:17 PM

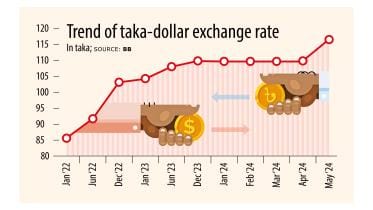

Exporters to win, consumers to bear the brunt

The exporters have already welcomed the central bank's move to devaluate the local currency, which they have long been waiting for.

8 May 2024, 16:51 PM