A third of budget spent on interest payments, subsidies

More than one-third of the national budget of Bangladesh was spent to make interest payments and pay subsidies in the first seven months of the current fiscal year mainly due to persistently lower revenue earnings.

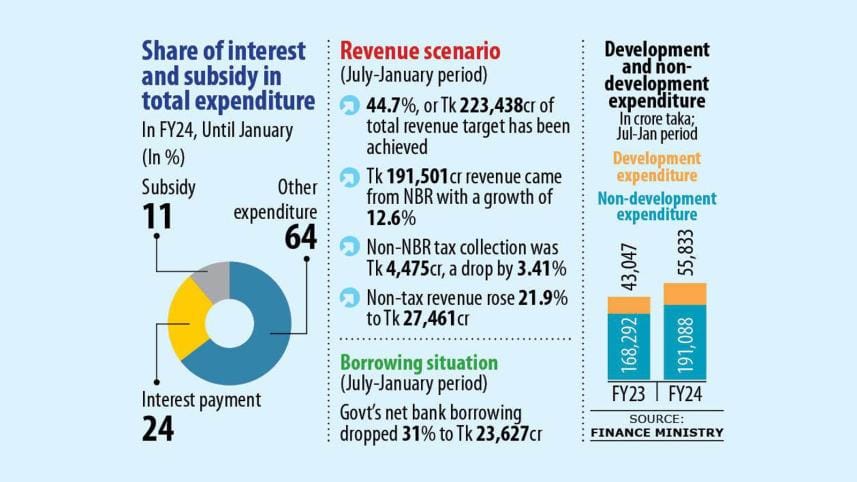

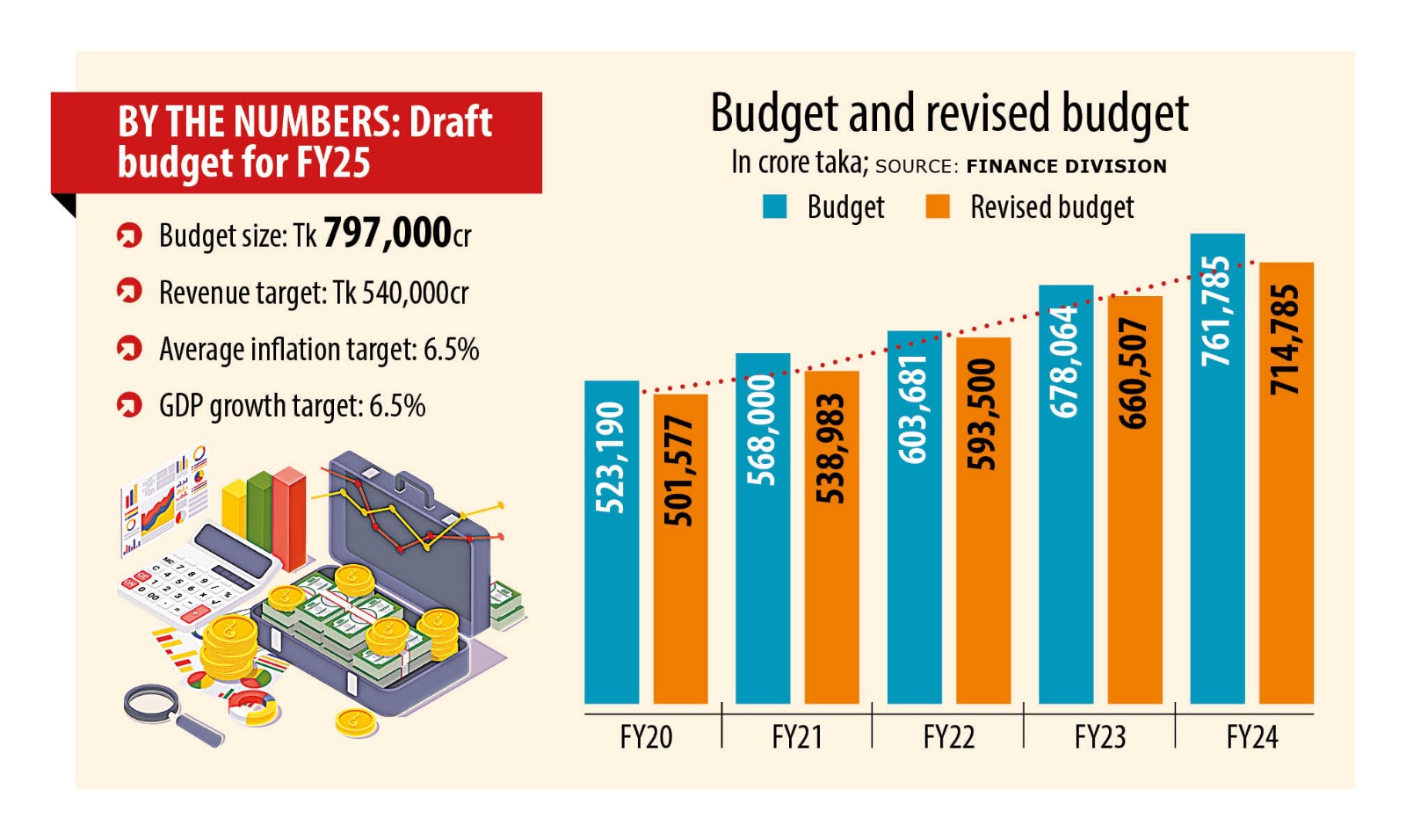

The government spent Tk 246,583 crore in July-January of 2023-24 out of the total budget of Tk 761,785 crore for the entire fiscal year, figures from the finance ministry showed. The outlay under interest payments and subsidies was Tk 88,226 crore, which was 36 percent of the allocation.

In order to meet its expenditures, the government is taking on more debts since tax collections are not growing at a healthy clip. Bangladesh's revenue as a share of GDP is currently 8.2 percent of GDP, among the lowest in the world and significantly below peers.

The low revenue collection significantly limits the fiscal space necessary for critical public investments and social sector spending to support vulnerable sections of the population.

The government relies on the domestic banking sector, the sales of the national savings certificates (NSCs), and external borrowing to finance the budget deficit, with banks being the top source of funds.

Finance ministry data showed the interest payment was Tk 60,555 crore, a year-on-year increase of 26 percent in July-January. The payment on the domestic front rose 15 percent to Tk 51,213 crore while it climbed three-fold to Tk 9,342 crore against foreign loans.

The cost of funds mobilised through the sales of treasury bonds is on an upward trend. So, the interest expenditure climbed.

The yield rate of treasury bonds has gone past 12 percent from 8 percent in June 2023, Bangladesh Bank data showed.

Although the sales of savings instruments like NSCs are low currently and the interest rates against them have fallen, many of the schemes have matured. This means the expenses of the government under the segment increased.

The expenditure in the form of subsidies has been rising fast since last fiscal year because fuels, liquefied natural gas, and fertilizer have become costlier in the international market, raising the cost of imports for the import-dependent country.

In the first seven months of FY24, the subsidy spending was Tk 27,671 crore. It was Tk 26,212 crore in July-January of 2022-23.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said growing loans and the spike in the interest rate sent the interest payments higher.

The interest rate of foreign debts has gone up and there are also some market-based components of loans. The sharp depreciation of the local currency has added to the higher cost of financing.

"The situation has become very unfavourable for the government," Mansur said.

It was assumed that the actual subsidy expenditure would surpass the target. The expenditure was bigger than expected owing to higher energy bills because an elevated volume of arrears had to be paid back.

In the last five years, the discretionary expenditure—wages and salaries, pensions, subsidies—increased faster than the revenue earnings, narrowing the government's fiscal space.

The bank borrowing to finance the deficit has not risen much this fiscal year: it borrowed Tk 23,627 crore between July and January against Tk 34,306 crore in the identical seven-month period in FY23.

The net sales of NSCs were negative, which refers to a situation when the government repays more than the instruments sold. It repaid Tk 6,763 crore in July-January and Tk 3,035 crore in the same period of FY23.

NSCs were the primary source of domestic financing a couple of years ago. However, its issuance has turned negative because of less competitive interest rates and tighter controls.

As of September 30, the government's outstanding debt stock was Tk 16,55,156 crore.

"The interest payment will rise further as the government is borrowing more," said Prof Selim Raihan, executive director of the South Asian Network on Economic Modeling.

He said until the government focuses on accelerating revenue collection, the loans will keep increasing. Therefore, the interest payment will be challenging in the coming years.

The economist said the subsidy spending rose not only because of the price hike in the international market but also because of the inefficiency in the energy sector.

Prof Raihan thinks raising the price is an easy option to cut back on subsidy expenditure. "However, we have not seen any improvement when it comes to increasing efficiency."

The revenue collection rose 13 percent year-on-year to Tk 223,438 crore between July and January. The National Board of Revenue's receipts increased 12.6 percent to Tk 195,501 crore. Non-NBR tax revenue, however, dropped 3.4 percent to Tk 4,475 crore.

Non-tax revenue increased 21 percent to Tk 27,461 crore in the seven-month period.

The government spent Tk 191,088 crore from its revenue budget in the seven months, which accounted for 40.2 percent of the allocation. In FY23, it stood at 39.7 percent.

Development expenditure was Tk 55,833 crore, or 20 percent of the allocation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments