Bad loans at scam-hit banks surge after political changeover

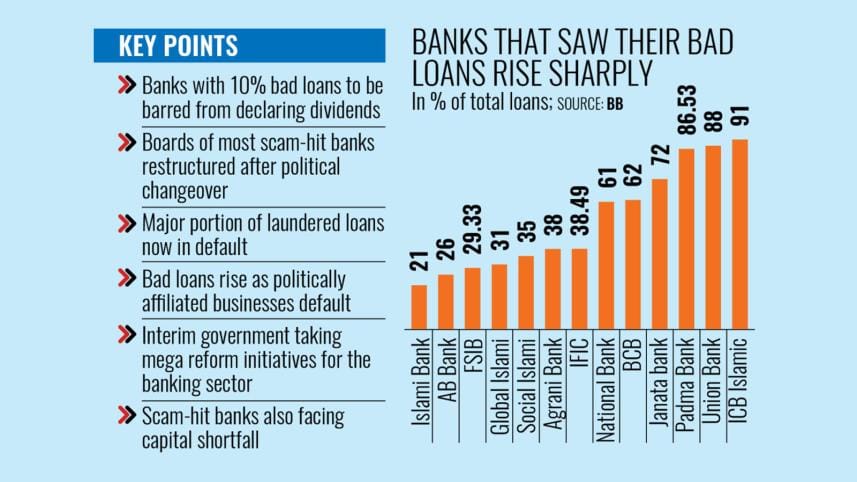

Bad loans soared to alarming levels at over a dozen banks that were mired in loan irregularities and major scams under the previous regime, as large businesses with ties to the former government defaulted heavily following the political changeover.

At the end of last year, defaulted loans in the banking sector stood at Tk 345,765 crore, with those state-run and private commercial banks holding the majority.

Among them, non-performing loans (NPLs) at state-owned Janata Bank reached a record Tk 67,148 crore by the end of 2024, accounting for 72 percent of its total disbursed loans, according to Bangladesh Bank (BB) data.

Bad loans at Janata Bank increased by 284 percent in just one year -- up from Tk 17,501 crore, or 19.2 percent of its total lending, at the end of 2023.

Once a respected lender, Janata Bank gained notoriety due to a series of scams and loan irregularities involving Anontex, Crescent, Beximco, Thermax and S Alam Group during the previous government's tenure.

Bad loans linked to these five defaulters crossed Tk 45,000 crore.

The bank is now going through a severe liquidity crisis and struggling to carry out regular banking operations.

To ease the cash crunch, it recently sought a Tk 20,000 crore liquidity support from the interim government and the central bank.

Md Mazibur Rahman, managing director of Janata Bank, told The Daily Star last week that since the political changeover in August, the bank's new management has been working to manage loan irregularities.

Legal action is now being taken against defaulters, he added.

At private-sector National Bank, default loans rose by 109 percent year-on-year to Tk 25,846 crore by the end of 2024, making up 61 percent of the total disbursement.

After the interim government took office in August last year, the central bank restructured the boards of 11 banks, including National Bank.

National Bank, the country's first private-sector commercial lender, had a prosperous past. However, it became a loss-making entity due to massive loan irregularities, poor governance and boardroom conflicts.

During the 16-year tenure of the previous Awami League government, business conglomerate Sikder Group dominated the bank. After the political changeover, Abdul Awal Mintoo, a businessman and vice-chairman of the Bangladesh Nationalist Party (BNP), was appointed as the chairman of National Bank.

Default loans at Islami Bank Bangladesh spiralled to Tk 32,817 crore by the end of 2024, up from Tk 6,919 crore a year earlier. The amount accounts for 21 percent of its total lending.

Islami Bank was one of the worst-affected banks due mainly to the controversial business conglomerate S Alam Group, which dominated the board of the largest Shariah-based bank until mid-August last year.

The Chattogram-based conglomerate and its affiliated firms borrowed more than 80 percent of Islami Bank's total Tk 155,659 crore in loans.

Other banks under S Alam Group's influence were First Security Islami Bank, Union Bank, BCB, and Global Islami Bank. These lenders also saw a sharp rise in bad loans last year.

Year-on-year, defaulted loans at First Security Islami Bank surged by Tk 15,710 crore to Tk 17,851 crore. At Union Bank, bad loans rose by Tk 23,992 crore to Tk 24,835 crore, while at BCB, they increased by Tk 224 crore to Tk 1,432 crore.

At Global Islami Bank, defaulted loans climbed by Tk 4,216 crore to Tk 4,442 crore.

Following the political changeover, these banks were freed from S Alam Group's influence after the central bank dissolved their boards and appointed new ones.

Officials at these banks said that a large portion of the loans disbursed to S Alam Group and its associated companies is now in default.

Defaulted loans at AB Bank stood at Tk 8,573 crore at the end of last year, up from Tk 5,272 crore a year earlier. Bad loans at IFIC Bank rose by Tk 14,603 crore to Tk 17,182 crore over the same period.

Salman F Rahman, a close adviser to ousted prime minister Sheikh Hasina, was the chairman of IFIC Bank. After the government's fall, the central bank restructured the board and removed the Rahman-led management.

Officials at the bank told The Daily Star that although Rahman's Beximco Group had only a 6 percent stake, the group exerted significant influence over IFIC and secured around Tk 10,000 crore in loans -- posing a major risk for a bank of its size.

Bad loans at state-run Agrani Bank reached Tk 27,932 crore, or 38.45 percent of its total lending.

The bank ran into trouble due to excessive exposure to a few large borrowers, including Bashundhara Group, Orion Group, Zakia Group, and Joj Bhuyia Group, according to BB documents.

Social Islami Bank, another lender previously controlled by the S Alam Group, saw its bad loans rise to Tk 13,267 crore, or 35 percent of total disbursed loans.

Padma Bank's defaulted loans increased to Tk 4,870 crore, or 87 percent of its total lending. A few years after its launch, the bank was hit by a massive scam and loan irregularities.

ICB Islamic Bank had the highest default loan ratio, with bad loans accounting for 91 percent of its total lending at the end of last year.

Bankers said defaulted loans surged in 2024 as large borrowers defaulted heavily after the Awami League's fall, pushing overall bad loans to an unprecedented level.

Besides, they said the central bank's directive for more transparency had led banks to disclose more accurate figures, including previously concealed bad loans.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments